Have an investing idea Build your own themebased ETF

Post on: 4 Июль, 2015 No Comment

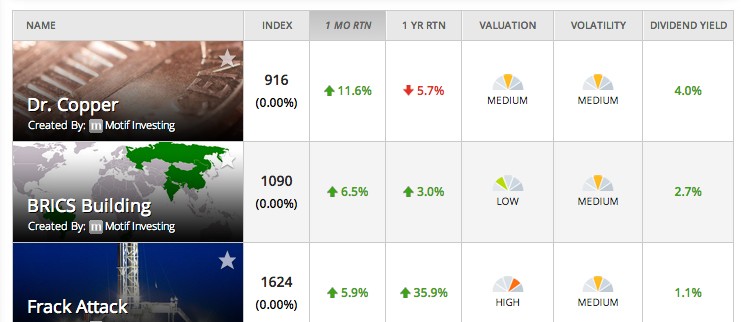

Think you can beat the market? Here’s your chance. Motif Investing. an online broker, lets you build your own theme-based portfolios or motifs as the company calls them. If others like your idea, they can also buy into it.

Think mini ETFs. Customizable, crowdsourceable, no-fee ETFs, said Motif Investing co-founder and CEO Hardeep Walia.

Each motif is a basket of up to 30 stocks with companies from different sectors, industries, countries, and with different market capitalizations. The minimum investment amount is $250. After that, each motif you create, or invest in, is $9.95.

The site hosts over 50,000 user-created motifs, which offer a window into the investing interests of Americans.

Sylvain Sonnet | Photographer's Choice RF | Getty Images

For example, the Obamacare motif comprises companies that the creator thinks will profit from the Affordable Care Act. It includes healthcare plan providers, hospitals, medical appliances and equipment makers, drug manufacturers and healthcare information services companies. The motif is relatively new—it was created on October 26, 2013—but the lifetime return is 17 percent. The S&P 500 returned 10.5 percent over the same period.

While the Obamacare motif is profitable, it’s not very popular, as measured by the social media tools on Motifinvesting.com, which allow members to rate motifs with a thumbs up or down.

On the other hand, the Repeal Obamacare motif, which includes companies in diagnostics, medical devices and assisted living, is popular with fellow members, despite significantly lower returns. Over a one-year period, it’s up only 4.2 percent versus a gain of 17.8 percent for the S&P 500.

The site also shows which motifs are trending. Currently, a motif called Shale Oil (up 42.3 percent over the past year) is near the top of the trending list, a reflection of the worries over oil prices due to the ongoing crisis in Iraq, Hardeep said.

Motif Investing, which launched in 2010, is No. 4 on the CNBC Disruptor 50 list, which features private companies whose innovations are revolutionizing the business landscape. Hardeep said he hopes to shake up the status quo in the investing arena by making it more intuitive, transparent, low cost, and giving customers more control.

If you don’t like a stock in your motif, you can switch it out for $4.95. You can also make money, by earning a $1 royalty payment if another member invests in your creation.

However, statistics show that beating the market isn’t easy even if you’re a professional. According to market research firm HFR, in 2013, the average hedge fund returned 9.13 percent for the year, versus a return of 32.36 percent for the S&P 500, including dividends.

In the end, if your idea doesn’t cut it, you will have no one to blame but yourself.

—By CNBC’s Kristina Yates