Google Can Predict Stock Markets Study Finds Fortuna s Corner

Post on: 22 Апрель, 2015 No Comment

FINANCIAL TIMES

25 Apr 2013 2:11pm

Google can predict markets, study finds

By Richard Waters in London

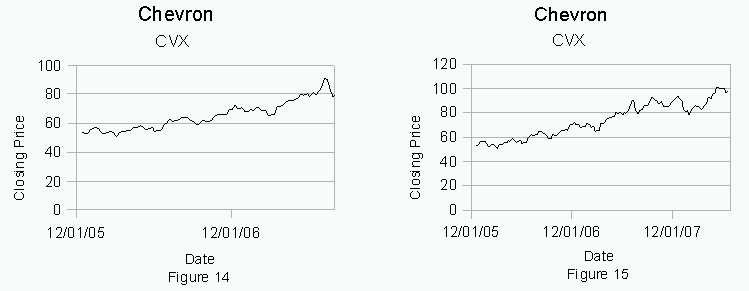

Searches of financial terms on Google conducted by millions of people can be used to predict the direction of the stock market, according to an analysis of search engine behavior stretching back nearly a decade.

The research, by a group of UK and US academics, is the latest attempt to mine mass behavior online in the pursuit of clues about future movements in financial markets.

The findings appeared to show t

hat people do more searches on terms such as “stocks”, “portfolio” and “economics” when they are worried about the state of the markets, said Tobias Preis, an associate professor of behavioral science and finance at Warwick Business School.

As a result, rises in search volumes for financial words are generally followed by declines in the stock market, as selling drives prices lower for a number of weeks, according to the research, which was published in the journal Scientific Reports. By contrast, a fall in financial searches often points to greater optimism among investors, leading to a rising market.

With the power of hindsight, trading on the back of Google search volumes about some terms would have led to significant investment gains, Mr Preis said. A short-term trading strategy constructed around increases or decreases of searches for the word “debt”, for instance, would have returned 326 per cent between 2004 and 2011, compared with a profit of only 16 per cent from simply owning shares in the wider market.

Google releases data each week showing the volume of searches for specific keywords, providing the raw material for the analysis. The increasing availability of large datasets like this has given rise to a rash of “big data” attempts to forecast financial markets, though there is little evidence yet of such efforts yielding profits in the “real” world.

Much of the experimentation has revolved around trying to deduce market sentiment from comments on social networks. However, a hedge fund set up to trade on information about market sentiment revealed in Tweets on Twitter closed after only a month.

Mr Preis warned that the findings from his group’s research might not hold for future stock market movements. Revealing the predictive value of data such as search results could change people’s behavior and neutralize the effect shown by the analysis, he said.

The work was funded by a US government program set up to study the predictive power of many different types of data. Mr Preis said that his group was in discussion with several investment groups about practical uses for their research.

A large amount of “noise” in the search data made it hard to isolate individual words that would have predictive value. For instance, the volume of searches for “colour” and “restaurant” appeared to be better guides to future stock movements than financial terms such as “Dow Jones” and “markets”. However, the researchers said they honed their sample by checking the daily frequency of a set of financial terms in the Financial Times.