Great Covered Call Tools at BornToSell Stock Trading To Go

Post on: 16 Март, 2015 No Comment

Mike Scanlin from over at BornToSell has been asking me to check out his site and covered call tools for close to a year now. With the StockBrokers.com 2014 Review published, I finally had the time to check them out. All I can say is nice, very nice.

BornToSells service is focused on making it easy to screen for Covered Calls and manage your own current positions. What I immediately noticed was how easy the site and tools were to use. Mike commented,

Thanks. My design goal was If Apple were to make a covered call screener, what would it look like? I wanted it simple enough for anyone to use. I chose not to use words like delta or implied vol. That annoys some power users but 90% of my users prefer it that way. And thats why we hide a lot of functionality.

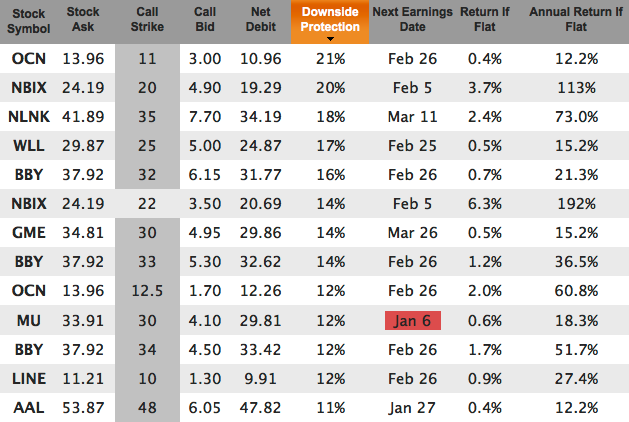

The main screener has all the options necessary to filter quickly and easily including expiration, option proximity to being in the money, stock price, sector, alongside a variety of fundamental variables. As you update your filters, results are updated on the fly. The site has only a 15 minute data delay, which for screening isnt too bad at all as many use end of day data.

The site also leverages its users to show the top 10 most popular covered calls within the community alongside the 20 most currently watched stocks. Considering that investors of every skill level subscribe to the site, I was impressed with the effectiveness of the top 10 list.

Since I test all the brokers through StockBrokers.com, I was curious to know Mikes thoughts on why BornToSell was better than the screening tools offered by the best online brokers for options trading. He cited three key reasons:

- Simplicity. Every broker has a screener. And most of them work marginally well for every possible strategy (condors, spreads, covered calls, etc). But none of them work exceptionally well for just 1 strategy. And they all require a steep learning curve. Most of them overly complexify a very simple strategy. We wanted to be best-of-breed for just 1 thing: Covered calls.

- Proper position tracking. In terms of portfolio tracking, few have the ability to group trades together into a single trade. For example, maybe you leg into a buy-write to get better fills on the stock and option portions of the trade. Good luck having your broker recognize that those two trades, placed on different order tickets, are part of a single covered call trade. So you never really know how much time premium is left in the position if its an in-the-money covered call.

- Removing the need for separate excel sheet tracking. Excel doesnt (generally) update pricing data, and certainly doesnt know about ex-dividend dates or earnings release dates that occur prior to option expiration.

I can see Mikes points #1 and #3. Most brokers do not make it easy to screen for option trades, and for those who trade Covered Calls, tracking them in excel can be a hassle (I couldnt agree more ). With that said, some of the brokers do a very good job with their option screeners, position management, and tools overall. tradeMONSTER is a great example.

Alongside the tools mentioned above, BornToSell also includes some other neat tools like the Roll Me tool which helps you compare the covered call you have vs 14 alternatives in case you want to modify an existing position. Another tool, the Income Goal screener, allows you to find covered call candidates based on your own personal portfolio metrics.

If you want to give BornToSell a whirl, you can start a two week free trial. The service runs $59.95 per month with quarterly and yearly discounted subscriptions also being available.