Hedging Against The Dollar Opening A Foreign Currency Bank Account v A Currency ETF

Post on: 25 Июль, 2015 No Comment

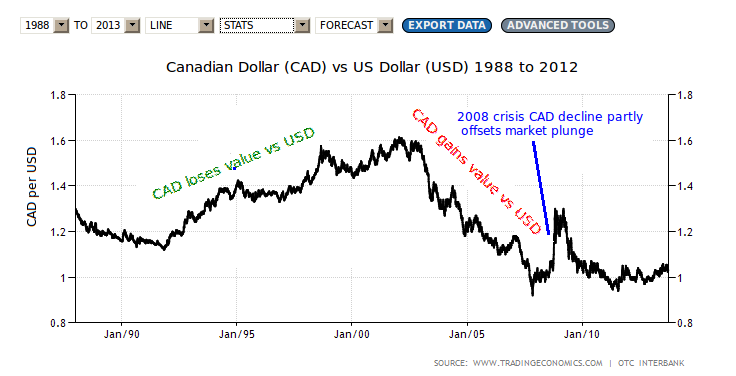

Lots of people have been asking me how to open up a bank account denominated in a foreign currency. The main reason appears to be a desire to hedge against future declines of the dollar. For example, right now the US dollar is trading at all-time lows versus the Euro, and at 30-year lows versus the Canadian dollar.

I must admit that I have no clue how to do this if one is not a citizen or permanent resident of another country. If you know how, please do enlighten us in the comments.

Now, Im no currency expert, but doesnt this sort of behavior seem like performance chasing? Its the new sure thing. I figure if you own a good chunk of international stocks, you are already enjoying some foreign currency exposure. In addition, a weak dollar makes our exports cheaper across the border, which increases sales for domestic goods. As I expect to keep earning and spending US dollars for the foreseeable future, I dont see any need for any additional hedging. If anything, I might hold more international stocks, but Im still open to contrary opinions.

Lets say you do have a desire or need for some currency hedging. Instead of opening up a bank account in Euros, here are two alternatives:

Foreign Currency CDs at EverBank

EverBanks offers what it calls WorldCurrency Certificates of Deposit. which invest in a variety of foreign currencies. For example, with the Euro CD your $10,000 will be converted to Euros, earn an interest rate between 2.50-3.0% APR depending on term length, and then be converted back to US dollars upon maturity. The British pound CD is currently earning between 4.25 and 4.50% APR. So youll have the chance to make (or lose) money from differences in exchange rates in addition to earning interest. Here are more pros and cons:

- Guaranteed interest rate

- $10,000 minimum purchase

- Available in 3, 6, 9, and 12-month terms. No account fees

- FDIC-Insured against bank failure, but not currency losses

- EverBank likely makes money off the yields in addition to the conversions. The currency conversion rate will be within 1% of the wholesale spot price EverBank pays for the currency.?

Foreign Currency ETFs from Rydex

Rydex has a group of foreign currency ETFs that come close to pure plays on that currency. For example, Euro:USD exchange rate is approximately 1.39:1, so the share price of the CurrencyShares Euro ETF (FXE ) is $139. If the exchange rate goes to 1.50:1, then the share price would be about $150. Along the same lines, the British Pound Sterling ETF (FXB ) has a share price of $201.

In addition, the ETF do effectively earn interest like bank accounts, as they give off monthly dividends. The Euro ETF is currently yielding 3.39%, and the British pound ETF is yielding 5.46%. This seems pretty good, considering Capital One 360 UK is yielding 5.25%. More pros and cons:

- Can buy as little as one share, from existing broker

- You are subject to possible stock commissions, and bid/ask spread

- Possible premium/discount to NAV

- Expense ratio is about 0.40%

Comparing the EverBank CDs and the CurrencyShares ETFs, it would seem that the ETF would win out if you had a broker that offered free trades like Zecco or WellsTrade .

Finally, you may be able to purchase or exchange into foreign currencies directly via a FOREX-specific broker or a standard stock brokerage that offers such capabilities. Im not sure how much interest these sites pay though I wonder if it is is standardized or if it varies like money market fund rates here.