High Frequency Trading The Need for Speed!

Post on: 7 Август, 2015 No Comment

High Frequency Trading: The Need for Speed!

Bob Lau, CFA

Head of Equity Trading

You have probably heard of High Frequency Trading (HFT) in the media. It has become prevalent in our financial markets today, with some estimates suggesting that HFT makes up to 70% of the volume of stocks traded in the U.S. and 35% in Canada. The questions then become: What is HFT and how can it affect traditional investors?

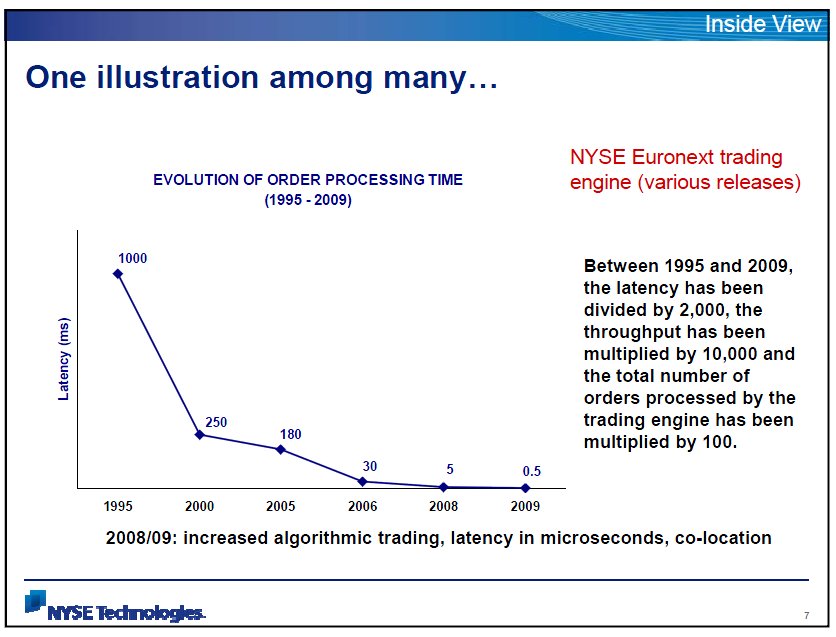

High Frequency Trading is a program trading platform that relies on technology to transact very high volumes of trades and analyze market data at very high speeds. The faster the technology and the closer the servers are situated to the exchanges the more effective an HFT is. As a result, HFTs invest heavily to keep their technology at the forefront and co-locate their servers at exchanges and trading venues, wherever possible, to increase the speed of their market connections. The combination of technology, speed and programming ability enable HFT firms to interpret and react to market data in microseconds.

There is a negative connotation regarding High Frequency Trading in general. Most HFT firms have no fundamental views on the securities they trade and are not ‘natural’ investors. For this reason, they are considered by many to be market noise. HFT firms have even been referred to as ‘unnecessary intermediation’ by some market professionals because they get in the way of natural investors trading with one another. HFT strategies involve extremely short holding periods and high turnover, with positions rarely held overnight. They target miniscule gains on each trade because their plan calls for them repeating the process several thousands of times per day to be profitable.

High Frequency Trading is not a new phenomenon. In some form or another, arbitrage trading strategies have been around for a long time. Market-making, statistical and index arbitrage are noteworthy examples of HFT strategies with long histories. It is also important to point out that not all arbitrage is negative for the markets, as many forms of arbitrage contribute to increased market efficiency. From a global perspective, HFT has been prevalent in the U.S. and other markets, well before entering Canada. Its rise domestically came as a result of the TSX going public and the ensuing fragmentation of the Canadian financial markets. The growth of HFT exploded in Canada around 2008, as there are now eight trading venues in Canada competing for trade orders, which means that each venue, to varying degrees, is incentivized to cater to HFT business to generate commission revenue.

Although there are numerous HFT strategies, they can be grouped into three common categories; general arbitrage, rebate arbitrage, and predatory strategies.

- General arbitrage makes the markets more efficient and should, in our view, be considered a ‘good’ form of HFT. Arbitrage, which is defined as the simulataneous buying and selling of an identical asset in different markets to capitalize on price differences between markets, has been around forever. What has changed since the rise of HFT is the speed at which market participants can take advantage of much smaller pricing discrepancies between markets.

- Rebate arbitrage is the result of exchanges or trading venues charging lower fees or offering rebates for market participants that provide liquidity. A liquidity provider is a market participant that stands ready to buy or sell a security at its quoted prices. The ‘maker/taker’ model gives rebates to these liquidity providers (passive flow) while charging those that take the liquidity (active flow). This model came about as financial markets became more fragmented and competition for trading flow increased. The TSX introduced the Electronic Liquidity Provider program in 2008, which contributed to the explosion of HFT in Canada. These ELP’s can afford to breakeven or even lose money on each trade as long as the rebates they receive covers their costs. Again, their speed and technology make it profitable for them as they are able to repeat this numerous times over a number of different securities. Whether they truly deliver liquidity to the markets at all times is still being debated.

- Perhaps the most frowned upon form of HFT are the predatory strategies. In general, this form of HFT tries to sniff out bigger orders and trade ahead of them. For example, if a predatory HFT notices that a small buy order in an illiquid security is filled quickly, they may assume that there is likely to be a large seller on the other side of the trade. Certain HFT’s capitalize on this by accumulating or shorting positions in front of the natural investor’s bigger order only to trade it back to the natural investor later at a profit. In these situations, the trading costs for the natural investor increase as a result of HFT activity in the market.

It’s very hard to quantify the effects of High Frequency Trading as financial markets are dynamic. In general, there have been positive and negative results from the rise of HFT. On the positive side, bid-ask spreads, or the difference between the quoted prices to buy and sell securities, have narrowed and trading volumes have increased. Some argue that these factors have actually attracted more investors into the markets. On the negative side, the infrastructure demand on the markets has increased exponentially as HFT firms send and cancel trade orders constantly which can affect other investors. Many also suggest that HFT has increased the market impact, opportunity costs, and trading costs for larger institutional orders, which also hurts investment returns for natural investors.

Source: S&P TSX / ITG

Certain rules have been instituted or suggested by regulatory authorities to curb High Frequency’s effects on the markets. Regulators in Canada (IIROC) have recently introduced fees to tax those straining market infrastructure by charging for order messages. Some also suggest slowing down order messages to put everyone on the same playing field. Another suggestion has been to eliminate the maker/taker model. The reality is that HFT is unlikely to go away – there’s not much incentive to do so. It is too early to draw conclusions on the effectiveness of rule changes but it will be interesting to see what the long-term effects on HFT are.

Edited by: Michael Job, CFA

Leith Wheeler is not responsible for any errors or omissions contained herein and we reserve the right at any time and without notice to change, amend or cease publication of the information.

Any investment and economic outlook information contained in this report has been compiled by us from various sources. Third party sources are believed to be reliable, but no representation or warranty, express or implied, is made by us or any other person as to its accuracy, completeness or correctness. We and our affiliates assume no responsibility for any errors or omissions.

By Leith Wheeler December 10, 2012