Gold Mutual Funds V ETFs

Post on: 17 Июль, 2015 No Comment

Updated Nov. 2, 2009 12:01 a.m. ET

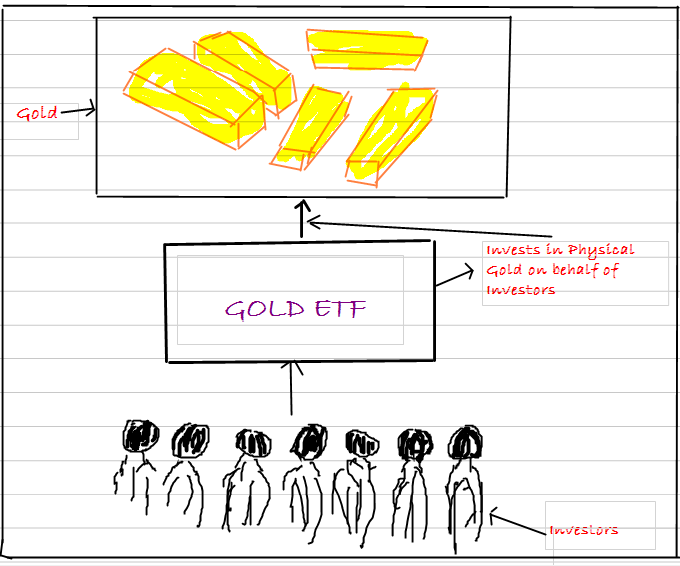

Mutual-fund investors pondering adding gold to their portfolios have an important choice to make: Should they buy a fund that owns gold-related stocks or an exchange-traded fund tracking the price of gold?

The Journal Report

See the complete Investing in Funds: A Monthly Analysis report.

At first glance, this year’s returns seem to point to stock funds as the clear winner. The average precious-metals stock fund is up 37%, according to Morningstar Inc. while SPDR Gold Shares. the biggest ETF directly tracking gold prices, is up 19%.

Gold-related stocks, which are predominantly mining companies, are a leveraged play on gold, says Joseph Foster, a portfolio manager for Van Eck International Investors Gold.

Here’s why: If it costs a company $800 to mine an ounce of gold, and gold is $1,000 an ounce, the profit for the company is $200. If gold rises to $1,100, the profit becomes $300. That’s a 50% rise in profits off a 10% rise in the price of gold.

As a result, gold stocks have, over time, tended to move twice as much—up or down—as the price of gold, Mr. Foster says.

Of course, there are other factors at work when it comes to gold stocks and the funds that invest in them. Individual companies can run into production problems or financial issues. Stock-fund managers can make bad picks.

The bigger issue is, simply, that these are stock funds. If the stock market goes into a free fall, gold stocks will get sucked into the downdraft. Between August and October of last year—the height of the financial-market panic—SPDR Gold was down 21%, but the average precious-metals stock fund lost 52%, according to Morningstar.

Gold stocks got creamed with everything else, Mr. Foster says. Then, once the height of the panic abated, gold stocks screamed back quickly.

So, if the idea is to have a slice of the portfolio that acts as a kind of insurance policy designed to hold up better than other investments when Armageddon seems imminent, the ideal investment is one that smooths out overall returns and doesn’t make things worse. In that case, the better option may be gold ETFs such as the SPDR or iShares Comex Gold Trust.

If the investment premise is that gold is in the midst of an extended bull market, perhaps because of rising inflation or monetary and fiscal policies that lead to a weaker dollar, then gold stocks may be the better choice.

Of course, the risk with gold stocks is that gold prices in fact decline and that bang turns into an implosion.

Send questions and comments to Mr. Lauricella at tom.lauricella@wsj.com .