Hedge Funds and Institutional Investors Go for the Gold

Post on: 25 Май, 2015 No Comment

Related Content

A blip. This is how the rah-rah gold cognoscenti describe the latest dive in gold prices. Currently, an ounce of gold is trading in the $1,185.40 range, down from its high of $1,257.20 at the New York Mercantile Exchange on June 18. But the consensus among some money managers is that the price blip is short-term and the price of gold may rise as high as $1,500 in the coming months.

“I hold to my belief that gold at $1,500 an ounce is achievable by year-end, reaching $2,000, maybe $3,000 an ounce, maybe even more in the next few years,” says Jeffrey Nichols, senior economic analyst for Rosland Capital in Santa Monica, Calif. and managing director of American Precious Metals Advisors in New York.

And in times of economic turmoil, it’s nice to hold onto something physical, and institutions and hedge funds are doing just that with gold. Paulson & Co.. with approximately $31 billion under management, is the largest hedge fund to back the precious metal. The hedge fund is said to own more gold than several major countries combined, and earlier this year founder John Paulson launched his own gold fund with $250 million but which currently has more than $500 million in assets.

David Einhorn’s Greenlight Capital, with about $5 billion under management, was one of the first major funds to store physical gold, citing lower storage costs. In his letter to partners for the second quarter, Einhorn notes the fund’s investment in African Barrick Gold, which operates gold mines in Tanzania, and is one of the fund’s top five positions.

Paulson, Einhorn and their fellow gold aficionados have invested in gold as a multi-year, long-term hedge against inflation. Rosland Capital’s Nichols cites these reasons for investors attachment to gold: U.S. monetary fiscal policy and its growing deficits “with the Federal Reserve becoming America’s main financing vehicle,” as well as the monetization of debt, especially sovereign risk issues in Europe. The strong demand for gold in India and China can be seen against decreasing mining production showing that the supply is not keeping up, Nichols explains.

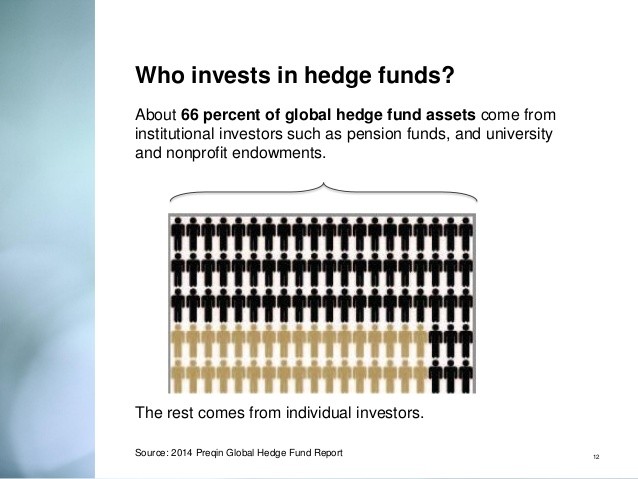

“For pension and endowment funds, which were prohibited from investing in commodities in the past, it’s fairly new to be able to use gold as a hedge in the form of diversification,” Nichols continues, adding that these funds are bullish fundamentally on gold as an asset class today.

“In the past several years, we saw a very notable switch of pension funds to holding gold for the first time,” says Aram Shishmanian, the CEO of the World Gold Council (WGC). Pension funds started investing actively in gold last year viewing the metal as a safe long-term investment, the head of the WGC affirms.

The gold investment of choice for those pension funds that invest in alternative investments tends to be gold exchange-traded funds, like the largest, gold-based ETF, SPDR Gold Shares with about $50 billion in assets (the shares trade on NYSE Arca, under the symbol GLD). ETFs are traded on an exchange and therefore regulated, liquid and cost-effective structures, adds Juan Carlos Artigas, manager of investment research at WGC. “The storage and insurance costs are embedded into GLD’s annual fees,” he says. Among pension fund investors is the Teacher Retirement System of Texas in Austin, Tex.

The Trust holds gold bars and seeks to reflect the performance of the price of gold bullion.

Prior to 2004 when GLD launched in the U.S. market, the only way for pension funds to invest in the yellow mineral was to hold physical bullion and in the amounts they needed this would mean a great expense to store, house and insure, Artigas continues. “For the funds and endowments to invest $100 million, ETFs are a much more efficient way to benefit from the wealth characteristics of gold,” he adds. Other GLD ETF holders include the New Jersey Division of Investment, which is the manager of the state’s public pension fund and the Pennsylvania Public School Employees Retirement System.

In volatile times, when the dollar is weak, the Euro is up and down and the bears are roaring, it’s not a mystery that gold investment is reassuring. Take it from someone who’s seen wild inflation first-hand.

David Behr, a native of Zimbabwe, who works for an Internet services company, has been living in New York for two years, but has seen what it’s done to his country — and has invested in physical gold through BullionVault.com, which is based in London and has a vault in New York, as a long-term hedge against currency risks, he says, adding that he likes holding physical gold.

Tom Winmill, portfolio managers for the Midas Funds, sees “value-oriented institutional investors starting to sniff around mining companies now that their administrative costs are coming in lower than expectations and several of their price-earnings ratios are more in line with stocks — 13 times to 14 times earnings instead of an historic extensive multiple of 20. Now it’s running at a slight discount,” he says.

Whether in ETFs or physical gold, the story that’s hundreds of years old is still being written.