How Bonds Affect Mortgage Interest Rates

Post on: 28 Май, 2015 No Comment

Bonds affect mortgage interest rates because they both compete as investments. They are attractive to investors who want a fixed, and therefore stable, return in exchange for relatively low risk.

Why are bonds lower risk than stocks. They are essentially loans to large organizations, such as cities, companies and even countries. The critical difference is that a bond can be resold on a public market. This makes a bond an easily traded security. like a stock.

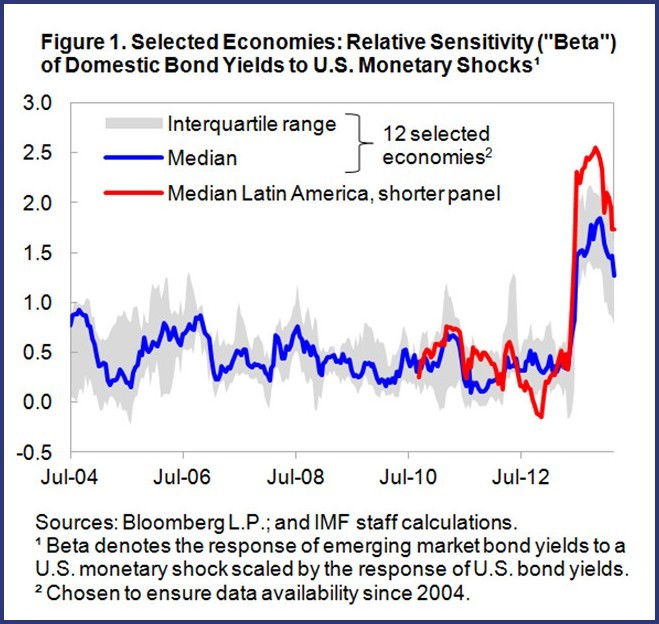

Bond investors are looking for predictable outcomes, but some are willing to take on higher risk to get a better return. That’s why there are various types of bonds. The highest risk bonds, like junk bonds and emerging market bonds, also have the highest return. Bonds with medium risk and return include most corporate bonds. The safest bonds include most municipal bonds. and U.S. government Treasury notes .

Mortgages are higher risk than most bonds because they are longer-term, typically 15 to 30 years. That means they compete with the safest bonds of all, U.S. Treasuries, which are offered at 10-year and 30 year terms.

Treasury Bonds Affect Mortgage Rates the Most

That’s why banks generally keep interest rates on mortgages only a few points higher than Treasury notes. Since Treasury notes are guaranteed by the Federal government, they are ultra-safe and investors don’t require high rates.

As interest rates on U.S. Treasury notes rise, it means banks can raise the interest rates on new mortgages. This means homebuyers will have to pay more each month for the same loan. This gives them less to spend on the price of the home. Usually, when interest rates rise, housing prices fall.

Even though Treasury bonds have they lowest return, they have the biggest impact on mortgage interest rates. That’s because investors who are in the market for mortgage-backed securities expect a higher interest rate on these higher risk securities than offered on Treasuries.

What are mortgage-backed securities? They are backed by the mortgages that banks loan, but rather than hold them for 15 to 30 years, the banks sell the mortgages to Fannie Mae and Freddie Mac. who then sell them on the secondary market. They are bought by hedge funds and large banks. who sell the securities backed by these mortgages. However, the financial crisis showed that many mortgage-backed securities weren’t as safe as the investors thought because they contained undisclosed, high levels of subprime mortgages.

Why Higher Treasury Rates Didn’t Affect Housing in 2013

In 2012-2013, housing prices were rebounding from a 33% drop caused by the Great Recession. In many areas, prices doubled in just a year! This was the signal that many real estate investors were looking for. As prices rose, they once again felt that housing was a good investment. Many of these buyers used cash, which was sitting on the sidelines or invested in other commodities such as gold. These investors don’t care if interest rates rise, because they don’t need mortgages anyway.

Other homebuyers needed mortgages, but know that there’s still plenty of room for housing prices to go up even more. They feel confident that real estate is still a good investment, even if interest rates rise a bit. As home resale values increase, many homeowners who were upside down in their mortgages can now finally sell that home and buy a new one.

Last but not least, as the economy continues to improve, many people will go back to work for the first time in years. They’ve been living with relatives or friends, and can now afford to move out and buy a home. Therefore, even though higher bond interest rates cause mortgage rates to rise, this won’t slow down the housing market. Article updated October 30, 2014