High Dividend Stocks With Low P

Post on: 22 Апрель, 2015 No Comment

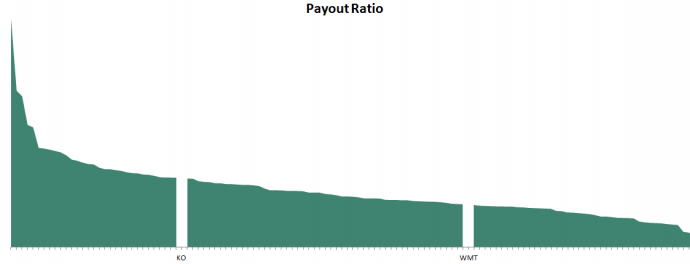

Finding a good stock is one thing and an entirely subjective thing, at that. Every investor has different levels of risk he or she is comfortable with. But, there are a few things that most investors agree on price-to-earnings ratio (P/E Ratio) and dividend yield.

147.29%

American Capital Agency Corp. (NASDAQ:AGNC ) is a residential real-estate investment trust (REIT). It had a $5.16B market cap and a 0.45 beta, meaning it is roughly half as volatile than the market at large. AGNC is trading at $28.08 a share, or 4.18 times its earnings, and pays a 19.94% dividend yield on a 94.81% payout ratio. The stock returned 18.78% in 2011. Brian Jackelows SAB Capital Management had $110.01 million in the company at the end of September after increasing its holding in the company by +17% during the third quarter. John Griffins Blue Ridge Capital. Bill Millers Legg Mason Capital Management and Ken Griffins Citadel Investment Group also hold positions in AGNC.

Ares Capital Corporation (NASDAQ:ARCC ) is a diversified investment company. It has a $3.17B market cap and a beta of 1.80, meaning it is more risky than the market. ARCC is trading at $15.45 a share, or 8.73 times its earnings, and pays a 9.32% dividend yield on a 79.96% payout ratio. The stock returned -0.06% in 2011. Charles Cloughs Clough Capital Partners had $41.73 million invested in the stock at the end of September after increasing its position in the company by +64% during the third quarter. Richard Driehaus Driehaus Capital and Bill Millers Legg Mason Capital Management are also fans of the company.

Atlantic Power Corporation (NYSE:AT ) is an electric utilities company. It had a $4.93B market cap and a 0.77 beta, meaning it is roughly 25% less volatile than the market at large. AT is trading at $14.30 a share, or 5.38 times its earnings, and pays a 7.87% dividend yield on a 18.75% payout ratio. The stock returned 4.46% in 2011. Both Jim Simons Renaissance Technologies and D. E. Shaws D E Shaw increased their positions in AT by over 50% in the third quarter.

Chimera Investment Corporation (NYSE:CIM ) is a diversified REIT. It had a $2.58B market cap and a 1.24 beta, meaning it is about 25% more volatile than the market at large. CIM is trading at $2.51 a share, or 4.83 times its earnings, and pays a 17.53% dividend yield on a 110.74% payout ratio. The stock returned -29.10% in 2011. Howard Gubermans Gruss Asset Management initiated a new $10.77 million position in CIM during the third quarter, a holding worth roughly 1.5% of its portfolio. David Costen Haleys HBK Investments and Ken Griffins Citadel Investment Group are also fans of CIM.

Hatteras Financial Corp (NYSE:HTS ) is a residential REIT. It had a $2.02B market cap and a 0.26 beta, meaning it is roughly one-quarter as volatile than the market at large. HTS is trading at $26.37 a share, or 6.54 times its earnings, and pays a 13.65% dividend yield on a 98.60% payout ratio. The stock returned 0.11% in 2011. Charles Cloughs Clough Capital Partners had $39.49 million in HTS at the end of the third quarter. Cliff Asness AQR Capital Management also has a position in HTS.

MFA Financial, Inc. (NYSE:MFA ) is a diversified REIT. It had a $2.39B market cap and a 0.32 beta, meaning it is about one-third as volatile than the market at large. MFA is trading at $6.72 a share, or 7.30 times its earnings, and pays a 14.88% dividend yield on a 109.98% payout ratio. The stock returned -4.82% in 2011. MFA is a favorite of Chuck Royces Royce & Associates, Cliff Asness AQR Capital Management and Charles Cloughs Clough Capital Partners.

Annaly Capital Management, Inc. (NYSE:NLY ) is a diversified REIT. It had a $5.16B market cap and a 0.30 beta, meaning it is 30% as volatile than the market at large. NLY is trading at $15.96 a share, or 8.31 times its earnings, and pays a 14.29% dividend yield on a 147.29% payout ratio. The stock returned 2.70% in 2011. Bill Millers Legg Mason Capital Management had $116.86 million in NLY at the end of September after increasing its holding in the company by +91% in the third quarter.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.