Hedge Funds What is the Outlook

Post on: 30 Июнь, 2015 No Comment

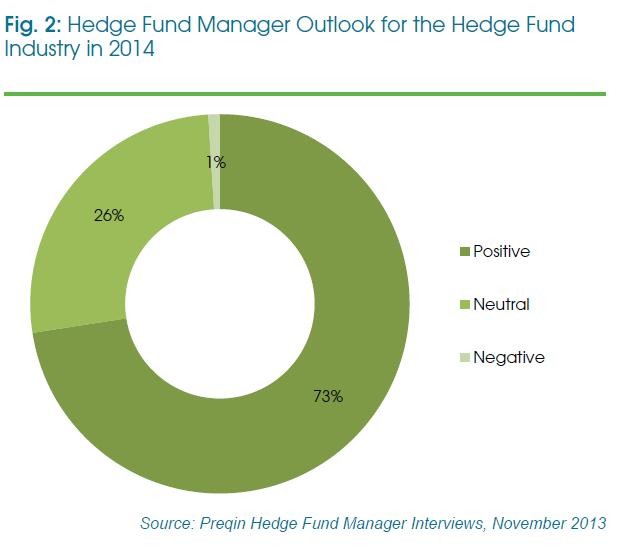

Hedge funds have received a reasonable amount of investment media coverage lately. It seems as though they are hovering, just like circling vultures waiting for their prey. Are they a high fee, unregulated disaster just waiting to happen? Or, in a low return environment, are they the best thing out there?

Many have argued that hedge funds are all so different that it is futile to try to classify them under one heading. Others argue that hedge funds are not really an asset class at all but simply different investment strategies using conventional assets. We agree with investment strategist and researcher Tim Farrelly. Our belief is that a single asset class of Diversified Hedge Fund of Funds (DHFOF) makes sense from the point of view of defining a useful asset class: predictability; and, investability. All the different hedge fund strategies, including equities trading, commodity trading, fixed interest trading and various forms of arbitrage, are a little like the hundreds of stocks that make up an equities index. All of those stocks are fundamentally different from one another but when brought together they, as a group, become more predictable.

When DHFOF managers bring together a number of managers in a predominantly market neutral fund, they are trying to diversify away all those different factors until left with manager value add (known as alpha) plus a little bit of market exposure. From this perspective, the forecasting task is to estimate an achievable level of alpha, after fees.

The DHFOF definition passes the investability test as well. Most investors will seek to gain exposure to these markets via a DHFOF, or seek to replicate a DHFOF approach by investing in a diversified spread of hedge funds. So how much value add can we expect from hedge funds? If we look at historical returns over rolling five year periods, hedge funds were providing cash plus 8% type returns. But that was before the massive amounts of hedge fund inflows that have occurred in the last five years. The rapid growth in funds under management has made, and will continue to make, adding alpha harder and harder in years to come.

Historically hedge fund managers have been able to achieve very high and consistent levels of pre-fee alpha. Many of these managers really know how to make money in the markets. They also manage to charge very high fees, which in practice tend to eat up a very large portion of the alpha. The problem with the fees on hedge funds is that not only are they high, but they are also asymmetric. You pay away a share of your profits, but dont get any refund on losses. For example one manager makes a 20% profit and receives a performance fee of 20% of the return, and another manager loses 10% so does not receive a performance fee. The before fees average return is 5%, but after fees falls to only 1%.

In the short term, most DHFOFs seem to be well managed and reduce the more predictable type of risks and, as a result, have shown fairly low volatility and very modest losses in the bad years. However, the possibility of a systemic failure or market meltdown cannot be ruled out.

Farrelly forecasts a one in 50 chance that DHFOFs experience a loss of 26% over a one-year period, way in excess of anything that has been seen to date. While one in 50 seems a pretty low probability of something occurring in anyone year, it translates to about a one in five chance of that event occurring some time in the next ten years — in other words, unlikely, but nonetheless distinctly possible. Similarly, the one in 20 chance of a 15% downturn translates into a 40% chance that such a downturn will occur at least once in the next decade. Never the less, in an environment with low expected returns, hedge funds are still a worthwhile diversifier. This is particularly so for investors with a relatively short five year time frame.

More articles