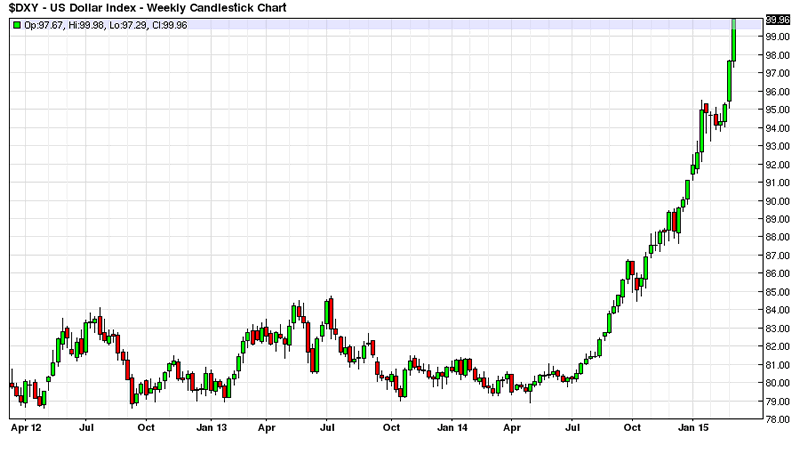

Higher interest rates stronger currency

Post on: 17 Июль, 2015 No Comment

In the comments Kimble had a great point long term estimates of the level of the dollar can be heavily influenced by the current level. Although this may seem like economists being myopic, it has more to do with our extremely limited understanding of how the exchange rate works.

When doing applied (adhoc) work, me and economists like me enjoy using the assumption that higher interest rates will lead to an appreciation in the currency. The fundamental assumption driving this is that if interest rates are higher, they will attract more foreign capital, increasing demand for the local currency, and thereby driving up its value. Backing up this idea is a second factor, that if interest rates are higher domestic consumption falls, reducing the demand for imports at a given exchange rate, which reduces the supply of currency, increasing its value.

Now for some reason, the evidence does not follow this well polished argument. In fact, economists agree that a random walk seems to outperform any exchange rate model we can create .

What could be the problem with our description? Firstly we have expectations. Once market participants have a view of where the exchange rate may be, they might hold it there even if interest rate differentials change. I dont believe this, as I think market participants would try to take advantage of any immediate arbitrage opportunity that presented itself. However, this can be used to explain why exchange rates can get stuck at certain levels.

This leaves us with the sad realisation that there is probably something wrong with the model. I have no problem with the supply view, higher interest rates will lower domestic demand. However, I do have a problem with the demand section.

We are told that higher interest rates will attract capital, as it increases the return for investors. Now a higher interest rate will mean that someone can put money in the bank and make a greater return, but doesnt it also impact on the growth in the value of assets in a negative way? In NZ at the moment, currency fluctuations seem to be driven by European and Japanese investors who simply want to put their money in our banks in this case a higher interest rate has increased the capital inflow, which in turn has led to an appreciation in our dollar.

However, bonds and bills are one type of investment good. There can also been investment in property and the stock market. Higher interest rates will reduce peoples willingness to borrow and over the following months they will lead to a reduction in domestic economic activity. If this leads to a slowdown in the rate of property price growth (or a reduction on rental yield growth), property becomes a less attractive investment. The same holds true for stocks. If current global investors are moving into property and stocks, then an increase in the interest rate will actually reduce capital inflows, and possibly lead to a depreciation in the exchange rate.

As a result, it is important to look at what investments foreign capital will move to and from before we can state whether a higher interest rate will lead to a higher exchange rate. As we cant seem to forecast the intricacies of these individual movements, our exchange rate forecasts become very path dependent (for a similar example look at forecasts of oil prices ![]() )

)