Hedging Your Mutual Fund Portfolio

Post on: 25 Апрель, 2015 No Comment

Hedging Your Portfolio

Hedging Your Mutual Fund Portfolio

What do farmers and airlines know that you don’t?

So far in our series on managing risk we’ve taken a look at market timing and portfolio diversification as two powerful techniques to control risk in our mutual fund portfolios. Today we’ll take a look at the third and final one: hedging.

Now, I’ll note up front that hedge funds have tainted the whole concept of hedging, primarily because most hedge funds don’t hedge. Many of them use highly leverages techniques that have nothing to do with hedging. That’s not what we are talking about here.

Why Portfolio Diversification Doesn’t Always Work

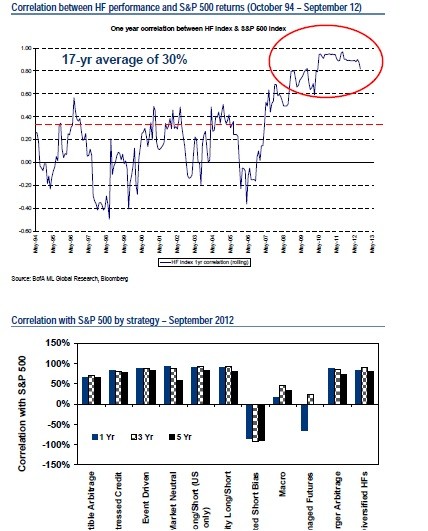

If you take a look at the portfolio we constructed last time, it still had one area that could be improved. If you look at the times when things go bad, they seem to go bad for all the funds at the same time. An example would be around 9/11/01, where almost all investments were negatively affected. It turns out that it’s not uncommon for investments to have more correlation, around negative market events, in fact that even has a name, negative covariance. This limits the amount of risk improvement we can expect to get from a straightforward diversification strategy, where we are seeking out funds that have a low correlation to one another.

What we need to do is isolate that market risk, and somehow get rid of it. That’s what the conservative investors in the commodities markets do. Everyone knows that the commodity markets are only for high risk, wild eyed speculator types, right? Well, it turns out that some of the most conservative financial transactions being done are there in the commodity pits, where you’ll find for every trader taking a flyer on corn or jet fuel, there is a farmer or an airline locking in a future price and selling off that market risk, or hedging that risk.

So, that’s where we are now. We’ve constructed a portfolio that has above market returns, with lower risk, but is still correlated somewhat to the overall market. If we can just eliminate some of that market risk, we can reduce the impact of that evil negative covariance, which in theory should reduce the overall risk of the portfolio.

But historically hedging a stock or mutual fund portfolio has been done by short selling index tracking stock, or buying put options on those tracking stocks, or dealing in stock futures. All of these are are either beyond the scope of most investors, and in certain types of accounts (e.g. IRA and cash accounts) they are not even allowed.

Next time: Next time we take a look at simple way to create a true hedge with only mutual funds, and we take a look at hedging our diversified portfolio as an example. The results may surprise you.