Hennessy Funds Hennessy Technology Fund (HTECX)

Post on: 20 Август, 2015 No Comment

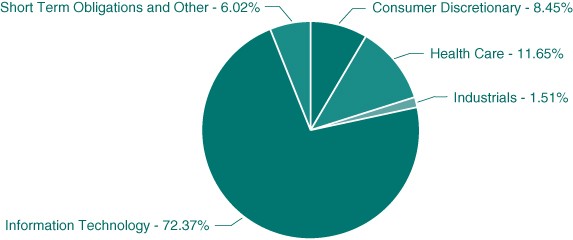

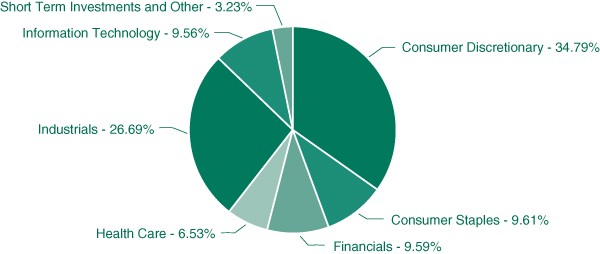

Country Allocation as of 12/31/2014

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Fund Facts

morningstar AS OF 12/31/2014

The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company. Please read it carefully before investing. A hard copy of the Prospectus can be requested by calling 1-800-966-4354.

Mutual fund investing involves risk; Principal loss is possible. A non-diversified fund, one that may concentrate its assets in fewer holdings than a diversified fund, is more exposed to individual stock volatility than a diversified fund. Investments are focused in the technology industry, which may be adversely affected by rapidly changing technology, availability of capital, R&D, government regulation and the relatively high risks of obsolescence caused by scientific and technological advances. Investments in foreign securities may involve greater volatility and political, economic and currency risk and differences in accounting methods. The Fund may invest in IPOs which will fluctuate considerably due to the absence of a prior public market and may have a magnified impact on the Fund. The Fund invests in small and medium sized companies, which may have more limited liquidity and greater volatility compared to larger companies.

Morningstar Proprietary Ratings reflect risk-adjusted performance as of 12/31/2014. For each fund with at least a three year history, Morningstar calculates a Morningstar Rating based on a Morningstar risk-adjusted return measure that accounts for variation in a funds monthly performance placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The fund received 1 star for the three-year, 1 star for the five-year and 2 stars for the ten-year periods ended 12/31/2014 among 194, 185 and 146 Technology Funds, respectively. Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in distribution percentage. Each Morningstar category average represents a universe of funds with similar objectives. The Morningstar Style Box reveals the fund’s investment style as of 12/31/2014. The vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). Morningstar, Inc. All Rights Reserved. Past performance is no guarantee of future results .

The Hennessy Funds are offered only to United States residents, and information on this web site is intended only for such persons. Nothing on this web site should be considered a solicitation to buy or an offer to sell shares of any Hennessy Fund in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction.

Quasar Distributors, LLC, Distributor.