History of the Indices Dow Nasdaq S P More

Post on: 16 Март, 2015 No Comment

Ever wonder why people quote the Dow performance each and every day? The Dow was up today, the Dow was down today, why does it matter? I mean the Dow is made up of 30 stocks! What about the Nasdaq Composite or the S&P 500? At least with the Nasdaq Composite you get a hundred companies and with the S&P 500 you get, well, 500 companies. Ever wonder the origins of these indicies and who decides what companies get in? Well I did and it has nothing to do with showing off your stack underneath the buttonwood tree.

Dow Jones Industrial Average

What: Charles Dow, back when he was an editor at the Wall Street Journal in the 19th century, devised a way to measure the performance of the industrial components of the American stock market. That is, he wanted a way to quickly see how industrial companies that were being traded in the United States were doing. His creation? The Dow Jones Industrial Average, an average of the thirty largest and most widely held companies in the US. Thats it, only thirty companies and most of them arent involved in heavy industry at all! (Nice little trivial bit, of the original twelve, only General Electric remains)

Why: Old habits are hard to break and this index dates back a long long way. While there are a lot of complaints about the Dow, how it only tracks thirty companies, how the price weighted nature gives more influence to the higher priced stocks, etc. it is still believe to track the overall market pretty well so people stick to it.

Nasdaq Composite

What: The origins of this index are in the NASDAQ stock market itself. NASDAQ stands for National Association of Securities Dealers Automated Quotations and its an electronic securities trading market with over three thousand companies listed. The Nasdaq Composite is a total stock market index which means every single company that trades in the Nasdaq is integrated into the index. It was launched 1971 with a starting basis of 100 and since then has reached peaks of near 5000 (dot com boom anyone?).

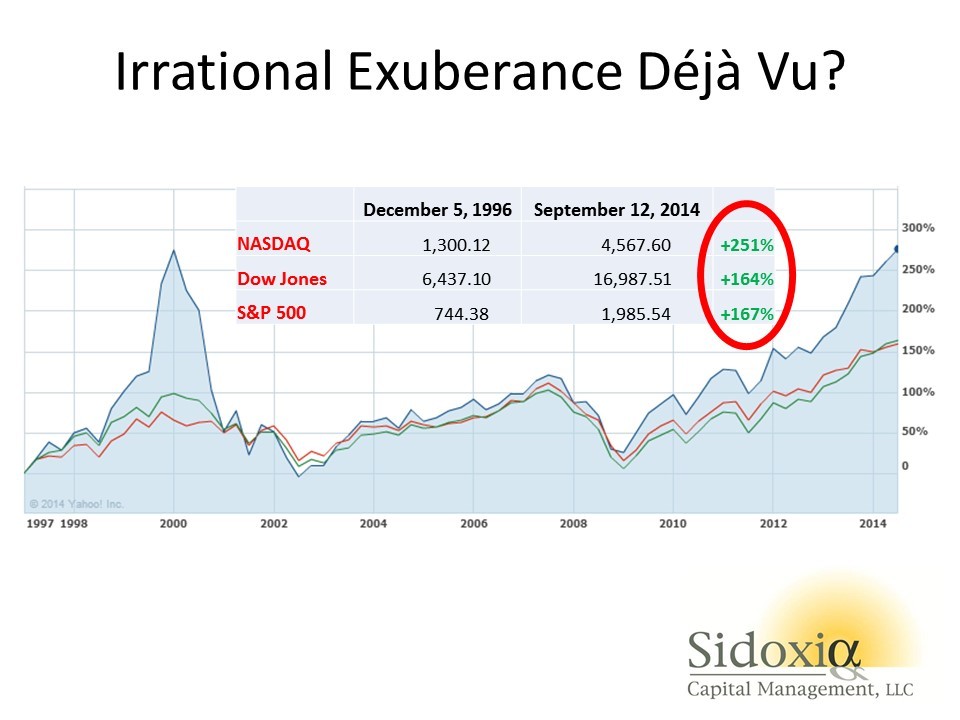

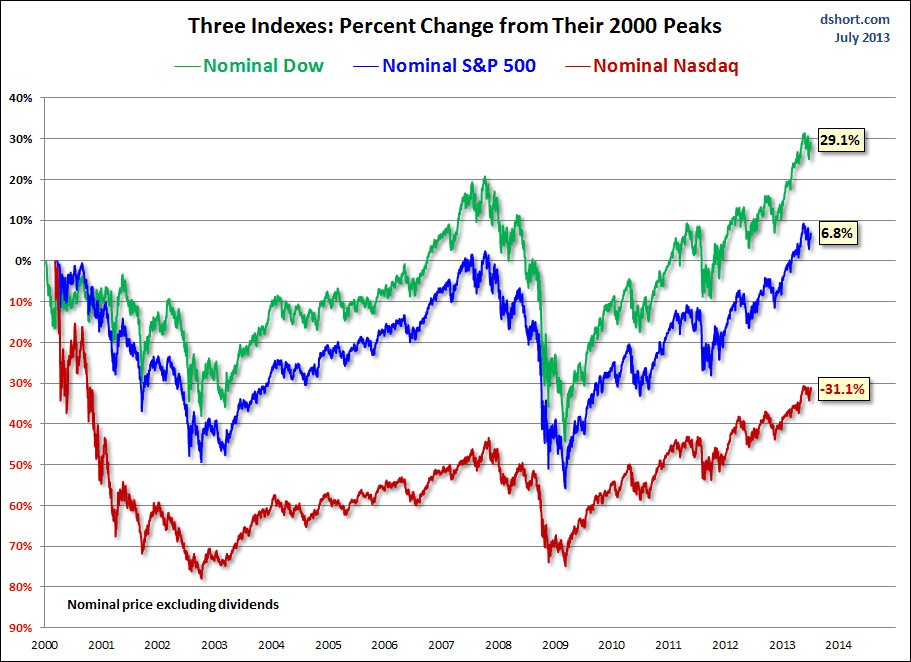

Why: Why the Nasdaq? Well it has a lot of the hot tech companies like Yahoo and Dell so many look to it to see how tech companies are doing. Thats part of the reason why the index spiked in the dot com boom but hasnt recovered since. Whereas other indices have beaten their former highs, the Nasdaq isnt close. The Nasdaq is also the largest of the US stock markets in terms of average shares traded per day and number of companies listed, so having a good gauge on its performance is always a good thing.

S&P 500

What: Five hundred large-cap companies traded on either the New York Stock Exchange or the NASDAQ and the index was started back in 1957. Before then, it was just the S&P 90 but they decided to throw in 410 more for good measure (okay, I made that last part up). The index itself is float weighted, which means they only count shares that are publicly available (instead of total shares) in the weighting and valuation; which is different than the other indices.

Why: This may be a chicken and egg scenario but a lot of mutual funds use the S&P 500 as their benchmark since its 500 large-cap companies, it makes sense that a mutual fund with a significant large cap component would want to measure itself against it.

Other Notable Indices

Some other notable indicies are the NYSE Composite, the Russell 2000, and the Wilshire 5000. The NYSE Composite is an index of all the stocks traded on the New York Stock Exchange. The Russell 2000 is part of the Russell Investment Groups family of indexes in various market segments, the 2000 is their small cap index. Finally, the Wilshire 5000 (its long name is the Dow Jones Wilshire 5000 Composite Index), a name that will seem less cool after another three thousand years, is an index of every single stock thats traded in the US.

So there you have it, a brief look at all the indices, a little on why I think theyre popular (which may not be why, but Ive tricked myself into believing it!).