How Dividends Make You Money

Post on: 3 Май, 2015 No Comment

Please refer to our privacy policy for contact information.

One of the ways you make money with stocks is by investing in companies that pay dividends.

Dividends are profits the company distributes to shareholders. The companies dont do this out of the kindness of their hearts this is what a company is all about; making money for the owners.

Dividends usually dont represent all of a companys profits. The company retains some portion for future use — in acquisitions or to retire debt, for example.

Most companies pay dividends in the form of cash, although you may hear of occasions when a company uses stock instead. Many investors are attracted to stocks with a good history of paying dividends. These companies are usually well established and profitable, but may not offer much in the way of growth potential.

The companys board of directors sets the dividend at a quarterly meeting. It is important to note that they are under no obligation to pay a dividend. If the company is hurting financially or the board is concerned about future prospects, it can forego the dividend.

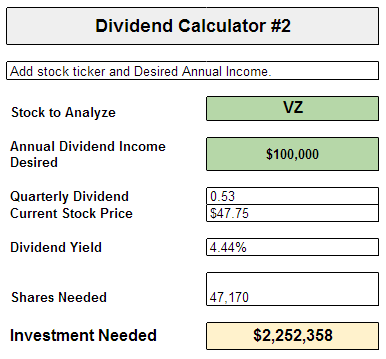

The board sets the dividend rate at a per share basis. For example, the board may declare a quarterly dividend of $0.50 per share. This means if you own 100 shares of stock, you will get a check for $50 for that quarter.

Important Dates

There are four important dates to remember about dividends:

- The Declaration Date This is the date the board sets the dividend and announces when the stockholders will get their checks. The board also announces the Ex-Dividend Date, which is a very important date to know.

- Record Date This is the date when the company sets the list of shareholders to receive the dividend. You must own the stock before this date to get the dividend; however, it is the Ex-Dividend Date that is more important.

- Ex-Dividend Date This date usually falls 2 4 days before the Record Date. This date allows for the completion of all pending transactions, since it usually takes three days to settle a regular stock sale. The Ex-Dividend Date is the most important date as far as owning the stock if you want to receive the dividend.

- Payment Date This is the date the company mails the checks, often two weeks or so after the record date.

On the Ex-Dividend Date, the market discounts stocks price since the dividend is no longer available to buyers.

Types of Dividends

Dividends come is two types: fixed and variable. Dividends that pay at a fixed rate go to owners of preferred stock, while variable dividends go to common stock holders.