Hedge Fund Documents Capital Fund Law Group

Post on: 16 Март, 2015 No Comment

Hedge Fund Documents

Your hedge fund attorney will prepare five core documents, which are necessary to launch the fund:

(i) a private placement memorandum, (ii) limited partnership agreement, (iii) subscription agreement, (iv) investment management agreement, and (v) management company operating agreement.

Private Placement Memorandum

A private placement memorandum (“PPM”) is a securities disclosure document that provides investors with material information about the fund to enable an investor to make an informed investment decision. Similar to a prospectus in an initial public offering, a PPM potential investors with specific information about the terms of the fund, the background of the management company and other issues.

See our post: What’s in a Private Placement Memorandum? for more information about a PPM’s contents.

Limited Partnership Agreement

The limited partnership agreement (or in the case of an LLC-based fund, an operating agreement) is the legal governing document of the fund. The limited partnership agreement outlines the terms of the fund and rights of an investor and fund manager. In contrast with the private placement memorandum, which is written in plain English, the fund’s limited partnership agreement is a complicated legal document. Among the terms of the limited partnership agreement are:

•a description of the powers and activities of the general partner (typically also the fund manager);

•a thorough discussion of all fees and expenses, including management, performance or other potential fees as well as brokerage and audit expenses that a limited partner may pay either to the fund manager or other third parties;

•an explanation of the allocations and distributions of profits to all partners, including how profits are calculated and timing of distributions;

•a description of withdrawal provisions, including minimum and maximum withdrawal amounts, lock-up periods, gates, and distribution dates; and

•a designation of power of attorney, which authorizes the Fund Manager to act on the limited partner’s behalf for such purposes as voting the Fund’s securities, buying and selling Fund securities, admissions of new limited partners, and amendments to Fund formation documents and other documents necessary of continued Fund activity.

To become a limited partner of a Fund, an investor must sign a countersignature page that it agrees to be bound by the terms of the agreement.

Subscription Documents

Subscription documents provide investors with a description of the steps necessary to purchase limited partnership interests in a fund and provide fund managers with eligibility information about the investor. This is the investor’s contract with the Fund, which specifies the fund subscription amount and outlines under what terms the investment is being made. For Fund Managers, this document requires investors to attest that they meet certain eligibility standards, such as being an “ accredited investor ” or “qualified client”, as required by SEC regulations and state law in order to invest in the Fund.

Investment Management Agreement

The investment management agreement is an agreement between the fund and the investment management company (often the same entity as the general partner). It defines the services that a fund manager will provide. It also assigns to the fund manager a power of attorney over the Fund’s assets, including the contributions made by the limited partners, and gives the Fund Manager the broad discretionary authority to manage such investor funds and securities in a manner that the Fund Manager believes is consistent with the investment strategy of the fund. Since the fund manager and the fund are controlled by the same individuals, the investment management agreement becomes a document signed by the same individuals on both sides.

Management Company Operating Agreement

The fund manager operating agreement is the legal governing document that provides all of the rights of the founders of the fund. This document specifies how ownership of the fund is divided among the principals of the fund. The management company operating agreement or its contents is not disclosed to investors.

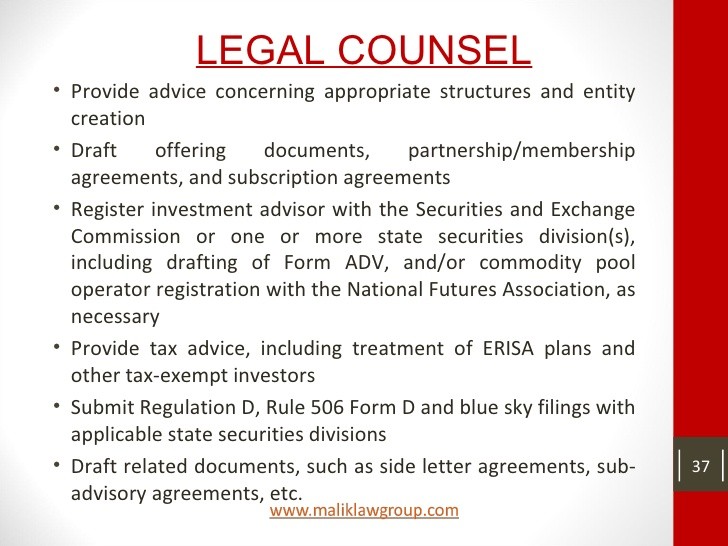

Form D Filings, Investment Advisor Registration

In addition to the five core fund documents, there are required SEC and state filings, including form D filings and in some cases, investment advisor registration.

If you have any questions about structuring the hedge fund offering documents, please give us a call.

Call us at (801) 465-3620 to schedule a complimentary consulation. Schedule a Consultation