Have perfect control over your Retirement Savings with the help of a SelfDirected Precious Metals

Post on: 13 Июль, 2015 No Comment

Have perfect control over your Retirement Savings with the help of a Self-Directed Precious Metals IRA

As you are getting closer to your retirement age, it will become more relevant than before to give cautious notice to the holdings before your retirement date. Your risk tolerance and financial goals will surely change as you will get older. This is certain that you will not like to take more risk with the retirement savings that you have at the age of 55. So, a wonderful option to reduce that kind of risk is to create a self-directed precious metals IRA. This will give you a golden opportunity to see a wonderful appreciation in your retirement savings.

What is meant by self-directed precious metals IRA?

The IRS permits all the individuals to create a self-directed IRA, which further permits them to use all the alternative investments ideas with their savings relating to retirement. In traditional IRA, investors can invest in various financial instruments such as certificates of deposit, mutual funds, bonds, and stocks. In a self-directed IRA, you can invest non-traditional investments like precious metals and real estate. There are also certain items such as rare coins and fine art, which is not allowed in the self-directed IRA.

Appropriateness of a self-directed precious metals IRA?

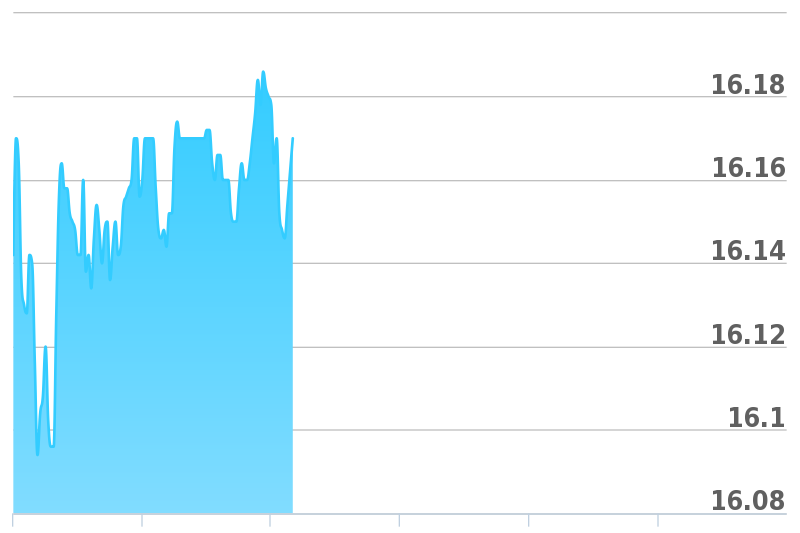

Anyone who is interested in protection and the safety of buying power for their retirement savings is a suitable candidate to open gold or precious metals IRA. In case, you desire more control on your money as well as dislike the unpredictability and volatility of the stock market, than gold can give long-term growth as well as stability to your retirement account.

All the older people, who have substantial amount of funds in a traditional IRA, can easily protect this money by investing in a precious metals IRA. By having self-directed IRA, you will also have the ability to invest your money in other investments like stocks. A precious metals IRA will represent just a portion or all of your complete retirement savings.

You can just begin by opening a new account and start making contributions from your salary. It is also very much possible to hire a custodian to open your account. In case, you have a retirement savings plan (401-K or IRA), then just tell your current account custodian to contact your new account custodian to transfer all or some of your funds. By chance, you select to rollover all your holdings, then you will get a check and after that set-up a precious metals IRA within sixty days by complying with the IRS rules to avoid paying any taxes or penalties on your provisional withdrawal.

What are the IRS rules relating to precious metal IRA accounts?

- All silver and gold investments within your IRA account have to meet with the set standards for excellence.

- Collectible or graded coins having numismatic value along with an intrinsic silver or gold value are not allowed. All the silver bullion coins minted before the year 1964 will not meet with this excellence standard and will not be permitted.

- The physical metals might not be in the custody of the IRA account holder. Rather they will be kept in a secured facility known as depository. At the time of your withdrawal from your IRA account, you will either get payment or the physical delivery of the gold based on the value of your holdings.

Command is the main word- You can exchange, sell or buy the precious metals based on your precious metals IRA account.

A perfect choice

If you desire the strength and safety of physical silver and gold rather than uncertainty, then a self-directed precious metals IRA is perfect for you. Like any other smart investor, you will never put all your assets in a single investment. Silver and gold always make sense when it comes to diversification and must denote a part of your total retirement portfolio.