Hedge Fund Cover Without the Hedge Fund Fees Bloomberg Business

Post on: 25 Май, 2015 No Comment

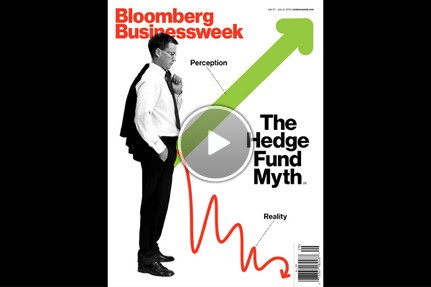

Most people think hedge funds aim to shoot the lights out and return a zillion percent. The funds are mocked for not beating the S&P 500 Index, which is up 136 percent over five years. Not to defend hedge funds, but, as the name suggests, many of them are actually just looking to hedge stock and bond exposure. They’re designed to get positive returns regardless of market conditions, and to not move in lockstep with the broad markets.

With the stock market rally feeling tired and the threat of rising rates lingering, more investors are turning to “alternative” or “liquid alt” mutual funds and ETFs to diversify portfolios and dampen volatility. Assets in alternative strategy mutual funds — a category that includes long/short equity and market-neutral funds — have swelled to $140 billion from $22 billion a decade ago, according to Morningstar Inc. Now, alternative ETFs are attracting attention. At $1.4 billion, assets have more or less doubled from a year ago.

People like the non-correlated returns hedge funds can provide, but they don’t like the high minimums, high fees, early withdrawal fees and lock-up periods that come with them. ETFs mimicking hedge fund strategies eliminate those issues. You aren’t getting the real thing, but you are getting a generic, robotic version of the real thing for less than half the cost.

The largest of the bunch, at $764 million, is the IQ Hedge Multi-Strategy Tracker ( QAI ). It attempts to replicate the return characteristics for six hedge fund strategies. A mathematical model analyzes hedge fund performance patterns to identify the assets classes being used by hedge funds. The ETF then invests in liquid proxies — broad-based ETFs — for those asset classes to get similar performance.

It has returned 2.5 percent this year with half the volatility of the S&P 500, which is up 4.1 percent. On a risk-adjusted return basis, after adjusting for volatility, QAI’s return is 0.41 percent to the S&P 500’s 0.36 percent. QAI ‘s correlation to the stock market is.0.36, less than that of Vietnam stocks. It charges 0.94 percent of assets annually — high relative to traditional ETFs but low next to alternative mutual funds and hedge funds.

WisdomTree Managed Funds (WDTI ), at $156 million, is the second largest of the group. This is an actively managed ETF with a managed futures strategy. That essentially means it goes long and short futures contracts connected to commodities, currencies and interest rates. It looks for momentum signals in these markets to determine its moves. WDTI is down 1 percent this year. It has no correlation to the S&P 500 and about one-third the volatility. WDTI charges 0.95 percent.

Other notable ETFs in this area with assets above $30 million include the ProShares RAFI Long/Short (RALS ) ETF and the IQ Merger Arbitrage ETF (MNA ).

Are these products safe for average investors? They’re much less volatile than the S&P 500. But their strategies can be very hard for individual investors to wrap their minds around. And if the concept behind an ETF is tough to grasp, the best strategy for investors to take may be to walk away.

More stories from Eric Balchunas:

- The ‘Hotel California’ Flap: ETF Investors Should Take It Easy

Eric Balchunas is an exchange-traded-fund analyst at Bloomberg. More ETF data is available here , and weekly ETF podcasts can be found here .