Guide to Investing in Latin America

Post on: 9 Сентябрь, 2015 No Comment

Latin American Investments from ADRs to ETFs

You can opt-out at any time.

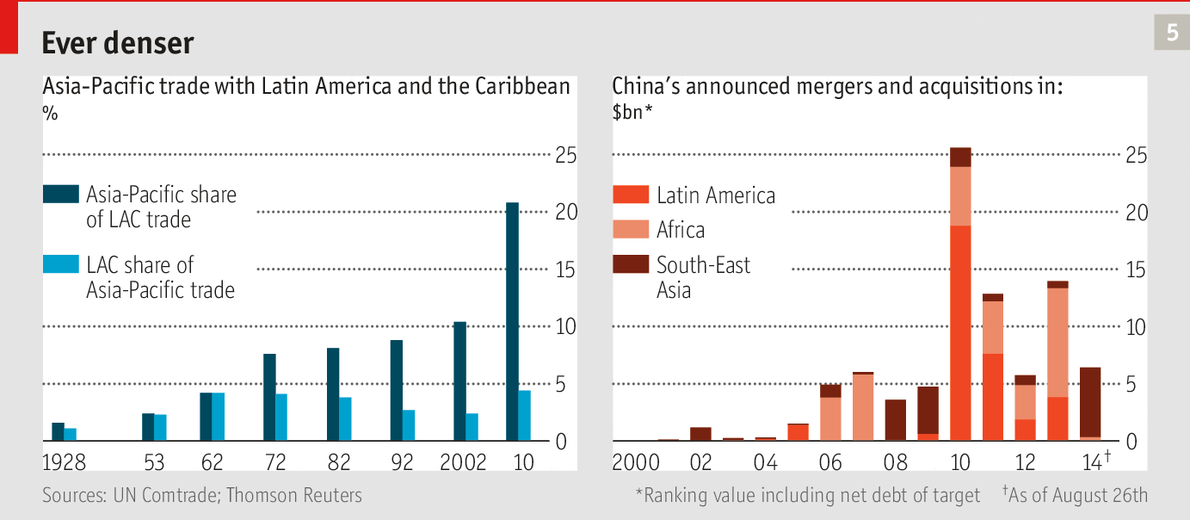

Latin America consists of a very diverse set of economies spanning the Americas, ranging from Peru’s blazing economy that has grown 7% annually over the past eight years to Argentina’s inflation-ridden economy that continues to struggle. In aggregate, the International Monetary Fund expects the region to produce grow some 3.6% in 2013, putting it below Asia’s aggregate 7.1% projected growth rate and above rates seen in the developed world.

Many economies in Latin America have benefited from higher commodity prices, as their collective basic materials exports have generally risen over the years. But despite reliance on commodities in regions like Peru and Chile. Mexico and other Central American countries have managed to grow their non-commodity exports at an even faster rate. Finally, middle class consumption has also begun to rise with the influx of wealth into these countries.

Investing in Latin America with ETFs

The easiest way to invest in Latin America is using exchange-traded funds (“ETFs”) that provide diversified exposure to the region in a single U.S.-traded security. With over $1.5 billion in total assets and an expense ratio of just 0.5%, the iShares S&P Latin America 40 Index (ILF) represents one of the most popular options for those seeking exposure to the region. Top holdings include Mexico’s America Movil and Brazil’s Petroleo Brasileiro, with a skew towards financial stocks.

Investors looking for broader exposure may also want to consider the SPDR S&P Emerging Latin America (GML) ETF, which attempts to achieve performance corresponding to the S&P Latin America BMI Index. With $130 million in total assets, a 0.59% expense ratio, and more than 100 different securities in its portfolio, the ETF offers exposure to a greater number of companies than the iShares S&P Latin America 40 Index that just tracks 40 top companies in the region.

There are many other options for investors looking for more specific exposure, too. For instance, the Market Vectors LatAm Aggregate Bond ETF (BONO) offers exposure to the region’s bond market that has been performing extremely well given the capital influx. The Market Vectors LatAm Small-Cap Index ETF (LATM) may also prove interesting to those looking to assume a little more risk in their portfolios by investing solely in small-cap securities .

Benefits & Risks of Latin American Investments

Latin America represents an attractive growth market for investors, outpacing many other developed regions of the world. While over-reliance on commodities could hurt some countries like Chile and Peru, others like Mexico and parts of Central America are well positioned to ride out lower commodity prices. As a result, aggregate Latin American ETFs may offer investors diversified enough exposure to gain the best of both worlds.

Aside from commodities exposure, here are some other risks to consider:

- Geopolitical Risk – Countries like Venezuela and Argentina are known for nationalizing foreign corporations, manipulating their currency, and taking other actions that could be detrimental to public companies operating in the space.

- Currency Risk – Many Latin American countries have troubled pasts when it comes to currency valuations, including Mexico’s Black Peso crisis and Argentina’s devaluation, in addition to other risks like inflation that have hit countries like Brazil.

Takeaway Points to Remember

Latin America represents an attractive destination for international investors given its exposure to commodities, growing middle class economy, and increasing industrialization. Those looking for the easiest way to invest may want to consider several different ETFs that offer varying levels of exposure to the region. But, investors should also be aware of the many risks that the region faces, including geopolitical risk, commodity risk, and currency risk among others.