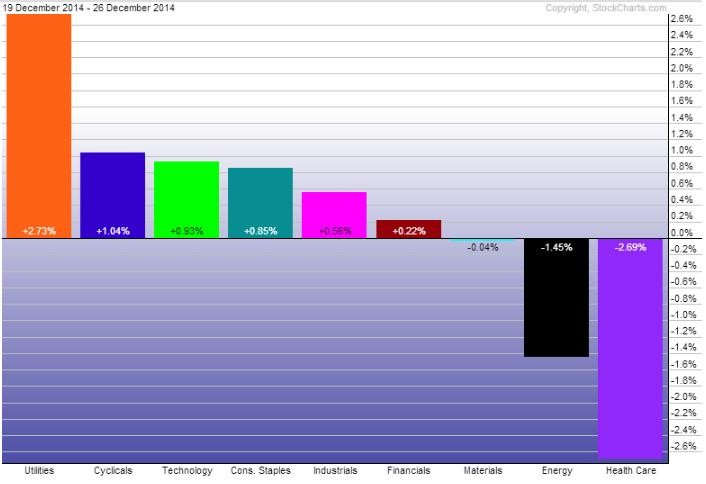

Healthcare stocks fall from first place in race for year s bestperforming sector The Tell

Post on: 17 Сентябрь, 2015 No Comment

FactSet

In the race for the best performing sector of the year, healthcare stocks slipped slightly behind consumer discretionary stocks Thursday after asserting dominance for much of the year.

One sector represents what consumers want (a new car, vacations, retail therapy, entertainment), while the other represents what they need (health insurance, medical treatment). With implementation of the Affordable Care Act seen as buoying the health care sector, its interesting to note that the recent slip coincided with a report that penalties for not having health insurance will be delayed. Then again, an early reading of consumer sentiment showed a recent drop but those numbers will be updated on Friday.

For the year, the health care sector on the S&P 500 Index /quotes/zigman/3870025 SPX is up 32%, compared with the 32.5% gain in the consumer discretionary sector. The biggest subsector gains are biotech stocks in the health care sector with a 69% gain on the year, and Internet and catalog retail in consumer discretionary with a 86% gain. That could get tweaked with Amazon.com Inc. /quotes/zigman/63011 /quotes/nls/amzn AMZN reporting after Thursdays close.

Since the end of the September quarter, the health care sector is up 4.3%, while consumer discretionary is up 3.7%.

The price gains during the year have also bolstered the weighting positions of both sectors on the S&P 500. While tech companies make up $2.96 trillion in market cap on the S&P 500 and financials make up $2.71 trillion, consumer discretionary and health care currently weigh in at about $2.06 trillion each by market cap in the third and fourth positions.

So far during earnings season, 18 out of 23 companies in the healthcare sector have beaten the consensus earnings estimate for the September-ending quarter, or by 78%, according to John Butters, senior earnings analyst at FactSet. Thats slightly better than the consumer discretionary sector, where 23 out of 30, or 77%, have beaten earnings estimates as of Thursday midday. Thats compared with the average 74.5% beating estimates for the S&P 500 index so far. See Drug companies score big on earnings .

As far as exchange-traded funds go, the Vanguard Health Care Index Fund ETF /quotes/zigman/1485056 /quotes/nls/vht VHT is up 35% for the year, with the iShares U.S. Healthcare ETF /quotes/zigman/262113 /quotes/nls/iyh IYH up 33% and the iShares Nasdaq Biotechnology ETF /quotes/zigman/85342 /quotes/nls/ibb IBB up 54%.

Wallace Witkowski

Follow The Tell on Twitter @thetellblog

Follow Witkowski @wmwitkowski