How Do I Calculate The PEG Ratio

Post on: 3 Июнь, 2015 No Comment

Posted by David Sterman, StreetAuthority on August 23, 2013 3:00 pm

Although there are many ways to place a value on a stock, most investors still start their analysis with a price-to-earnings (P/E) ratio. Yet its a related ratio that will really help to spot value. This weeks question sheds light on this little-known valuation tool.

Question: I know the PEG ratio is important, but where do I find the formula?

Ann E. New York, NY

The Investing Answer: Youre right, Ann, its quite important. Yet you wont find it on any financial websites, or in any analysts research reports. To figure out this ratio, youll have to do a bit of quick math.

For the uninitiated, the PEG ratio is the combination of two different inputs. Heres what the formula looks like

PEG ratio = P/E ratio (which is the current stock price divided by earnings per share) / Earnings growth rate.

Wait, you say. Earnings per share from what year? The earnings growth rate from what year?

Good questions.

You can use the PEG ratio in the context of trailing earnings (i.e. the most recent fiscal year, or trailing 12 months), or you can use this years earnings, or even next years earnings. Lets take a closer look, using this years earnings as an example.

Lets say that Acme Inc. has a share price of $30, earned $1 a share in 2012 and is expected to earn $1.35 a share this year. Well, from that, we can deduce that this stock has a P/E ratio of 22.2 (30/1.35) and earnings are growing at a 35% pace ($1.35 vs. $1.)

Now plug those numbers into the PEG ratio formula

PEG ratio = 22.2 PE ratio / 35 earnings growth rate

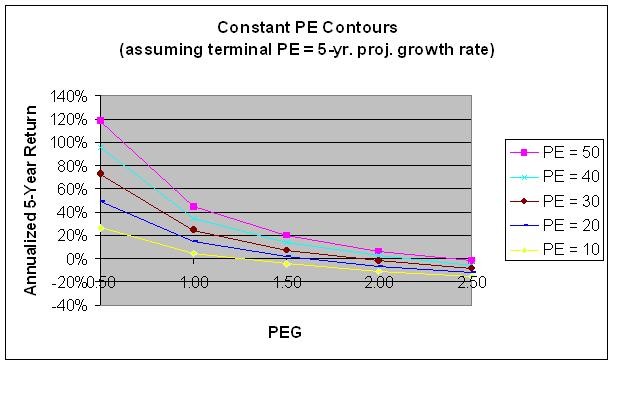

That leaves you with a PEG ratio of 0.63 a great number. As this number is below 1.0, we can see that earnings are growing quickly enough to justify the current P/E ratio. Said another way, this stock appears to be undervalued, as long as the P/E ratio remains below 35.

But what if the converse was true? What if the P/E ratio was 35 and the earnings growth rate was 22%. Then youd have a PEG ratio of 1.60. And anytime this gauge moves above 1.0, shares start to become overvalued, at least by this measure.

You can use the PEG ratio for a variety of companies and industries. Its even handy when comparing companies in the same industry. Calculate the PEG ratios of five related firms, and spend most of your final research time on the companies with the lowest PEG ratios.

There are a few notable exceptions to this rule. For example, companies that operate in deeply cyclical industries (such as homebuilders, automakers and energy producers) tend to sport very low P/E ratios when the economy is growing at a fast pace. Thats because investors assume that earnings will soon peak and turn down. So these P/E ratios are quite low, but you need to look out several years to get a sense that earnings are expected to keep on rising.

Conversely, these very same stocks may look sharply overvalued when the economy is in a funk, as their earnings will be depressed, leading to very high P/E ratios (and hence high PEG ratios).

Thats why the PEG ratio is best used as a tool for companies in the sectors and industries that dont go through booms and busts. The technology sector, which manages to grow at a moderate pace every year, is a great example. Lets look at software provider Oracle (Nasdaq: ORCL) .

Oracle has boosted EPS at least 15% in six of the past eight years, and its EPS growth rate over that time stands at 19%. Over the years, any time you bought Oracles shares when the current (i.e. same years) P/E ratio was below 19, that would have been a savvy move.

One final thought: Although the P/E ratio is very popular, it doesnt really tell us much. Yet when paired with earnings growth rates, you can get a much better sense if a stock is rightly priced. Its especially helpful if you are deciding between two companies in the same industry. Give the PEG ratio a tryout the next time you are assessing a group of stocks.

P.S. All those charts, ratios and spreadsheets can be mind-boggling. Many so-called investing systems promise you the moon and are complicated that they should only be used by professional investors willing to sit in front of their computer screens for hours on end each day. Not this one. Its called the Dividend Trifecta Strategy , and it just might be the key for regular investors who want to secure a large and steady stream of dividend income right now. Go here to learn more .

David Sterman Source: InvestingAnswers

Starting this month, these stocks could pay you thousands of dollars a year for the next 100 years. Click here for your free report.