Hidden 401k Plan Fees Can Ruin Your Retirement

Post on: 13 Октябрь, 2015 No Comment

July 22, 2011

The 401k is a fantastic investment vehicle, but it can come with hidden costs. Too often, an employer sponsored 401k plan can contain fees that are not visible in the balance statement. Understanding these fees is the key to gaining control of your retirement savings plan. A few percentage points here and there can really add up over time.

Focus on the 3 Types of Fees

There are three kinds of fees that your 401k plan will charge you: Plan Administration Fees, Asset Based Fees, and Service Fees.

Plan Administration Fees

Plan administration fees are charged at different amounts depending on the deal worked out by the employer. Smaller companies are less likely to get as good of a deal as larger employers. These are typically paid on fixed quarterly schedule. These fees can include:

- Record Keeping and Accounting Fees. This includes services such as monitoring employee matching and profit sharing contributions, keeping track of vesting schedules, and conducting audits as required by law.

- Custody and Trustee Service. This is for the custodian that actually holds the plan assets. All of those stock certificates have to kept somewhere, right?

- Other Administration Fees. These include things participant education, customer services, and the plan’s website.

Asset Based Fees

Asset based fees can take many forms, but since these fees are taken out of your assets they are not visible in your account statement. There are three primary types of asset based fees:

- Management Fees. These are fees that are taken out for the services of someone who actively decides which stocks the funds will hold.

- Expense Ratio. This is the total operating expenses a fund charges to investors. These funds are typically less than 1% and can be as low as 0.2% in the case of low cost index funds .

- Investment Advice. These are fees paid by an employer to advise them on their investment selection. These fees are in addition to the expense ratio fees.

Transaction and Service Based Fee

These are fees that are charged to a plan participant for the completion of specific service:

- Loan Fees. If you are trying to take loan out against your 401k, the administrator may charge you a one time loan administration fee.

- Paperwork Fees. There are other circumstances that may require additional fees. For example, in the event of a divorce, the plan administrator may charge a fee to divide the couple’s assets.

Conclusion

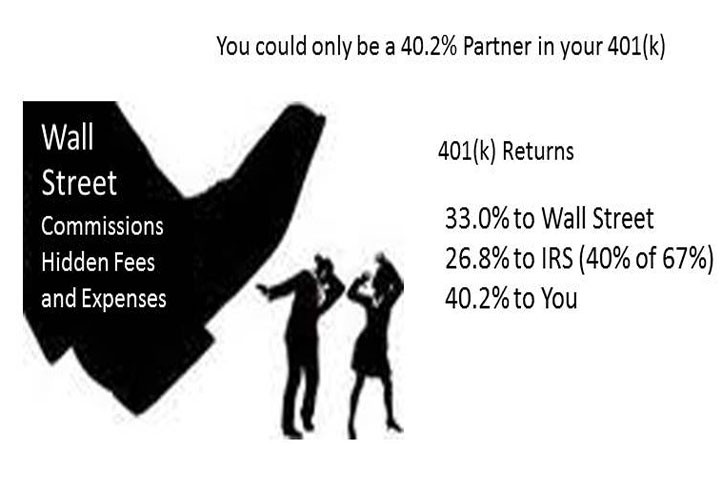

401k plans have a huge tax advantage over many other forms of savings. It is also the case that compounding interest of pre-tax money makes these plans an excellent way to build retirement savings. Nevertheless, there seems to be an endless variety of fees that can be charged by these plans. While many of these do not appear to be significant, they can have a similar compounding effect as small interest growth does when your portfolio grows.

Over time, these fees can have the effect of drastically reducing the eventual growth of your savings. How large of an effect? Let’s say you set aside $500 per month in your 401k plan for 30 years, and generated 8% returns. You would end up with $745,179. But instead of earning 8%, your 401k’s hidden investment fees pull down your performance to 6.5% for the same 30 year period. Your nest egg drops to only $553,089. Those hidden fees cost you $192,090. This is why we are such big fans of utilizing your Roth IRA first in your retirement plan.

Go ahead and get the company match in your 401k, but the rest should go into an investment where you can easily see — and control — your investment costs. Open a Roth IRA today. By better understanding the fees in your plan, you can make the right decisions to minimize these expenses and to ensure that you get all that you can out of your retirement savings accounts.

Jason D. Steele is personal finance writer and a consumer advocate.He specializes in helping people eliminate credit card debt and maximize rewards. His work can be found at personal finance sites like Money Crashers, Ask Mr Credit Card, and at his home page.