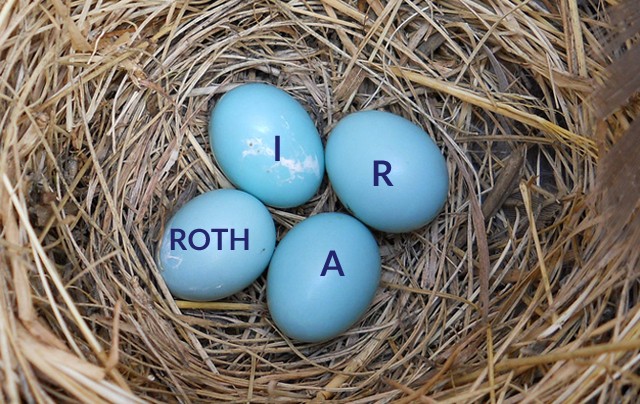

Gold IRA Rollover Protecting Your Golden Nest sep

Post on: 23 Май, 2015 No Comment

Gold IRA Rollover: Protecting Your Golden Nest?

Before we get into the mechanics of a gold ira rollover. it may be important to first explain what an IRA is?

Well, IRA is short form for individual retirement account.

This was created by the US congress to assist citizens to privately plan for their financial needs post retirement.

Most employees in the US entirely relied on the benefits given to them by the social security fund once they had retired.

This all changed in 1974 however, with the introduction of the ERISA Law, effectively changing retirement plans from DB (Direct Benefit) to DC (Direct Contribution) plans.

Read more about ERISA and its implications here.

The average employee in a 9 to 5 job has some kind or equivalent of a retirement plan. Most companies and governments around the world encourage the taxpayers to set up some sort of pension plan to lean on, in their old age.

Notice, while this is very commendable, the employer/government rarely discusses with the employee/civil servant about the viability of such savings in the future.

90% of these employees have been sculptured either by lifestyle or misplaced financial ideologies, to invest their lifetime savings in a traditional 401K IRA (Individual Retirement Account) plan.

Such a plan is typically paper-backed and revolves around investments in the form of mutual funds, bonds, real estate Capital, LLC, and blue-chip companies stocks.

The employee, after toiling hard through the years, looks forward to retiring wealthy, only to find out that his stash is not as sizable as he had expected.

Why? We are faced with the reality of the devaluing of the US dollar every waking moment. Thanks to inflation, prices of commodities have shot through the roof, and were in the midst of a threatening an economic meltdown.

The culmination of such and similarly related crisis is the considerably decreased purchasing power of his retirement nest-egg. Stocks, on the other hand, are not any more secure.

As a company expands, more shares are created, and the consequence is the plummeting of the value of the original stock. Even worse, a single hefty recession could wipe out the entire life savings.

Gold IRA Account The benefits

Gold has over the years maintained a steady and upward trend as far as its market value goes. This is mainly because its not possible to overproduce this precious metal, in spite of the growing demand.

So to speak, backing your retirement funds with gold, not only hedges your investment against the fluctuating economic forces, but also leaves you at a better position of accruing enormous returns should you sell the gold in future.

This further implies that the value of your retirement package keeps on appreciating as the demand and prices of gold skyrocket. A gold IRA account furthermore provides the investor with the much-needed tax relief unlikely to be enjoyed with other traditional forms of investments.

Diversifying your investments, by using some of the funds in your 401K account to purchase IRS approved IRA gold coins is a smart way of creating a strong retirement portfolio.

Setting Up A Self Directed IRA

A self directed IRA is a unique form of a retirement account that allows the investor more control over his portfolio. This implies that he can invest in number of viable investment options without many restrictions imposed.

The beauty of it is that anyone is eligible to set up such as an account. IRAs are managed by custodians, which arrays from financial institutions to insurance companies and brokerage firms.

Since the IRS allows the custodians to impose any rules above the usual ones, its important to consult widely on the limitations of an IRA opened within a particular establishment.

The profits attached to such a venture are however quite numerous. In such a scenario, your investments are better protected against bankruptcy and creditors. Most countries and states have outlawed the seizure of personally managed IRA assets.

The owner of the account, in addition, can invest in fields that he feels he is well versed in. The investments strategies and other crucial decisions are often left at his disposal. A self directed IRA typically forms the first step in setting up a gold IRA account.

Acquiring a Gold IRA Account

With your new self-directed IRA in place, it is now easier to add gold to your retirement funds. Your custodian through IRS Account Executive will help you purchase the IRS approved IRA gold coins.

The Account Executive is usually an IRS authorized gold and precious metal dealer. The custodian is responsible for all the paperwork filed and the transfer of funds to the gem broker.

Hence, its wise to conduct due diligence when choosing a suitable custodian in the first place.The coins are then stored safe depository, and you proceed to earn interests each time the price of gold rises, just as trading in forex.

The gold IRA account enjoys the same privileges as any other self-directed IRA.

What rules apply to Gold IRA Rollovers?

The rules were recently updated at the beginning of this year, 2015. The significant bits are as outlined below:

1. One is not allowed to make IRA to IRA transactions twice in a year (not calender year). You are only limited to one rollover per year. This implies that if for instance you have done your first transaction, then subsequent transactions in the same year period will not be considered as rollovers but as part of your gross income. This obviously impacts on your Tax liabilities.

2. Once you report an amount as gross income, it will be considered an early withdrawal from your retirement savings plan and hence attract a 10% withdrawal penalty.

Despite the implementation of all the above rules, there were exceptions given for transactions made in the year 2014.

This implies that if you made a transaction in April 2014, you can still make another transaction before April 2015 but only once. Thereafter, the new rules will be fully effective.

What things must you look out for and avoid while doing a Gold IRA rollover.

From the rules given above, it becomes obviously important to plan for your rollovers and the best way to plan is have the confidence of a competent gold ira advisory.

Gold IRA rollovers are the most profitable kind of rollovers. This is because they do not get affected by financial crises. But given that the new rules are soon going to be effective, you should be able to plan well before doing any transaction.

It is important to know that multiple transactions will only eat into your income if you fail to calculate well and avoid them.

You should look for the most reputable institution to handle your gold ira rollovers. This will minimize the risks associated with investments in general. A good institution will significantly help you in making rollover decisions in line with the expectation of the markets and the economy at large.

What Companies can Help You to Rollover your Gold IRA?

How will you get the relevant information about these companies?

Basically, there are various specialized companies that will offer you expert services. Some of these companies include Regal Assets and SBC Gold. Regal Assets have the most reputation, the lowest (no-)fees and no customer complaints that we could find.

401K to Gold IRA Rollover: 3 Simple Steps

Rolling over your existing 401K account into new, gold IRA account is just as simple. The first step is having your IRS approved precious metal dealer contact your custodian and inquire about the possibility of adding physical gems to your portfolio.

In the case in which the custodians regulations do not permit such a transaction, your gem dealer can help you find keepers who specialize in gold IRA accounts.

Having done this and filling out the necessary paperwork, you may choose to roll over part or whole of your retirement funds to your new gold IRA account.

With the funds in place, it is now possible to purchase gold coins into the new IRA account.

This transformative process may require around 3 to 6 business days for all the necessary transactions to be completed. There is another, simpler way however, which you can read more about in the gold ira investing article.

It also takes a similar span of time for an entire traditional life-savings investment to devalue by half in the face of an economic meltdown. Take action today and safeguard your future with a gold IRA rollover.

Be sure to read these articles for more info: