Gold Opportunity To Form A Bottom

Post on: 16 Март, 2015 No Comment

Capitulation on Monday could finish off sellers. A bounce first would refuel them instead.

The following are the latest daily summaries of my ongoing intraday coverage, providing context to interpret price action. Any prices listed are for a contracts current front month. Their direction tends to correlate with any ETFs listed for each.

Today’s Highlight: Thursday’s test of higher prior lows needed to be the bounce’s peak in order to resume the decline targeting new lows. It was. And it did. Friday’s plunge set up the potential for Monday either to capitulate and end the bear market, or to refuel sellers with another futile bounce.

Dollar Basket

Friday’s gap up to the 82.45-82.50 bounce limit was reversed down immediately to end the day largely unchanged, keeping alive potential for resuming the decline targeting 81.40.

Jun Contract EC; (NYSEARCA:FXE )

Thursday’s reaction down from testing its 1.3140 target began Friday by gapping down. The 1.3065 pullback limit was probed only briefly before recovering back to Wednesday’s 1.3105 high. The rally can resume up to 1.3325 unless first closing under 1.3065, which would target at least 1.2990.

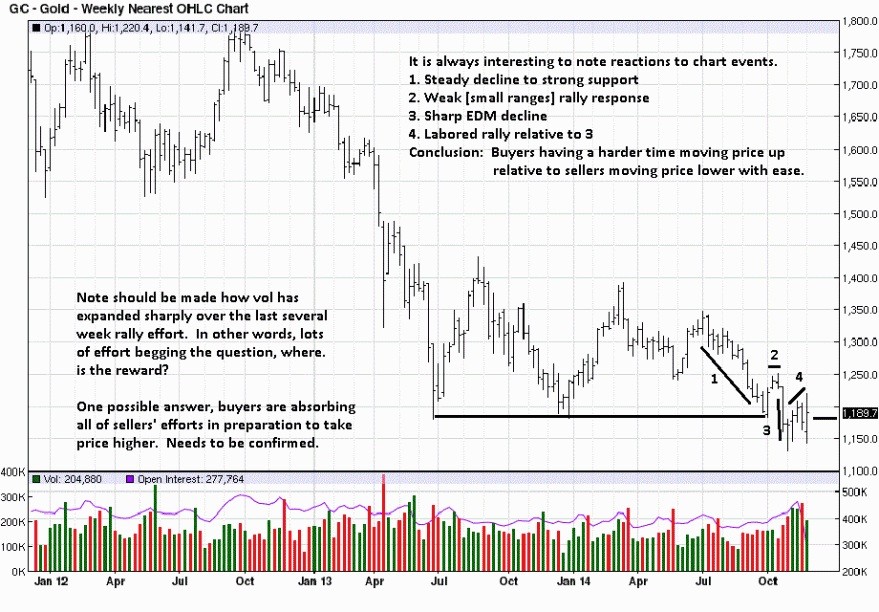

Apr Contract GC; (NYSEARCA:GLD )

Thursday’s test of higher prior lows up to 1567.00 needed to be the bounce’s peak to resume the decline targeting new lows. It was. And it did. Friday’s plunge down to 1491.40 cannot be a trend low, since its gap down was under all prior lows. Even an immediate rally would need to be retraced. The pattern has no attractive parameters at this stage, with room for a bounce up to 1521.00, but much lower lows likely upon closing under 1495.50.

May Contract SI; (NYSEARCA:SLV )

The attraction back down to 27.15 proved to be an understatement as Friday’s plunge fell to new lows at 26.00 and next targeting 25.75.

30-year Treasury

Mar Contract US; (NYSEARCA:TLT )

Firming in the face of Thursday’s stock market rally had suggested any initial recovery attempt would extend sharply higher intraday. In fact, Friday’s open gapped up above Tuesday’s 146-30 lows and extended back above the original 147-14 sell signal, bringing the 148-00 bounce target within reach.

Apr Contract CL; (NYSEARCA:USO )

Delaying a recovery after Thursday’s drop back to 93.35-93.65 support was likely to be bearish, as proved by Friday gapping down under the 92.00 prior lows and extending lower intraday to 90.27. The afternoon’s bounce tested 91.75, and back under 91.05-91.20 would resume the drop next targeting 89.25.

Natural Gas