High Speed Low Drag Combining HighTech Risk Management With ETFs

Post on: 30 Июль, 2015 No Comment

Low-cost investments and high-quality risk assessments are bigger and better with cutting-edge technology at Innealta Capital

For typical advisory clients, there’s really only one risk: losing their hard-earned money.

Risk is the two-horned dilemma of financial advice. On one side, risk is the reason people need financial advisorsif Treasury bonds were paying 10% yields, few people would need financial help. Yes, theyd also need insurance assessments, cash-flow management and tax mitigation, but as financial planners discovered in the 1980s, nobody will pay you 100 basis points for those services.

Of course, default risk and inflation would eat into those risk-free returns and bond values, but few retail investors are sophisticated enough to think about those things. That brings us to the other prong of the risk conundrum. Because most people don’t understand investment risk, risk management is hard to sell and even harder to keep clients focused on.

I know that some advisors, broker-dealers and asset managers have developed programs to help clients better understand risk and stay the course during market downturnsand that some of them are quite good. But as far as I can tell, the word hasn’t gotten out to the majority of advisors clients. It doesn’t help that academic views of risk differ greatly from the way normal people see risk. For typical advisory clients, there’s really only one risk: losing their hard-earned money. That’s why, in their heart of hearts, most clients are looking to their advisors to take their money out of the market before it goes down.

There’s a potentially greater risk to investors than bailing at the wrong time, and it’s not covered by most risk education programs: high investment costs. Markets and portfolios may go up and down, but fees and loads are constant and forever (even the impact of a one-time, up-front load will be felt throughout the life of an investment). In my view, the primary job of a professional financial advisor is to mitigate these costs.

For 22 years, starting with the Reagan bull market (which really took off in 1982, but didn’t catch the attention of advisors until 86 or so), well-allocated, buy-and-hold portfolios were the risk management tool of choice for retail advisors and their clients. The prevailing theory was that by diversifying holdings over low-correlating asset classes, investors could consistently capture attractive returns over time. Many did, even with the market correction of 1991 and the dot-com crash of 2001.

All of that changed in September 2008, though, when virtually all asset classes (except Treasuries) took a nosedive at the same time, and advisors and investors alike were painfully confronted by the fact that the markets had changed, linking asset classes through leverage, globalization, packaged products and programmed trading. Consequently, traditional asset allocation has largely gone the way of parachute pants, fax machines and Donkey Kong, and have been replaced by demand for a new, higher level of risk management.

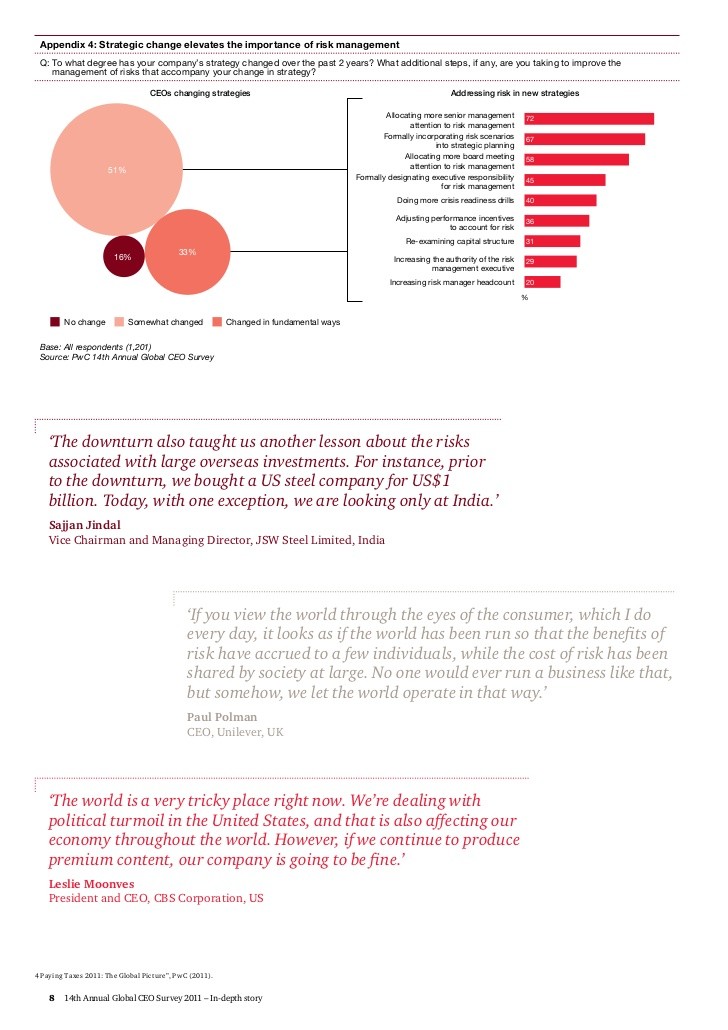

Not surprisingly, the new wave of risk management portfolio solutions has been provided courtesy of today’s leading-edge technology, which enables the creation and management of highly diversified, low-cost investment vehicles (like ETFs) and risk assessment models that can collate and analyze risk factors on a scale that has never before been possible. Innealta Capital in Austin, Texas, is one of a handful of firms that has successfully combined the broad diversification of asset classes available in today’s ETFs with risk management computer modeling to create investment portfolios with significantly reduced risk and substantially increased returns. In fact, Innealta’s low-cost portfolios may well be the next generation of managing risk in client portfolios.

Innealta is well-aware of its role in today’s advisor-managed portfolios, providing contact and the flow of information as a major part of its advisor relationships. In the new investment climate, advisors have closed their ranks on money managers. Advisors who used to use 12 or 15 managers now want deeper relationships with a small number of managers, so we provide a ton more data to the advisors we work with, said CEO Jeff Montgomery.

Montgomery added that Innealta provides its retail advisors with the same RFP quarterly due diligence as its institutional clients. Even if they are with big brokerage firms, they want to know more than traditional disclosures. Not only are E&O carriers looking for more accountability in portfolio management and denying coverage if they don’t find it, but more and more advisors understand that if the money management goes bad, there’s really nothing else that matters.

To provide sound money management for today’s investors and advisors, Innealta focuses on managing risk. Our risk-based portfolios express a very unique product design that includes a proprietary decision-making process that analyzes the relative attractiveness of individual equity asset classes versus fixed, explained Montgomery. These portfolios optimize the risk-reward trade-offs within and among a range of broad asset classes, over longer term investment horizons, and in a disciplined buy and harvest long-term equity rotation strategy that is based on selection, diversification and patience.

Innealta’s strategies come in two forms, and both are available as mutual funds: the Country Rotation Core, which holds ETFs in over 30 countries equity markets, including 10 emerging markets; and the Sector Rotation Core, which holds ETFs in 10 U.S. sectors. While Innealta doesn’t disclose much about how it assesses the relative risks in each of these markets, the Proprietary Tactical Model is 19 years old (it used to take 12 to 18 hours to run on a given country or sector; now it takes just 1.5 hours) and evaluates four major components that cover all major aspects of the investment climate.

Macroeconomics: The overall economy is evaluated, including monetary policy, the shape and level of term structure of interest rates, business cycle identification, personal consumption, credit spreads and real interest rates.

Fundamentals: Equity attractiveness and fundamental variables are used to measure the relative value of each equity market versus bonds.

Risk: Risk metrics are used to capture the level of uncertainty in the markets.

Technical: Momentum and market conviction metrics are used to quantify the strength of market movements.

How have the portfolios performed? Since its inception on Jan. 1, 2010, through Dec. 31, 2013, the Country Rotation Portfolio posted a risk-adjusted rate of return (Sharpe ratio) of 1.13 with standard deviation of 4.75, versus 0.61 and 10.48 respectively for its benchmark, the 60% MSCI ACWI ex-U.S./40% Barclays Capital U.S. Aggregate.

Both portfolios are in the top 1% in their respective Morningstar categories, and with annual turnovers between 100% and 200%, costs run between 140 and 170 basis points.

Even though the numbers are good, the million-dollar question for Innealta is, how do you sell low risk? It is a challenge, admitted Montgomery, but not a major one. Because our portfolios are low risk, we have a blended benchmark that’s 60/40 equities to bonds, so the advisors look at a second set of data: a special category for risk management. They think of us as a marathoner rather than a sprinter. And we got pretty well-known by avoiding the huge hit in 2008.

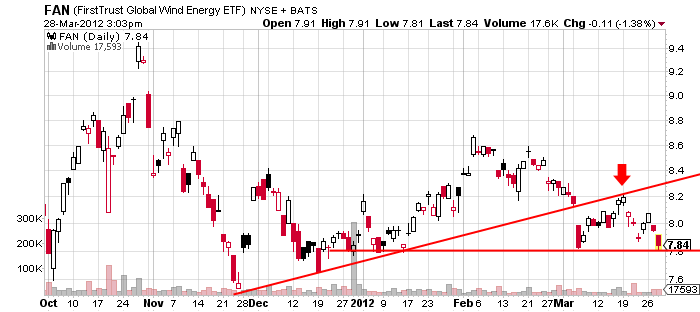

Montgomery is referring to the Sector Rotation Portfolio, which was 60% in bonds and 40% in stocks (evenly spread across information technology, health care, consumer staples and energy) on July 1, 2008, when the S&P 500 was at 1,285. By Oct. 1, when the S&P had fallen to 1,161, the Sector Portfolio had been repositioned to 100% in bonds and avoided the 35% drop in the S&P by Nov. 20.

Reflecting its risk/return prowess in 2008 and since, Innealta has about $5 billion under management, much of it institutional, which represents a 700% increase each year since 2011. There are not a lot of risk managers in the ETF space, and we are now the largest, said Montgomery. We want to help advisors manage risk. I don’t think there is any issue more poignant than risk management post 2008.

Correction: The print version of this article incorrectly said that the Proprietary Tactical Model is eight years old. It is actually 19 years old. This article has been corrected to reflect that.