Hedge Fund Insurance Fiduciary Liability

Post on: 16 Март, 2015 No Comment

Fiduciary Liability

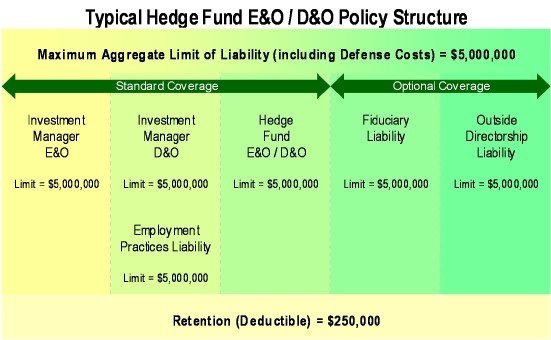

Fiduciary Liability Insurance protects the fiduciaries of employee benefit plans for sums they are legally obligated to pay as a result of an actual or alleged wrongful act or breach of their fiduciary duties under ERISA. The policy also provides coverage for defense expenses to defend a claim made against the fiduciary for an actual or alleged wrongful act, after the insured pays the retention (deductible). When purchased (for an additional premium), Fiduciary Liability coverage is usually added by endorsement to the fund’s E&O/D&O policy; although some funds opt to pay more for a separate policy in order to get a lower retention (deductible).

There are two ways that hedge funds may have a fiduciary liabilty exposure. First, the fund manager (investment adviser entity) may sponsor a retirement (401k) or health plan for its own employees. And second, if twenty-five (25%) percent or more of the fund’s assets are owned by benefit plan investors (as defined under ERISA regulations and as modified under ERISA section 3(42) by the Pension Protection Act of 2006) then the fund may be deemed to hold plan assets, and the fund’s investment manager will be deemed to be an ERISA fiduciary (note: Hedge Fund Insurance is not a law firm and cannot provide legal advice — please consult with qualified legal counsel to determine whether your firm has a fiduciary liability exposure). Under ERISA law, a fiduciary can be held personally liable — and fiduciaries may not be indemnified by the fund out of plan assets. Our hedge fund clients with a fiduciary liabilty exposure purchase this policy primarily to protect their personal assets. It is important to note that unless coverage is specifically added, an E&O/D&O policy will exclude ERISA claims.

Every insurer has a somewhat different policy form. The better forms have a broad definition of wrongful act and include many of the following features:

- Duty to defend; Broad definition of claim to include: Written demand Civil proceeding Criminal proceeding Formal administrative or regulatory proceeding Worldwide coverage; Marital property extension; Omnibus welfare plan coverage; Civil penalties under sections 502(i) and 502(l) of ERISA in definition of damages; Defense coverage for claims seeking benefits due to injunctive or equitable relief in the U.S.; No exclusion for: Failure of maintain insurance; Failure to collect contributions; Libel, slander, defamation; Severability of exclusions and application; Automatic coverage for: Sold plans; Terminated plans; Newly formed or acquired plans if plan assets are less than 10% of total plan assets; Continued coverage for: Merged plans; All plans for prior acts in the event of change in control; Bilateral Discovery — upon termination or cancellation for any reason, other than non-payment of premium, the insured organization may purchase an Extended Reporting Period (tail).

The U.S. Supreme Court’s decision in LaRue v. DeWolff, Boberg & Associates, Inc. allows individual 401(k) plan participants to sue plan fiduciaries. This makes it more important than ever for hedge funds with 401(k) plans to purchase this important coverage.