Gundlach The Japanese are Out of Options Buy Japanese Stocks and Short JPY

Post on: 24 Июнь, 2015 No Comment

In Gundlach’s view the Japanese government is out of options, and is therefore going to start debasing the Yen in order to stimulate growth. As this happens we should see the Yen weaken and the Japanese stock market rally. Gundlach said in the presentation that he would not be surprised to see Japanese stocks up as much as 3000 points in 2013. That equates to around a 30% rise from its current level of 9500 .

Here’s why.

Japan has been piling up debt in recent years, as the government continues to spend more than it receives in tax revenues in an effort to stimulate growth. Currently Japanese government debt stands at 211.7% of GDP. That is a staggering number, and around twice the debt to GDP ratio here in the US.

As you can see from the next chart, there also seems to be no interest in addressing the problem. Japanese government spending has skyrocketed in recent years.

At the same time the Japanese birth rate has plummeted. This means that in coming years there are going to be less and less working individuals to support a growing population of retirees. This also means that there are going to be less and less tax revenues, which will exacerbate the country’s debt problem even further.

Gundlach says that when you take these charts together, they show that the Japanese government is out of options. They cannot continue to increase government spending (fiscal policy) to try and stimulate growth. That basically leaves monetary policy and the Bank of Japan, who has the ability to print an unlimited amount of Yen, to come in and save the day. Basically more quantitative easing like we have been seeing here in the US.

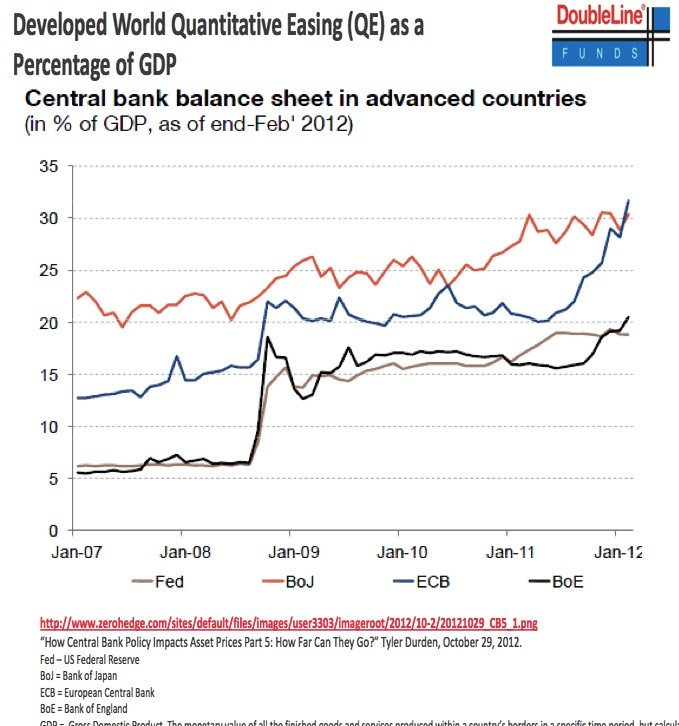

As we can see on the next chart however the Bank of Japan has already expanded its balance sheet massively (quantitative easing ) and is way ahead of the US in terms of quantitative easing as a percentage of GDP.

In Gundlach’s view, the Japanese Yen is not going to be able to take much more quantitative easing before it starts to sell off dramatically. If and when that does happen there is not going to be any interest from the Japanese government or the Bank of Japan in defending the currency. Japan is an export economy, so a weaker yen is better for the country’s economy, not worse.

So that explains the argument for the short Japanese Yen trade.

What about his recommendation to go long the Japanese stock market?

There are two reasons Gundlach thinks that Japanese Stocks are about to head substantially higher.

- All else being equal, a weaker yen means a higher Japanese stock market. When a currency is devalued everything from peanut butter to the price of a company’s stock goes higher by definition, all else being equal.

- Japan has an export oriented economy. If the Japanese Yen weakens, Japanese goods and services are cheaper for foreign buyers. This is true even though Japanese companies haven’t lowered their prices. This should be very bullish for Japanese companies and their stock prices.

Since it seems like you benefit from both the weakening of the yen and the pickup in stock prices from buying Japanese stocks you may be asking: Why do I need to go short the Japanese yen?

Good question.

When buying Japanese stocks either directly or through an ETF, your dollars are converted into Japanese yen. If the yen depreciates during the time you hold Japanese stocks, then all else being equal, you will lose money when you sell Japanese stocks and convert your money back into US Dollars.

This is why you need to go short the Japanese Yen at the same time you buy the Japanese stock market. It hedges away your currency risk.

How can you execute these trades?

In my opinion the best way to get exposure to the Japanese stock market is through the iShares MSCI Japan Index Fund (EWJ), an ETF which tracks the performance of the Japanese Stock market. For the currency portion of the trade, you can either go short the CurrencyShares Japanese Yen Trust (FXY) or open a spot currency trading account with a company like Oanda.com, and go long the USD/JPY.

You can see all the slides from his presentation here .