Hotelling Rule and Depletable Resource Theory

Post on: 7 Июль, 2015 No Comment

Hotelling Rule and Depletable Resource Theory

Hotelling rule states that in a competitive market, the price of a depletable resource must increase at the same rate as the discount rate. Arbitrage will remove any deviation of the future prices. The theory for this special case was worked out in the classic paper of Hotelling (1931).

An intuitive explanation of the Hotelling rule is as follows. Consider a competitive market with identical producers having depletable resources on the ground. Any production level will see the eventual depletion of the resources, and the producer has to decide how best to optimise production between now or the future so as to maximise profits.

Suppose he increases his production sufficiently high increasing present supply and lowering present prices. This causes his resource stocks to deplete at a faster rate, and the rate of future price increases γ to be high. In this case, γ > r (discount rate). However, his competitor may find it more optimal to not follow his lead. This will enable them to enjoy future higher prices, which grows higher than the discount rate. As such, equilibrium sets in such that the producer will lower his production enough so that γ = r.

Again, suppose that he limits his production, so that present prices become higher whilst stocks are depleted more slowly. Future price increases now become less, such that γ < r. Competitors now find it more optimal to increase their production, and invest the money into the money market for a higher return. As such, equilibrium sets in such that the producer will increase his production enough so that γ = r.

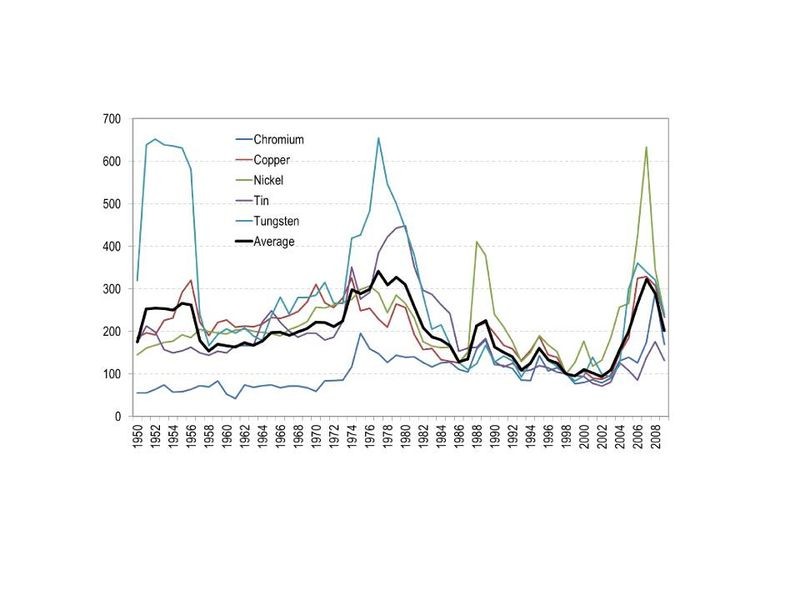

How has the Hotelling Rule performed over the years for oil prices in particular? The Rule was first published in 1931, during which oil prices were low due to the Great Depression and a spate of oil discoveries in the middle east and the USA (Texas and California). This surplus disappeared during the World War but renewed Middle East discoveries pushed prices down again in the 50-60s. This led to the creation of the OPEC which imposed an oil embargo in the 1970s causing prices to more than double. From 1980 to 2005, oil prices stayed low with continued oil discoveries and slow oil demand growth. This changed in recent times with the growing demand in the emerging economies when oil prices more than tripled from the 30s to 100s.

These price cycles have thence not followed the continued rates growth predicted by the Rule. These shortcomings are due to the assumptions in the Rule. These include a fixed amount of depletable resources and a lack of a risk premium. The first assumption was flawed with new technologies and investment in exploration and discoveries. Investors also generally demand a risk premium to investing in resources due to inherent project and demand growth risks. The latter came out of the Capital Asset Pricing Model in the 1960s.

* Hotelling rule is not to be confused with Hotelling law. The latter states that in economics, it is rational for producers to make their products as similar as possible. This is also referred to as the law of minimum differentiation or Hotelling linear city model.