Home Builders ETFs for the Home Construction Industry

Post on: 25 Июнь, 2015 No Comment

List of ETFs Focusing on the Home Construction Sector

You can opt-out at any time.

Please refer to our privacy policy for contact information.

There’s no doubt that the home building industry has changed with the turn of the current economy. A sector that was booming not too long ago is now under a lot of duress. However, that doesn’t mean there isn’t an investing opportunity …

If you have opinions about these questions, then home builders stocks may be an opportunity to buy or sell depending if you’re bullish or bearish.

But which stocks do you buy? Which are poised to move or have increased volatility? Maybe you have an opinion about the industry or certain sub-sectors like painters. kitchen remodelers. construction materials. etc, but not individual home construction companies. If that’s the case, you may want to save yourself some time and commissions and consider a home builder ETF instead.

With a home builders ETF, you can have instant exposure to the home construction sector, without having to research individual stocks to find the right combination for your portfolio. That work is already done for you. And as opposed to a home builders index, you can get this instant exposure for your portfolio without having to buy or sell and index basket. Again, this will save you on commissions.

So if home builders ETFs sound like the right fit for your portfolio, then I have you covered. There aren’t a slew of options, but there is some diversity, which gives you choices when picking a home builder ETF. Check out the funds below to help you decide which home builder ETF will help you accomplish your investing goals…

This home builders ETF from iShares tracks the Dow Jones U.S. Select Home Construction Index. With a more specific focus on home construction companies, some of the top holdings are DR Horton, Lennar Corporation, Toll Brothers and NVR Incorporated. It also includes home construction retail operations like Home Depot and Lowes.

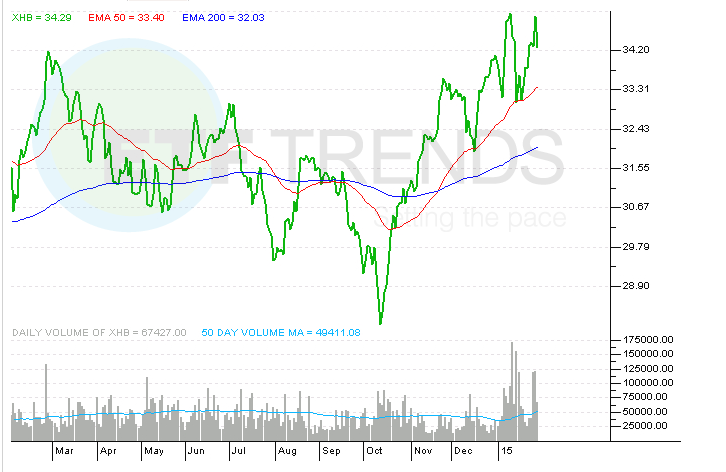

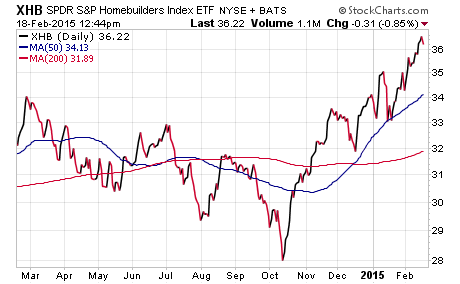

This home builder ETF from State Street Global Advisors (SSgA) is a SPDR that correlates with the S&P Homebuilders Select Industry Index (SPSIHOTR). With a sole focus on home building companies, some of the top holdings include Masco Corporation, Pulte Group, Owens Corning and Lennar Group.

This ETF tracks the Building & Construction Intellidex Index and with a focus on home builders, some of the top company stocks in the fund and index are Vulcan Material, KBR, and Fluor Corporation. This fund also includes retailers such as Lowe’s and Home Depot.

This home builder fund from First Trust tracks the ISE Global Engineering and Construction Index and is designed to give investors (according to First Trust) exposure to companies that are engaged in large civil and capital projects such as infrastructure, utilities, transportation, telecommunications, commercial, residential, and commerce facilities and whose roles are within the engineering, designing, planning, consulting, project managing, and/or constructing of these projects. To be included, a company must receive at least 70% of revenues from these types of services and projects based on the reportable segment/division from its most recent annual report.

Some of the top holdings in the fund are Vinci SA, KBR, Fluor Corporation and McDermott International.

Don’t forget check back on this list from time to time to see if any other home builders ETFs are added or if any are removed. I will update the list when things change.

Also, before making any trades. be sure to consult your broker, your advisor or a financial professional. Research each ETF individually, know how each fund works. Keep an eye on how they react to different market conditions. As with any investment, conduct your due diligence. No investment is risk-free, so make sure you are aware of the pros and cons of any investment or in this case…Home Builders ETF.