Guide To The 10 Most Popular Leveraged Inverse Etfs 2015

Post on: 14 Апрель, 2015 No Comment

3A%2F%2Fwww.zacks.com%2F?w=250 /% For investors seeking to hedge their portfolios, these 10 leveraged inverse ETFs could be interesting choices.

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% The ETF world is gaining immense popularity as evidenced by the roughly $1.3 trillion invested in the space. At least part of this interest is due to low

3A%2F%2Fwww.zacks.com%2F?w=250 /% Over the past decade, Exchange Traded Funds (ETFs) have gained tremendous popularity due to many advantages and flexibility that they offer investors.

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% Over the past decade, Exchange Traded Funds (ETFs) have gained tremendous popularity due to many advantages and flexibility that they offer investors. Some

3A%2F%2Fetfdb.com%2F?w=250 /% Here is a look at ETFs that currently offer attractive short selling opportunities.

3A%2F%2Fetfdb.com%2F?w=250 /% ETF Overview. This is a list of all of the Leveraged Equity ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not

3A%2F%2Fen.wikipedia.org%2F?w=250 /% Leveraged ETFs. Leveraged exchange-traded funds (LETFs), or simply leveraged ETFs, are a special type of ETF that attempt to achieve returns that are more sensitive

3A%2F%2Fwww.stocktradingtogo.com%2F?w=250 /% Exchange Traded Funds (ETFs) have become a very popular form of investing over the last decade. Trading like stocks ETFs have allowed investors to take positions in

3A%2F%2Fwww.investopedia.com%2F?w=250 /% Direxion Daily 20+ Year Treasury Bear 3x ETF The Direxion Daily 20+ Year Treasury Bear 3x ETF (ARCA: TMV) offers bond bills the opportunity to wager big on a rise in

3A%2F%2Fwww.zacks.com%2F?w=250 /% Suppose, an investor buys a leveraged inverse ETF for $100 that has two times (2X) exposure to the underlying In this article, we take a look at the ten biggest and most popular ETFs for those investors who are new to the leveraged inverse technique

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% The ETF world is gaining immense popularity as evidenced by the roughly $1.3 trillion invested in the space. At least part of this interest is due to low costs, tax efficiency and transparency, while the large number of strategies that are easily

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% For these traders, there are more than 90 leveraged inverse funds in the space targeting different asset classes. In this article, we take a look at the ten biggest and most the popular vehicles in this sector. A quick guide to these ETFs could provide

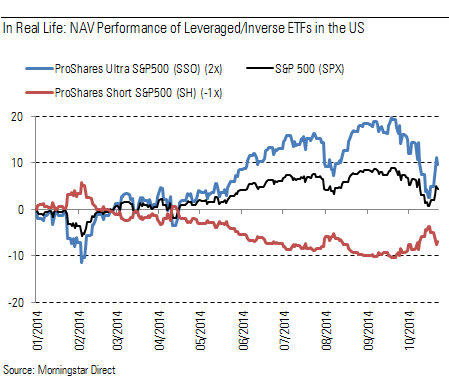

3A%2F%2Fseekingalpha.com%2F?w=250 /% The main focus of this article is leveraged S&P 500 ETFs, which aim to achieve some daily multiple of S&P 500 gains. Two of the more popular such funds House If The Index Swings 10% on 180 Consecutive Days I think the most common argument against

3A%2F%2Fwww.investopedia.com%2F?w=250 /% A leveraged ETF tracks an index, industry, commodity or currency to name a few. There are also inverse leveraged ETFs which means the If you read the fine print, most funds will recommend that you don’t stay invested in a leveraged ETF longer than

3A%2F%2Fin.finance.yahoo.com%2F?w=250 /% Most often investors fail to understand the inner workings of certain products that they invest in (especially the complex ones) and end up losing a great deal. For example, leveraged and inverse ETFs can highlighted 10 of the most popular (i.e

3A%2F%2Fca.finance.yahoo.com%2F?w=250 /% Most often investors fail to understand the inner workings of certain products that they invest in (especially the complex ones) and end up losing a great deal. For example, leveraged and inverse ETFs can highlighted 10 of the most popular (i.e

3A%2F%2Fwww.thestreet.com%2F?w=250 /% In fact, as you review bearish inverse and leveraged issues, you’ll note some interesting and perhaps counter-intuitive conditions. Most of the AUM (Assets under ProShares 2 X Leveraged Long 7-10 Year ETF (UST) UST follows the Barclays Capital U.S

3A%2F%2Fwww.fa-mag.com%2F?w=250 /% But for all of the cheap options that the ETF industry offers, it certainly has a fair amount of products on the other side of the equation. Below, we outline the top ten cheapest and most expensive funds 6. 3x Inverse Silver ETN (DSVL) / 3x Long

3A%2F%2Fetfdb.com%2F?w=250 /% While developed European and Asia Pacific economies have received a significant amount of attention, the most popular investment destinations While there are no pure play leveraged or inverse ETFs in the BRIC category, there are several funds that