Google Earnings Trade To Hold Or Not To Hold Google Inc (NASDAQ GOOG)

Post on: 16 Март, 2015 No Comment

Trying to predict the future is like driving down a country road at night with no headlights on and looking out the back window. — Peter Drucker

My previous article about a Google (NASDAQ:GOOG ) earnings trade got a lot of attention. As a reminder, when Google was trading at $642, I suggested the following trade:

- Sell GOOG January 2012 600 puts

- Buy GOOG January 2012 610 puts

- Buy GOOG January 2012 680 calls

- Sell GOOG January 2012 690 calls

Later on when the stock rallied to $655-660 I suggested adjusting the strikes ten points higher to 610/620/690/700. The trade was executed for $4.70 with maximum profit potential of $10.00 (over 100%). Basically we are buying a 620/690 strangle (buying a call and a put with same expiration) and selling further Out of The Money 610/700 strangle to reduce the cost and the negative theta.

I got many questions from the readers why I’m suggesting selling the position before the earnings.

The concept of this strategy is described here. The general idea is to take advantage of the rising IV (Implied Volatility) of the options before the earnings. The rising IV combined with possible pre-earnings move of the stock should produce reliable and consistent gains over time. I described here why I don’t like holding those trades through earnings. It is based on the fact that the IV of the options jumps to the roof before earnings. The next day the IV crashes to the normal levels and the options trade much cheaper. A really large post-earnings move is needed in order for those trades to make money.

Below is the P/L graph for the Google trade:

Let’s now examine possible scenarios for the Google price after the earnings (Google is trading at $655 at this moment):

- The stock moves 6-7% to $695 or $615: the trade is about breakeven, small loss or small gain.

- The stock moves more than 6-7% (above $700 or below $610): the trade gains around 100%.

- The stock moves less than 5% (stays between $620 and $690): the trade loses 80-90%.

Of course in some cases the trade might also gain 50% or lose 50%, but you got the general idea.

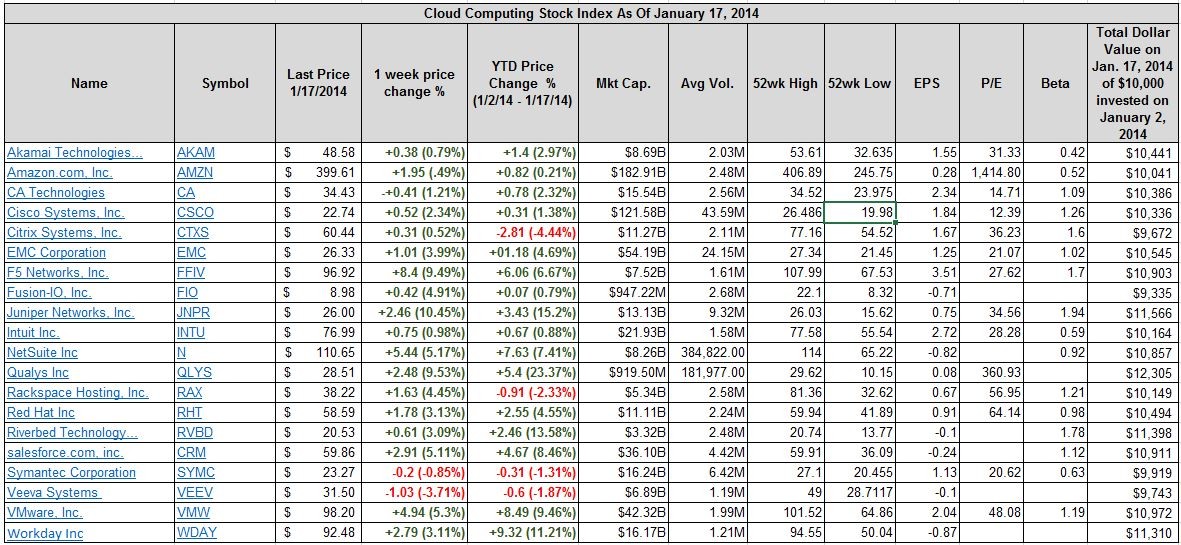

If you think that Google is guaranteed to move 5-6%, think again. Take a look at the history of the last twelve price movements:

As we can see, three out of twelve times the stock moved less than 5%, which would cause an earnings trade held through the earnings announcement to lose 80-90%.

This brings me to the next aspect of the discussion: Risk Management and Position Sizing. To better understand the concept, I highly recommend the Trade Your Way to Financial Freedom book by Van Tharp. The general concept is fairly simple:

- You decide how much you are willing to risk on any given trade.

- You determine the maximum possible loss of the trade.

- Based on the first two parameters, you decide how much to allocate for the trade.

Let’s take an example. You have a $100k account and you decide that you are willing to risk 2% per trade. Before making the trade, you determine that your maximum loss on this trade would be 20%. So you can allocate 10% of the account ($10k) to that trade knowing that your maximum loss would be $2k (20% of the trade or 2% of the account).

Now let’s see what might happen with the Google trade. If you buy few days before earnings, your only enemy is the negative theta (the time decay). The rising IV should compensate for the time decay, but even if it doesn’t happen, worst case scenario you will be losing few percent every day. You can always control your risk and sell the trade once the loss reaches 20%. So based on the 2% example, you can easily place 10% of the account into this trade and still sleep well at night.

However, if you hold through earnings, this is a completely different game. You can win over 100% but you can also lose 80-90%. Since the earnings are one day before options expiration, you will not have any time to salvage the trade. The IV will drop like a rock after the earnings and you will be lucky to recover 10-20% of the original cost. Based on the historical moves, the probability of large loss is real. It might be not high and not likely, but it’s definitely possible. To be precise, it is 25% (three out of twelve last cycles). Are you ready to take that risk? For me, the results are just too unpredictable.

Many traders who are advocating holding through earnings would argue that many small losers will be compensated by few homeruns. In the last earnings cycle I have been trading over fifty earnings trades. I closed all of them before earnings, but tracked how they would perform if left for after the earnings. Only two of the trades — Netflix (NASDAQ:NFLX ) and Mountain Coffee Roasters (NASDAQ:GMCR ) — would produce really big gains (in the 80-120% range, depending on the strikes and the expiration). But those two stocks moved more than 35%, the largest moves in at least 10 years. Those are moves of historical proportions; they are not going to happen every cycle.

For most other trades, even large stock moves would produce only moderate gains. For example, Amazon (NASDAQ:AMZN ) moved 13% which is a lot compared to previous cycles (double of the average move in previous cycles), but the straddle would gain just 40-60%. Akamai Technologies (NASDAQ:AKAM ) jumped 15% after the earnings, but the straddle actually lost 7%. The reason for this is the fact that the markets expected a big move based on the history of the post-earnings moves and the options have been priced accordingly.

As a classic example, Apple (NASDAQ:AAPL ) is considered a stock that moves a lot after earnings, but in reality, the average post-earnings move for Apple in the last twelve cycles was just 3.03%. Based on this fact, it’s not surprising that it would be much more profitable to sell Apple options just before the earnings and not to buy them.

Many other stocks moved much less than expected in the last earnings cycle, causing the option buyers heavy losses. Baidu (NASDAQ:BIDU ) moved 4.5% following the earnings and the straddle would lose about 30%. First Solar (NASDAQ:FSLR ) option buyers were even less fortunate: the stock moved just 3% and the straddle lost 55%. All the examples assumed buying a straddle (calls and puts with the same strike) which is more conservative than the strangle. Buying a strangle would produce much larger losses. In some other cases like TIVO (NASDAQ:TIVO ) or Aruba Networks (NASDAQ:ARUN ) the stocks had very mild moves while the markers expected 15-20% moves based on the previous earnings.

Going back to the Google trade, it’s your decision if you are ready to risk 80-90% holding through earnings even if the chances for such loss are relatively small. But next time when someone suggests allocating 20% of the account to one of those trades, think twice. If something goes wrong, 20% of your account is gone. Five bad trades and your account is wiped out. Believe me, five bad trades will happen one day. It’s not a matter of IF. It’s a matter of WHEN.

For me, it’s a matter of consistency and predictability of my trades. I always remember Warren Buffet’s Two Rules. Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1. I don’t think there is any investor including Buffet who has never lost any money, but the key for success in trading is to control the losses. When I sell before the earnings, I can control my losses. When I hold, I cannot. And this is all the difference.

Take care of the losers and the winners will take care of themselves — Michael Covel

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I own the Google Reverse Iron Condor