Gold IRA Rollover A Great Hedge Against the Financial Crisis

Post on: 28 Июнь, 2015 No Comment

March 13, 2015

With most of the asset classes, including equities, real estate and even bonds being significantly overpriced, it is only wise that the investors look for opportunities in other underpriced or fairly-valued sectors. Gold, Silver and other precious metals such as platinum provide such an investment opportunity.

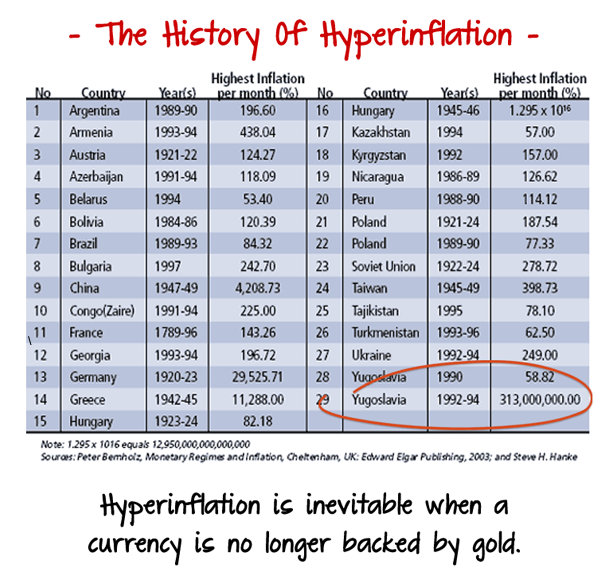

In the present turbulent economic conditions, these precious metals can prove to be a great hedge against the inflationary pressure that can rise from the Fed’s “accommodative ” monetary policies. It must be noted that in times of high inflation, people spend less and look forward to sit on cash, which disrupts the economic growth and leads to a crash in major asset classes except the precious metals.

Gold has always revalued itself to account for the excess currency in the system, simultaneously proving to be a great hedge against inflation. Since, stocks and real estate are already over-owned; they run a major risk of facing the hammer in times of economic distress, hence, those invested heavily in them must consider diversifying their investments with Gold, Silver and Platinum.

What is a Gold IRA?

Despite the alarm bells ringing, there are still many amongst us who do not want to invest heavily in the precious metals all at once. For adults in the age bracket of 40-50 years, it becomes very difficult to manage the household expenses and simultaneously invest in the asset classes. For those above 50 years and staring at a retirement the outlook is even bleaker to say the least.

So does this mean that there is no way to enjoy a well-deserved retirement? Can a financially-secure retirement ever be planned beforehand? The answers that we have will certainly be like music to your ears.

Among the many investment tools that can be utilized for planning the retirement is called Individual Retirement Accounts which are also commonly known as IRAs. stand out. And acknowledging the potential ROIs of the precious metals compared to any other asset classes in the long-term, it would be best to invest in a gold IRA.

In simple terms, a gold IRA is like a regular IRA which allows the buyer to hold gold instead of paper currency. The buyer can hold physical gold in the form of bars and coins approved by the Internal Revenue Service, IRS. The most popular ones are:

- American Eagle Gold Coins

- American Buffalo Gold Coins

- Canadian Maple Leaf Coins

- PAMP Suisse gold bars

- Austrian Philharmonic Gold Coins

A major point that one must keep in mind while thinking of procuring an IRA is that he cannot trade metals with any buyers or his/her family members.

Depositories

The precious metals that are held in a gold IRA are kept in secured depositories approved by the IRS. Some of the prominent depositories approved by the IRS are:

- Brinks

- Delaware Depository Service Company, LLC

- CNT Depository, Inc.

- JP Morgan Chase Bank NA

The depository that a buyer gets also depends on the IRA custodian that has been chosen.

Opening an IRA account

An IRA account can be opened at any financial institution, such as banks, mutual fund companies and brokerage houses. These IRA providers can then act as custodians and execute transactions on the behalf of their clients. Some prominent names of such service providers are Regal Assets, Vanguard, Fidelity and T. Rowe Price.

Investing in an IRA account

While it is obviously beneficial to invest as much as possible in the retirement plans, because of the proportional tax-protected gains, the government, however, places some restrictions depending on the age-factor.

For example, if an IRA buyer is younger than 50, then the contributions to a traditional IRA are limited to $5000 per year. But if the buyer is 50 or over 50, before the end of the year, then an advantage of $1000 can be availed on the top of $5000, taking the total applicable IRA contribution to $6000 per year.

The buyer has the choice of using these contributions to invest in one, one-half, one-quarter or one-tenth ounce gold coins minted by the Treasury Department some of which have been mentioned above. The IRA can also choose to invest in other precious metals such as one-ounce silver coins, certain platinum coins and specific gold, silver, platinum and palladium bullion.

Should gold always be a part of IRA?

Unfortunately, there is no easy math that can calculate the time period for which gold or other precious metals should be a part of the IRA. The period can range from 5-20 years depending on the time preceding the retirement. However, a period of minimum 10 years is generally recommended by experts.

It is also up to the IRA-holder to seek expert financial advice to decide the term of the gold. It is extremely important as gold, like every other investment, has its risks and hence, it would be wise to calculate the expected risks and returns before investing in it. The IRA-holder must evaluate his risk-appetite before putting in the hard-earned retirement savings.

There is one simple way and that is to hold gold until the financial meltdown persists and also, until it appreciates in value. During the financial crisis, all other investments get highly undervalued and present lucrative opportunities. However, a gold IRA-holder can liquidate the investments in gold upon significant signs of economic revival and jump head-on in the equities and the real estate segment. It is also wise to remember that although gold is considered to be a long-term investment therefore, capturing on the capital gains is another aspect that cannot be neglected. The concept of reinvesting is a powerful one and should be effectively undertaken after due deliberation and expert financial advice.

Tangible investments are always better. They offer a sense of security, and the ability to track noticeable changes quickly enough to make the right decisions. A precious metal IRA offers the type of security that people can truly rely on during their retirement years.

Paper vs Gold

Most of us are no strangers to the notion that paper money has no intrinsic value. The value of regular money is determined by the financial market a system that is unstable at the best of times. In recent years, most people have learned to expect the worst, making it difficult to plan for retirement on a regular 401k. Now is not a good time to place ones faith in monetary value, that much is certain.

Precious metals, gold in particular, have been used in trade for centuries. Vastly more reliable than paper, gold has proven to increase in value consistently. Instead of losing hard-earned money on the stock market, investors should consider placing their faith in the one material that has outperformed the rest every step of the way.

At least 90% of all the gold ever mined up until this point is still in circulation. This proves that the precious metal is vastly more valuable and reliable than stocks, bonds, or papers. Gold has managed to hold its value since the concept of currency was first introduced in Egypt, several millennia ago.

Steady Against Inflation

Inflation is every investors enemy. Conventional IRAs and investment accounts are at the mercy of economic fluctuations. When unexpected crises hit, most investors stand by helplessly as they watch their accounts decrease in value. Gold, on the other hand, holds steadfast in the face of economic hiccups. Rising interest rates have absolutely no effect on a Gold IRA. International conflicts have absolutely no power over precious metals. Even when banks fail, precious metal holders are completely unaffected.

The most recent recession, in the early 2000s, led to significant loss for many investors. Some lost an enormous chunk of their retirement funds, while others lost absolutely everything. For these people, an easy retirement may not be an option. Investors who placed their trust in gold, however, came out of the recession without a scratch. These people are the ones who are looking forward to a comfortable retirement without a single financial worry on the horizon.

A Gold IRA is Self-Directed

Traditional IRAs are usually under the control of a broker. In many cases, this broker is more concerned with making a quick buck than keeping the clients best interests at heart. In many cases, investors are completely unaware of the goings on in their own investment accounts, simply because their brokers are not dedicated to keeping them in the loop.

A gold IRA is self-directed. This means that the investor has full control over what happens in the account and when. Although a custodian is assigned for the safekeeping of the gold and for the handling of paperwork, the investor has the final say in all transactions. Most people prefer this sort of arrangement as it allows them to keep a finger on the pulse of their investment account, enabling them to make quick decisions when necessary.

Long Term Stability and Growth

Take into consideration the fact that the dollar is worth 97% less than it was in 1913. and it becomes clear that traditional IRAs are not particularly lucrative. On the flip side, the value of gold has increased by about 400% in the last decade. In 2004, an ounce of gold was worth just over $400. Now, ten years later, the same amount of gold is worth at least $1400. It has been suggested that a single ounce of gold may be worth over $5000 by 2020 .

Conventional IRAs are susceptible to every minor change on the global financial markets. Within the blink of an eye, investors will find themselves at a serious loss. Changes in the value of gold are gradual but constant. Within the next decade or two, gold IRA accounts could have doubled or tripled in value. Gold-backed IRAs, therefore, are perfect for medium or long term investments.

Increase in Demand

In the last 8 to 10 years, the demand for gold has increased exponentially. This is largely due to the fact that banks are doing everything they can to hold on to their precious metal stores instead of selling them. It is becoming increasingly more expensive for mining companies to aggressively pursue gold, as natural gold deposits are becoming more rare by the day. This increase in demand for gold further serves to boost its value on an almost daily basis.

Types of Gold Investment

Gold investments are surprisingly flexible. It is possible to invest in gold in paper form or as an ETF. Many people prefer to invest in physical items such as jewelry, bullion or bars. Irrespective of the type of gold-backed IRA, this is still one of the most secure and most lucrative forms of investment available. A gold IRA is virtually untouchable in terms of economic downfall.

Gold coins and bullion might be the most popular form of precious metal investment right now. This is simply because the whole process is much more accessible to new investors. At the same time, investing in gold bullion is just as lucrative for seasoned investors who know their way around the markets.

It is impossible to accurately predict the state that the economy will be in twenty or more years from now. It is certain, though, that gold will continue to hold its value until then. Gold has an almost miraculous way of never losing its purchasing power this much has proved to be true since the dawn of time.

Flexible Purchase Amounts

Perhaps the best thing about a gold IRA is that the investor has a large amount of freedom when it comes to deciding whether to buy small or large. Gold can be purchased in such a way that investors are able to manage their budgets more closely. If you have enormous amounts of cash to spend, or if you are rolling over your entire IRA, you have the opportunity to buy as much gold as you can. If, on the other hand, you prefer to test the waters or if you only have a small budget available, you can buy smaller amounts of gold and slowly build up your investment as you go along.

The great thing about gold-backed IRA accounts and precious metal investments is that investors have the ability to scan markets and pounce on new opportunities as they become available. Should you find that the price of gold is at an all-time low, you have the ability to purchase in bulk. This will generally be followed by the absolute pleasure of watching your investment blossom into a veritable nest egg that promises to keep you going in later years.

Only the Purest Forms of Gold Accepted

Only the purest forms of gold will back a gold IRA. A purity rating of less than 99.5% will automatically be rejected. This is great news for all investors, as it means they cannot be duped into purchasing substandard precious metals. When the time comes to cash in the IRA, an investor will be secure in the knowledge that the monetary value of the investment will be particularly high.

Eligible Coins

The safest coins for gold-backed IRA investments are American Gold Eagle and Canadian Maple Leaf coins. These coins have the highest purity rating. As these coins are traded most often, purchase costs tend to be significantly lower than with other gold coins. These coins are often sold in weight, rather than in number.

Financial advisors warn against using collectors items for investment, purely because each coin will need to be evaluated separately. This creates a complicated and lengthy process that could result in significant losses if coins are proved to have a low purity rating.

Tax Benefits

During your retirement years, you have the opportunity to cash in your precious metal IRA and reap the rewards of a lower tax rate. Cashing in gold for money still leaves you liable to pay income tax, however, the taxed amount is considerably lower than you would expect on a traditional IRA. The reason for this is simple: currency conversion costs less when changing from gold to physical cash. Because gold is considered to be a capital asset, investors are not required to report all of their transactions to the IRS.

High Liquidity of Precious Metals

Conventional IRAs are strict when investors want to convert them to cash. Specific dates need to be adhered to and notice periods must be given. The high liquidity of a gold IRA means that the precious metals can be converted to cash at virtually any time. In some cases, penalties for early withdrawals may be completely waived. When medical bills begin to pile up, when home payments are due, or if disability becomes an issue, gold-backed IRA companies tend to be flexible and consider the special needs of theirclients.

When stock prices fall, gold prices tend to rise. By keeping an eye on the markets, investors have the ability to convert their gold to cash at the most opportune moments. The high liquidity of gold bullion and coins means that investors have the ability to maximize their ROIs in the most efficient way possible.

Safe Storage when you Need it Most

Holding facilities for precious metals are among the safest in the world. Investors can expect their gold to be completely secure at all times. These storage facilities are monitored constantly. Transactions can generally be completed at least 364 days a year, which means that although the gold may not be in the investors direct possession, accounts can be accessed at any time.

Custodians assigned to investors gold are responsible for its safe keeping. These representatives are highly knowledgeable, and trained to handle any investment-related questions. They take care of all paperwork, eliminating the additional stress and frustration from their clients lives.

Minimal fees are applicable for gold storage. On the bright side, these fees are almost always lower than fees associated with maintaining traditional IRAs and similar investment accounts. The elimination of broker fees certainly makes the whole process much easier, and much more affordable.

Easy Tracking of Investments

Stringent security measures and dedicated custodians ensure that all investments are easily tracked. Investors generally have the option of receiving quarterly statements, should they wish to keep a close eye on the value of their gold IRAs. Of course, it may be simpler to give ones custodian a call whenever financial check-ups are deemed necessary.

The fickle state of the economy makes it almost impossible to keep accurate track of ones traditional IRAs until it is too late. Precious metal investments tend to be more stable, allowing investors to keep an eye on things at all times.

Securing a Comfortable Future

Smart investors will make it their goal to invest in gold now, to secure a future that is entirely free of financial concerns. Instead of watching their current IRAs dwindling in value and hoping for the best, investors have the opportunity to take control of the situation. With such a high return on investment, a gold-backed IRA is clearly the most reasonable choice.

The Golden Message

Adults and potential-retirees must realize that retirement is an aspect that they will have to face eventually, and it always happens sooner than one is ever prepared for it. Therefore, it is important to understand that the time is of essence and the one who plans and invests in gold IRAs early will definitely survive the retirement time without being overburdened by financial woes. In short, as John Ray’s phrase rightly once remarked:

“The early bird catcheth the worm.”