HotScans Trading Strategies

Post on: 19 Май, 2015 No Comment

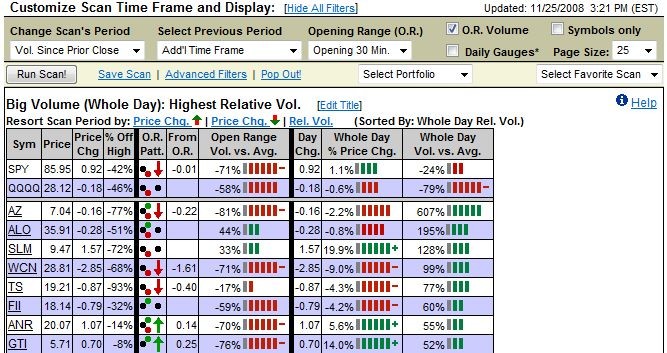

Pop Out: Open a HotScans Pop Out window

HotScans Strategies are predefined scans. They are organized based on trading patterns or market conditions. The large selection of predefined scans within each Strategy section enable you to quickly find a scan that meets the criteria you are looking for in a trade set up. As overall market conditions change, or your trading style develops, you will want to look at different variations of your favorite Strategies or even branch out into new scans. Below is a summary of the main Strategies sections:

- Opening Range (OR) Strategies : This is HotScans’ specialty! Use the OR scans to follow momentum on big days, or fade the morning moves (buy the dips, sell the rallies) in the direction of the major trend. There are four variations of each scan to enable you to scan for very specific conditions or cast a wider net. Momentum Strategies : HotScans is your Most Up & Most Down stock scanner for professionals! This section enables you to find the biggest price movers based on percent price change, absolute dollar change, or relative to the stock’s average daily range. More specific scans require the stock to be breaking out now, retracing back to a Fib area (24% — 38%), or more. And don’t forget that with the HotScans’ Basic Filters you can make sure that the stocks that show up are in your desired price range, trade on your favorite exchange, have enough average range or volume, etc. Gap Strategies : Scanning for stocks that have gapped is easy. HotScans takes gap scanning to a new level of effectiveness by focusing on additional key criteria in trading gaps such as:

- What the stock does after the opening gap?

- Where is the gap in the big picture — new highs, into a pivot level, etc.

- Is the volume confirming the direction?

This section also shows you how to scan for stocks that have NOT gapped. Consolidation : Support and resistance are created when stocks consolidate. Price volatility is born out of price consolidation. Risk/Reward is easily defined when consolidation exists. This section screens stocks for intra-day and/or daily consolidation. Furthermore, you may require that the consolidation is occurring at the right place in the big picture of a stock’s trading ranges. Volume : The most important information about volume is not how many shares traded, but rather how much volume traded relative to the average volume of the stock. Secondly, where did the volume occur within the stock’s range? Finally, did the volume move the stock up or down? These three factors can give your trading an edge. Scan for the confluence of volume and price from a five minute basis up to the whole day! Stocks in Leading Industry Groups : The leading stocks in the strongest and weakest industry groups are often market leaders for more than one day. Here’s a simple way to find them. Regression Channels : Linear Regression Channels are a good measure of price volatility which may signal the end of a move or the beginning of a bigger move. These scans identify stocks that could be at important inflection points on their daily charts. Flags : High, tight consolidation on a daily chart that is trending! This an ideal place to find momentum day trades and swing trades.

Remember, the navigation at the top of this page will direct you any of these Strategy sections.

How to Get Started Using a Strategy

Think of the Strategy section as your quick menu of trade set up choices. Every Strategy is not going to be the best one to use all the time. Find the Strategy section that best fits your trading style or the current market conditions. For example, in a bull market the easiest Strategy is to buy strong stocks. Use Strategies that find breakouts and retracements in strong stocks. If you want to find short candidates then focus on selling weak stocks that have rallied intra-day, or are at the top of a consolidation range.

If you have a particular pattern you like to trade then review the descriptions of each strategy. There is probably a Strategy that is close to what you want. If not, then use these preset scans as a way to see how we have set the filters in order to find patterns in price and volume. Look at the settings in the Advanced Filters when you run the Strategy and you will see how you can alter them to scan for your pattern. You may also post to the message board or email info@marketgauge.com to ask how you can find what you would like to see in a trade set up.

If you do not have a specific pattern in mind we suggest you start with the Strategies outlined on the Start Here page. And get a copy of the free e-book, Trading The 10 O’clock Bulls , offered by Dataview that will describe in detail how to trade using the opening range. This is a trading technique that can be applied to ranges in all time frames.

Swing Traders & Day Traders

A common question from prospective users is Do you have swing trade strategies? Yes, we use many of these Strategies to find stocks that are in the right place at the right time with the right volume on the daily chart for great swing trades. The most obvious swing setup Strategies are the Flags. Regression Channels. and the Daily Consolidation sections. However, many of the scans which are focused on intra-day trading are great at identifying stocks that will continue their moves for days making them good swing trade sources. Review scans at the end of the day! The Scan Tips will point out some of the Strategies that are good swing trade finders and portfolio builder, but don’t limit yourself to those mentioned.

Use the portfolio feature! Day traders and swing traders can be much more profitable if you put stock that are setting up on a daily chart into a portfolio and then let HotScans filter the portfolio to highlight when the stock is ready to move. Day traders this means keeping track of the stocks that look good in the swing trade scans mentioned above and keeping a list of the stocks that performed well in the last few days for you.

Important Advice!

The biggest mistake traders have made in using HotScans is to try to follow too much and/or chase the latest hot stock. HotScans is exceptional at identifying the hottest stocks at any time during the day, but it will give you too many ideas if you are not careful. The best way to start using HotScans is to:

- Focus on one or two Strategies or scans that fit your style. Focus on a specific trade setup. When you’ve mastered one, you can add another. When you have enough stocks to watch, focus on them, not HotScans. Go back to HotScans when you need new ideas.

- Use HotScans to build and monitor a portfolio of stocks and focus on those stocks.

- Even if you do not start with the Gapping Bulls or The 10 O’clock Bulls Strategies it is worth reading the related Trading Briefs listed below. These are good examples of how to keep it simple.