Gold Don t Fight The FED SPDR Gold Trust ETF (NYSEARCA GLD)

Post on: 6 Май, 2015 No Comment

Over the long run, real interest rates have played a significant role in the swing in gold prices (NYSEARCA:GLD ).

Exhibit 1: Gold prices driven by real interest rates

As seen in Exhibit 1, real gold prices are negatively correlated with real interest rates and the correlation is stable over long periods of time.

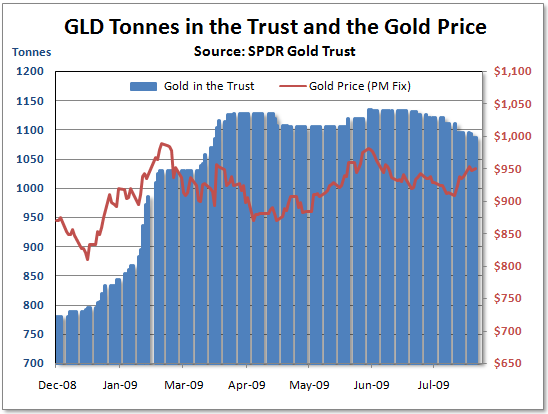

The fact that the FED had to engage in large scale-asset purchases (quantitative easing) following the US real estate bubble burst in late 2008, has led to a significant increase in the size of its balance sheet (as shown in Exhibit 2). Today, the FED and most central banks in the advanced economies are not comfortable with the size of their balance sheets. This is why an increasing part of FED officials has been keen to slow the pace of quantitative easing (QE). When will it happen?

Exhibit2: FED’s Balance Sheet expansion as a Positive Drive for Gold Prices

No Tapering in the short term

It is likely that the FED will delay the reduction in its asset purchase program in the short term due to three main factors:

1/The consequences of the 16- day budget impasse on the US economy. According to an estimate from Standard & Poor’s. the US government shutdown took $24 billion out of the US economy and lowered projected fourth-quarter GDP growth from 3% to 2.4%. Moreover, Fitch decided to place the US government’s AAA credit rating on rating watch negative due to the prolonged negotiations over raising the debt ceiling. Finally, Dagon downgraded the US Sovereign Credit Ratings to A- from A as the government is still approaching the verge of default crisis, a situation that cannot be substantially alleviated in the foreseeable future.

2/Data have been inconclusive so the FED is still waiting for more confirmation about the economic outlook to reduce its monthly purchases. As Chicago FED president Charles Evans put it recently, I don’t think we have enough positive information going into the next meeting to decide. He added also that there’s probably going to be some noise in those series, referring to recent economic data.

3/Credibility. Indeed, the actions taken at the FOMC’s September 17-18, 2013 Meeting threatened the central bank’s credibility as the market expected that the FED would taper its $85 billion monthly bond-buying program by roughly $10 billion. However, FED officials can argue that recent decision not to taper enhanced their credibility. Indeed, they decided not to taper as the decision is data-dependent and data have been recently mixed. What’s next?

Disappointing jobs report

On October 22, 2013, US nonfarm payrolls rose by 148, 000 workers in September while economists were expecting US job gains of 180,000.

This underperforming jobs number is likely push the FED to keep up its bond purchases if the FED aims to maintain credibility.

Will the Wait and See FED’s approach continue ? Not likely

The markets must be prepared for a rise in rates. As Alan Greespan put it, we’re still well below the [rate] level we normally ought to be at this stage. Indeed, as both real GDP growth and inflation rate are about 2%, 10-year Treasury yields should be trading intuitively around 4% versus 2.50% today. Quantitatively, 10-year Treasury yield valuations should include fundamental variables such as growth, inflation expectations and asset markets. The former chairman of the FED also added that the consequence of that is that when the bond market begins to move we may not be able to control it as well as we’d like to. And that has a lot of ramifications with respect to all sorts of markets.

Consequently, the FED will inevitably begin pulling back on the pace of asset purchases as soon as we see a few positive employment reports to support tapering.

Whether tapering starts in December, March or June, the outcome will be unchanged: a rise in long-term interest rates, driving a sell-off in the gold market.

In sum, whether I view gold as a currency or a commodity, I believe that gold is undervalued and it will likely trade higher over the long run. Nonetheless, as US bond yields must rise due to an inevitable taper, the yellow metal is likely to struggle first.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.