Hong Kong Investment Funds Association Fund Investment 101

Post on: 19 Июль, 2015 No Comment

Investor Education

What is a unit trust?

Unit trusts (and mutual funds as they are sometimes known) are professionally managed investment schemes that pool the money of like-minded investors together to invest into equities, bonds, and currencies. Many individual investors in Hong Kong find unit trusts to be a cost effective and simple way to access global equity and bond markets. For instance, with as little as US$1,000, you can invest in a global equity unit trust that invest in a basket of over 50 stocks, providing you access to the best investments around the world and maximum diversification.

Why should I invest in unit trusts?

Unit trusts offer individual investors a simple and effective way to invest and build wealth over time. Key benefits include:

- Professional Management

Unit trusts are managed by professional fund managers whose mandate is to identify the best investment opportunities, invest in them, and manage risk according to the unit trusts investment objective.

Fund managers have an average of 3 to 5 years experience in investment management. Through an international network, they have access to first hand macro and micro information which helps them make informed investment decisions.

Due to high transaction cost, lack of time, information, and market access, individual investors may find it difficult to benefit from investment opportunities outside of Hong Kong. With one simple investment of as little as US$1,000, an investor can access these overseas investment opportunities through unit trusts.

As each unit trust invests in an average of over 50 securities, it offer investor maximum diversification, that is, the gain of one investment can be used to offset any loss in another due to unforeseen economic, political, and investment factors.

Like stocks, unit trusts are traded and can be bought and sold daily, providing easy access to your money.

Many fund managers offer daily price quotation on newspapers and through their distributors, making it very easy to track your investments.

How do fund managers invest?

Investment Approach

An investment approach that starts with global markets macro economic research, then followed by stock selection.

A macro-economic analysis includes understanding and projection of interest rate, economic growth, inflation, and currency trends.

Stock selection is driven by company visits and quantitative research to understand the companys business strategy, financial situation, and growth prospects.

Stock weightings are heavily guided by country weightings of the trusts relevant benchmark index.

An investment approach that focuses on stock selection, supplemented by macro-economic factors.

Stock weightings are heavily guided by where the best stocks are found, with less emphasis on relevant benchmark country weightings.

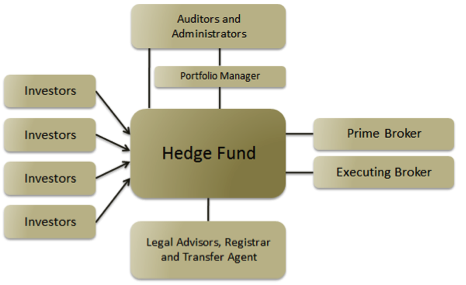

Investment Transaction

Individual fund management companies have strict internal guidelines to ensure investment orders are placed within the guidelines of the unit trusts objectives.