Honey s Bob Brinker Beehive Buzz January 2 2015 Bob Brinker s Bond Fund Blunders

Post on: 16 Март, 2015 No Comment

Friday, January 2, 2015

January 2, 2015, Bob Brinker’s Bond Fund Blunders

January 2, 2015. Bob Brinker’s low-duration bond funds that he has talked about many times over the past year on Moneytalk were huge, costly mistakes.

Bob Brinker (the junior one), who flies on the internet under his dad’s famous coattails, only signs his newsletters Brinker Advisory Service. (my little boy, what big teeth you have — the better to deceive you with.)

Jr’s newsletter often sets the tone for Bob Brinker’s Marketimer bond fund holdings. In December, the Brinker Fixed Income Advisor sold most of its holding in Fidelity Floating Rate High Income Fund and moved back into DLTNX.

Will Brinker’s Marketimer do the same in January? If he does, it would certainly be understandable in light of the following information. Jim did the research for us:

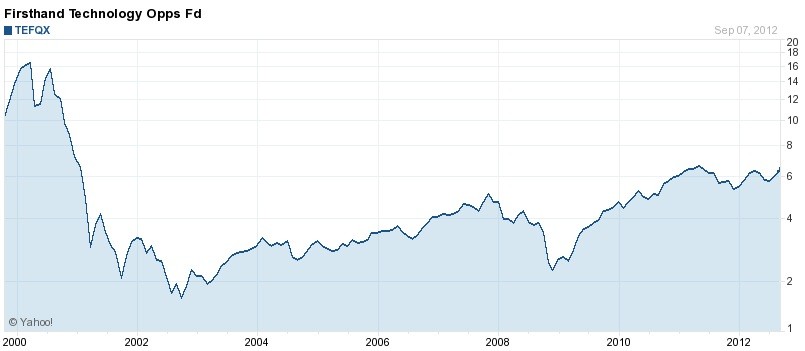

Jim said. I’ve taken a look at Bob Brinker’s final performance numbers for his fixed income portfolio. For calendar year 2014 his Income portfolio was +1.10%. If he had not made any changes from his prior holdings he would have been +6.11%. Here is the breakdown: DLTNX +6.47 vs. DLSNX +1.35, DODIX +5.48% vs. OSTIX +1.26%, MWTRX +5.83% vs. MWLDX +1.39%, and finally VFIIX +6.65% vs. FFRHX +0.41%. All this was calculated using the numbers from M*.

Using the numbers from Yahoo Finance I’ve come up with the performance from the point he made his changes. They are as follows: DLTNX +7.66% vs. DLSNX +2.02%, DODIX +6.99% vs. OSTIX 1.79%, MWTRX +6.54% vs. MWLDX +2.09%, and finally VFIIX +8.2% vs. FFRHX +2.23%. Overall that computes to an average of 7.35% vs. 2.23%.

Using either time frame Brinker’s funds that he sold outperformed the funds he bought by 5+%. It’s going to be difficult for his followers to ever make up the 5+% of additional gains that they missed by following his bond timing advice.

January 2, 2015 at 9:44 AM

Jim, thank you so much for that great information. Selling the Ginnie Mae fund and buying the Fidelity Floating Rate Fund was one of Brinker’s biggest blunders — And the change in the DoubleLine Funds almost as costly. Actually, all four changes were disastrous.

Today we won’t bring up the Vanguard High Yield Fund or all Nasdaq holdings, which he also sold and then bragged about various times on Moneytalk. The Nasdaq OUTPERFORMED the S&P 500 Index and the Dow last year. OUCH!

He is still bragging about being on Hulbert’s fabricated Honor Roll because of his 15 year returns. Well, let’s take a good look at some reality of Brinker’s Marketimer returns during this 5-year bull market that he is always tooting his horn about.

This is a screen-print from the Marketimer website. Last year, the Vanguard Total Stock Market Fund did 12%, while none of Brinker’s portfolios broke double-digit. And the much touted balanced fund (which is mostly in equities) only did 6%. Don’t break out the stationary and start writing a letter home. (click to enlarge ):