Hedge funds luxury prices for lousy results Canadian Business

Post on: 16 Март, 2015 No Comment

(Photo: Jeffrey Coolidge/Getty)

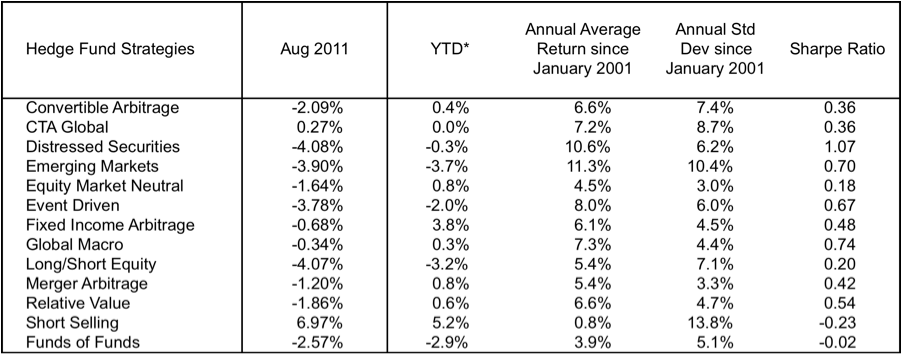

Canadian hedge funds are truly getting walloped in 2012. As of July 31, Scotiabank’s hedge fund index has fallen 7.57%, compared to the Canadian stock market’s drop of 0.9%. Hedge funds are intended to protect the savviest investors from market drops. But the reward for the sky-high fees paid by the average accredited investor has been returns that are about 15% worse than those on the Canadian balanced index of stocks and bonds since the end of 2010. Hedge funds are supposed to be a rarefied luxury for the most discriminating clientele, the Ferrari of investment vehicles. They’ve turned out to be more like the Pinto—sluggish and prone to bursting into flames.

Simon Lack, who allocated billions of dollars to hedge funds while working for JPMorgan, recently published The Hedge Fund Mirage. which makes the case that the average hedge-fund investor has earned pathetic returns. “If all the money that’s ever been invested in hedge funds had been put in Treasury bills instead,” writes Lack, “the results would have been twice as good.”

Hedge funds did well when the industry was small, but returns have gotten weaker as it’s grown. The typical global hedge fund underperformed Vanguard’s balanced stock and bond index every single year between 2002 and 2012. Yale research into hedge funds from 1996 to 2004 found 75% of them went out of business during the eight-year study. So even though surviving funds averaged 7.3% annually between 1998 and 2010, the average investor, who jumped on the bandwagon when prices were high, earned just 2.1% per year.

The same dynamic now appears to be at work in Canada. Large cash inflows to Canadian hedge funds over the past couple of years have coincided with the industry’s weak recent returns. In 2002, there were just nine Canadian hedge funds with five-year track records. Today, we have roughly 300 hedge funds in Canada, with the larger ones attracting an ever-increasing number of assets.

Of course, winning hedge funds do exist, but finding them ahead of time isn’t easy. What’s worse, reported returns aren’t always what they appear to be. Hedge funds aren’t registered with the Securities and Exchange Commission, and fund managers can communicate their results to the reporting services whenever they feel like it—or halt reporting altogether. When results are good, fund managers are happy to trumpet that fact to the public and to the hedge fund indexes. But when results are weak, they just clam up.

Jailed for his hedge-fund-turned-Ponzi-scheme, Bernie Madoff (whose fund represented more than 3% of the entire hedge fund industry) simply didn’t report his 2008 results. He, alone, would have dragged the index down, had he reported results from his cell. The same can be said of Long Term Capital Management—the hedge fund that nearly brought the global financial market to its knees. Its disastrous 1998 implosion was also omitted from hedge fund databases.

Odd reporting biases also exist here at home. When Scotiabank compares hedge fund returns to the S&P/TSX stock market index, they include dividends for hedge funds, but not for the index as a whole. It’s like comparing the airspeed between two birds—after clipping one’s wings.

Warren Buffett has had issues with the industry’s high fees and broken promises for years. In response, in 2008 New York asset management firm Protégé Partners bet him that five hand-picked hedge funds would beat the S&P 500 index over the following 10 years. The result? From 2008 to 2012, Protégé’s pet funds dropped by 5.89%, falling 20% behind Vanguard’s balanced portfolio of stock and bond indexes. In the rockiest stock market in recent memory, the hedge funds should have had an advantage. Instead, they struggled even to match the S&P 500 index.

The lesson? Take a moment to appreciate the dependable family sedan of the common balanced index fund. Even if you are an accredited investor, in this case, the populist choice will likely come out ahead.

Andrew Hallam is the author of Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School