How Did The Top 400 Wealthiest People Get So Rich

Post on: 7 Апрель, 2015 No Comment

[wp_campaign_1]

Do you have any idea how much the 400th wealthiest person in the world is making per year? $138 million. Thats right. Thats $138 million in a single year, which means that their net worth is most likely in the billions. How in the world does a person get so rich? What could they possibly be doing to earn so much money each year? One thing I know for sure is, they probably arent worried about PPI insurance (like ppiclaims.uk.com )

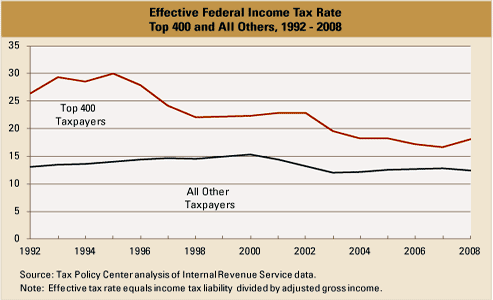

Yahoo! recently wrote an article about how the rich keep getting richer. According to the IRS, more than half of the typical earnings are not coming from regular income, but from capital gains! In other words, the majority of the income from the wealthy is made by their investments such as stocks or from property.

As for the regular income (from the top 400 wealthiest people), less than 10% of their overall earnings came from good old fashioned wages. With these percentages, do you truly realize how the wealthy are earning their money through passive income !

More than likely, these wealthy individuals just didnt roll out of bed one morning and find out that they were stinking rich, they had planned for this for the past 20, 30, maybe even 50 years. From the very beginning, these people have been investing their money into the stock market, into properties, or maybe even into businesses. Their money didnt go toward boats and flashy cars back then, it went toward their future, and now look at where they are!

The Average vs. The Wealthy

I have seen comparisons about how wealthy individuals live vs. the regular Joe across the street in your neighborhood. But, Ive never seen the comparison for how they lived 30 years ago when they just started out. How did one of them get to the point of earning millions of dollars per year, and the other is barely making their mortgage payments?

Lets assume that both of these men graduate from college and land a $50,000/year job. Throughout the next 30 years, both of them earn an average increase of 3%. The only real difference between them is their vision for the future:

- Graduates with $30,000 in debt

- Buys a brand new $25,000 car out of college as a congrats to himself

- Buys a new house soon after starting his job because he can make the payments. Its a $200,000 house with a $1,200 payment for 30 years.

- When Joe pays off his school debt, he decides to continue the payment, but now its towards a boat

Millionaire Mel

- Graduates with no debt

- Gets by with his beater college ride until he can afford to pay cash for a gently used one

- Buys a modest house for $80,000 and pays off the mortgage in just 4 years

- When Mel pays off his house, he beefs up his investment in his future

After 30 years, Joe has finally paid off his house, which means that his net worth is now $200,000 (the value of his house since he always purchased everything else on payments). For many of us, a net worth of $200,000 is quite a lot. In fact, when you check out how Joe got there on the chart below, it looks somewhat impressive.

This is the route of many Americans. As long as they never refinance and extend their house payment terms, theyll own their home free and clear by the time theyre 52 and it will be one of their only investments. Unfortunately, this is nowhere near the amount of money thats necessary for retirement, and to start saving at the age of 52 is obviously too late.

Now, as we described above, Millionaire Mel took a different route. He went through college without debt, paid off his house in a short time frame, and then he invested his remaining earnings with vigor. Check out his net worth when its overlaid on Joes.

Can you even see Joes net worth on that chart? Just barely. At the end of 30 years, Mel is worth nearly 2 million dollars! They both started with the same humble beginnings, but now at age 52, Mel can easily retire and live without worry. Since his interest now earns him an average of 5% per year, on his $2 mil, he could spend $100,000 a year and his net worth wouldnt go down. Sounds pretty intriguing doesnt it? This is how the rich keep getting richer. Investments and passive income.

How are you choosing to live? Are you Average Joe or Millionaire Mel?

Subscribe and Get Email Updates for Free!

Enter Your Name and Email Address Below: