Goldman Sachs Here s Why You Should Invest in Berkshire MarketBeat

Post on: 9 Апрель, 2015 No Comment

By Matt Phillips

Goldman Sachs analysts initiated coverage of Warren Buffetts Berkshire Hathaway Tuesday with a buy rating, saying the disconnect between the market value of the stock and the intrinsic value of the business is close to a multi-decade high.

The reason? Well you wouldnt know it by looking at the mood in the markets Tuesday, but it seems that Goldman is placing its bet on Berkshire based on its structural changes within the company and the firms outlook for a modest recovery to stay intact. Goldman analysts write:

We expect the catalyst to drive shares higher will be better-than-expected earnings growth. We believe Berkshire is both a structural growth story and levered to cyclical economic recovery. Structurally, Berkshire’s earnings will benefit from the ongoing shift in consumers auto insurance buying habits (via the direct-to-consumer GEICO subsidiary), the continuing change in the way goods are transported across the country (via the large intermodal operations at BNSF), and the enduring growth in energy and power demand (via the MidAmerican utilities).

Cyclically, Berkshire’s non-insurance entities are largely tied to GDP growth and to a lesser extent industrial production; certain smaller components are also levered to the housing market and as such we forecast a more subdued recovery for these businesses. However, as the country continues to emerge from its cyclical downturn, we would expect aggregated earnings to grow at a faster rate than what appears to be currently discounted in the stock.

Goldman has a 12-month price target of $152,000 for Berkshire A shares, and $101 for Baby Berkshires, which implies a 25% bounce for both share classes. The shares are down slightly Tuesday.

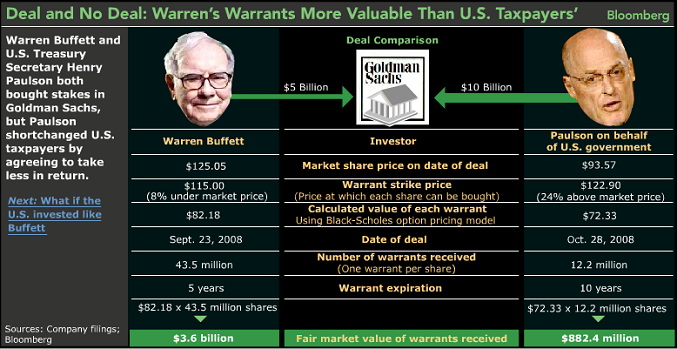

Oh for the record, its worth noting that Berkshire basically came to the rescue of Goldman Sachs during the peak of the financial crisis in September 2008, when Buffett decided to sink some $5 billion into perpetual preferred Goldman shares that came with a hefty 10% coupon. Buffett also received warrants that gave Berkshire the right to buy $5 billion of Goldman common stock at any time over five years for $115. So essentially, Berkshire is a part owner of Goldman, which is worth keeping in mind.

Swiss Franc Keeps Climbing Next

Confidence Data Weigh on Retail Stocks