Gold Is In A Bull Market And Stocks Are In A Bear Market

Post on: 31 Май, 2015 No Comment

Summary

- It may sound like a completely ridiculous statement, but it is true: gold is currently in a bull market, while stocks are in a bear market.

- It is all a matter of perspective.

- At this stage of the cyclical market cycle, investors would be well served to protect against recency bias and the reliance on extrapolation in their portfolio management process.

It sounds completely preposterous. In fact, it almost sounds idiotic. How could it possibly be that gold is in a bull market and stocks are in a bear market right now? After all, gold has been beaten badly over the last few years, while U.S. stocks have been on a tear since the end of last decade. Yes, stocks are in a bull market and gold is in a bear market from a cyclical perspective. But when one stands back from the trees and looks at the longer-term forest, a very different picture presents itself.

Stocks have been the celebrated asset class since the quelling of the financial crisis back in March 2009. And nowhere have the gains been more pronounced than in the United States, as the S&P 500 Index (NYSEARCA:SPY ) has increased by nearly +250% from its lows nearly six years ago. And thanks to the doubling of the national debt and the quintupling of the Federal Reserve’s balance sheet over this time period, it has been a veritable party for stock investors all along the way.

While gold (NYSEARCA:GLD ) was once part of the post crisis celebration, it eventually departed to the downside starting in September 2011. In the time since, gold has endured a peak to trough drop of more than -40% to lows that were reached as recently as a couple of months ago.

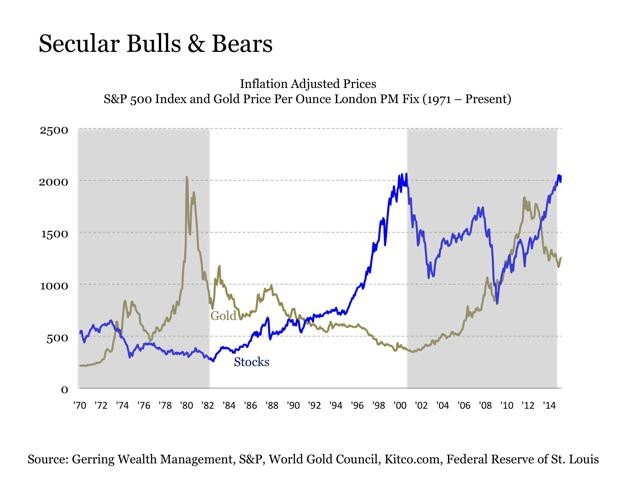

So how exactly can it possibly be that a U.S. stock market that is up nearly +250% is in a bear market, while gold that is down more than -40% is in a bull market? Because when one pulls back to view these markets from a longer term secular perspective, we see that the rally in stocks over the last several years at least to this point has been only the latest move higher in what has been a nearly two decade long violent churn in prices, while the recent decline in gold although dramatic is basically a pullback as part of what has been a longer term uptrend over this same time period. A walk through history helps provide context for this point.

The stock market has moved in secular cycles over time. In short, U.S. stocks have enjoyed periods of sustained strength followed by extended periods of consolidation. These phases have historically lasted around 17 years on average, with some periods running longer while others have concluded more quickly. For example, the periods from 1921 to 1929, 1949 to 1968 and 1982 to 2000 were all secular bull markets where the economic environment was consistently strong and stocks steadily rose. Conversely, the periods from 1901 to 1921, 1929 to 1949 and 1968 to 1982 were all secular bear markets where stocks at best moved sideways with crushing declines followed by equally euphoric rallies. Such is the market environment we have been operating in since 2000 upon the bursting of the technology bubble.

The same has been true of gold since the early 1970s following the collapse of the Bretton Woods system. But what is particularly notable is the following. During the period from 1968 to 1982 when stocks were in a secular bear market, gold was in a secular bull market. And when stocks entered into a secular bull market from 1982 to 2000, gold fell into a secular bear market. Finally, while stocks have been mired in a secular bear market since 2000, gold has been engaged in a secular bull market.

The reason for this contrast makes good sense. Periods of economic prosperity are characterized by strong and steady output growth, which is beneficial for stock prices. And such environments are often accompanied by political and financial harmony as well as pricing stability. As a result, investors feel little inclination to allocate toward safe haven alternative reserve currencies such as gold as a store of value and protection against the potential for relative pricing instability. On the other hand, periods of economic uncertainty are marked by uneven output growth along with extended periods of insecurity and occasional crises. This often leads to greater volatility in financial markets, potential geopolitical uncertainty, pricing instability whether it is hyperinflation or deflation, and concerns about the long-term solvency of economies and their representative currencies. In such an environment, the demand for alternative stores of value such as gold as protection against devaluation and political/financial uncertainty becomes greater, thus boosting the price.

Still, how does this explain why stocks have done so well in recent years while gold has struggled?

In short, just because stocks are in a secular bear market does not mean that it cannot experience fantastic cyclical bull markets. In fact, some of the greatest cyclical bull markets in history have taken place during secular bear markets. For example, virtually nobody remembers the Great Depression as a great time to have been invested in stocks. Yet the Dow Jones Industrial Average posted a +372% return from July 1932 to March 1937, which is a tremendous return over the course of nearly five years during one of the worst economic periods in U.S. history.

At the same time, just because gold is in a secular bull market does not mean that it cannot endure painful cyclical bear markets along the way. For example, gold lost more than -40% of its value from December 1974 to August 1976 before going on to increase exponentially in the years that followed before reaching the end of its secular bull market several years later.

What is even more revealing in showing how gold remains in a secular bull market while stocks are continuing in a secular bear market is an examination of inflation adjusted historical prices on a logarithmic scale. For while gold is still up more than +260% since the beginning of its secular bull market despite its recent cyclical pullback, stocks have fought all the way back over the last six years to still be down -1% on an inflation adjusted basis versus its August 2000 peak. In other words, an investor that put money to work in the market nearly a decade and a half ago would have seen the value of their money incrementally shrink on an inflation adjusted basis over this time period, while the gold investor would still have been handsomely rewarded despite having given back some value in recent years.

None of this means that investors should simply abandon stocks and throw their lot behind gold just because stocks remain in a secular bear market and gold is in a secular bull market. In fact, I have held a near zero weight to gold for nearly two years and continue to allocate to stocks as recently as Wednesday with a purchase of Gilead Sciences (NASDAQ:GILD ) on its sharp pullback.

But what it does highlight is the importance of investors to view the market from different vantage points and time horizons in order to avoid falling victim to recency bias in their portfolio management process. After a nearly six year bull market run in stocks, it has become all too common for investors to simply extrapolate forward gains for yet another year. But such oversimplification obscures the underlying risks that persist in its ongoing secular bear market phase. At the same time, investors may be overlooking opportunity by simply dismissing gold as a broken relic of an asset class, for the pullback over the last few years may still be nothing more than a consolidation of gains that have been registered since the start of the new millennium.

Disclosure. This article is for information purposes only. There are risks involved with investing including loss of principal. Gerring Capital Partners makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made. There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners will be met.

Disclosure: The author is long GILD. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.