How Do I Find Short Interest for a Stock

Post on: 16 Март, 2015 No Comment

Editor’s Note: Ask TheStreet is designed to answer questions about the market, terms, strategies and investment methods. Please email us to ask a question, but keep in mind that we cannot offer specific investment- or stock-related advice.

Where do you find the percentage of shorts in the float of a stock? — D.

I’m a big believer in the importance of investors knowing all about the short position in a stock before making a purchase. I’m going to answer D’s question first, and then explain what the percentage of shorts in the float of a stock is and why it’s important. I’m also going to assume that readers know what it means to take a short position in a stock, and understand what it means when I say that a certain number of shares of a stock are being shorted. (If you need a quick refresher on shorting, or short-selling, check out Stocks: Shorting .)

Where You Can Find Short Interest Data

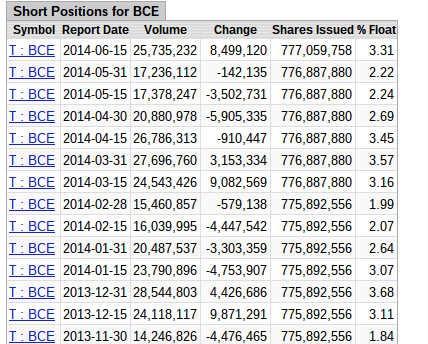

You can find data regarding the short position in a stock in a number of places. A good place to start is Nasdaq.com. which provides short interest data for stocks listed on the Nasdaq. as well as the New York Stock Exchange (NYSE) and the American Stock Exchange (Amex). The site is particularly helpful because it provides short interest data for each of the past 12 months, so you can see if the short position in a stock has been increasing or decreasing over the past year. However, Nasdaq.com only provides the number of shares shorted each month, as opposed to the percentage of shorts in the float of a stock that D. is looking for.

Where You Can Find the ‘Percentage of Shorts in the Float of a Stock’

The easiest place to find this information is by putting a ticker into Yahoo! Finance and clicking on the Key Statistics link. Scroll down a bit and look at the right column under Share Statistics — here you’ll find the most recent data for:

- Number of shares shorted

- Short ratio

- Short position as a percentage of the float

- Number of shares shorted during the previous month

The number of shares shorted should be the same as the information from Nasdaq.com.

The short ratio. also referred to as days to cover, is an expression of how large the total short position is in a stock relative to the average daily volume.

The short position as a percentage of the float is the information that D. is looking for. This percentage expresses the number of shares shorted divided by the float ( Float Defined ), or number of total shares that are free to be traded by the investing public.