Gold A Better Inflation Hedge Than Real Estate by Krassimir Petrov Ph D

Post on: 18 Сентябрь, 2015 No Comment

GOLD — A Better Inflation Hedge Than Real Estate

by Krassimir Petrov, PhD. The American University in Bulgaria. February 11, 2008

The U.S. will likely spin into a long era of high inflation. The coming years will look like the 1970s. There is also a good risk of hyperinflation, which is a particularly severe bout of high inflation. Thus, the vital question for every investor is: How to hedge, or protect your wealth, against inflation? Some, especially realtors, urge to hedge this risk with real estate. So, should we really hedge with real estate?

The right answer calls for knowledge of two closely-related topics. First, what is an inflation hedge? Second, what makes a good inflation hedge? The first answer is simple. An inflation hedge is an asset that loses little value in periods of rising prices. Thus, it holds its value and its purchasing power during inflation. This also applies to hyperinflation. An investor expecting inflation will buy this asset to hedge against inflation.

The answer to the second question requires understanding of the two basic types of assets: real assets and financial assets. Real assets have intrinsic value. They have value of their own. People value them for their direct or indirect usefulness. Examples include books, TVs, cars, wheat, gold, real estate, land, etc. Financial assets. on the other hand, are a claim on the income or wealth of a firm, family, or the government. Their typical form is a certificate or a receipt. They are often called paper assets or simply paper. In essence, they are based on debt. Examples include paper money, stocks, bonds, mortgages, and ETFs. All money market and capital market instruments serve as examples.

In general, real assets hedge better than paper assets. By definition, real assets have a value of their own. Inflation does not erode their value. Thus, real assets are all inflation hedges. It follows that real estate is also a hedge. Still, it does not follow it is the best, for all hedges are not created equal. Some assets hedge better than others.

Good hedges have a few key properties. We mention here only four. One key property of a hedge is that it holds its value. It should lose little value over time. Cars and eggs lose value over time. Land, silver, and wine do not.

Another key property is marketability. This means that it is easy to sell. Other people will easily take it for payment. Hence, it is good for barter. Chairs and clothes do not sell. Corn and gold do.

A third key property is divisibility. This means that the asset splits into smaller parts without a loss of value. Houses, cars, and cows are not divisible. Rice, wine, gas and gold are.

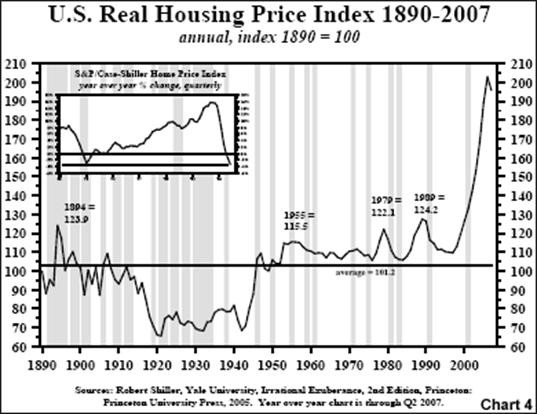

The last key property is financing. It is vital. Experts prefer to fully ignore it. Investors buy assets either with cash or credit. Cash-based hedges are good. Credit-based hedges are bad. As history shows time and again, assets bought on credit are prone to undue speculation and bubbles. The hedge might be already overvalued. In this case, investors should avoid it. It is clear that credit drives real estate. Moreover, real estate recently went through a wild bubble. It is grossly expensive, so a poor hedge.

The verdict is clear. Real estate is a hedge, but a poor one. It fails all of the above four tests. On the other hand, gold is a far superior hedge. Gold passes well all tests of a good hedge. That is why it is the ultimate inflation hedge. Better yet, now gold is cheap, while real estate dear. Thus, as a hedge, gold handily beats real estate.

One last issue concerns real estate. Buy it today, pay it later with cheaper dollars. Hundred dollars today will be worth tomorrow only fifty, may even ten. The currency debases. It is seductive; it makes people borrow; it lures; it makes sense; it is profitable. Seductive it is, yet treacherous! The investor may fall in many traps. One need fall in only one to go broke!

Let’s make one thing clear. Real estate bought with cash. free and clear of any debt, might be a poor hedge, but it is nevertheless a hedge. It will protect your money�s worth. It is not as good a hedge as gold, but will do the job. However, we emphasize that real estate bought on credit (with a mortgage) creates substantial new risks to the investor. Debt means leverage, and leverage means risks. In this sense, hedging one risk by assuming other new risks is possible, but not recommended.

So, what are the risks, or traps, associated with leveraged real estate? We mention here four. First, we could be wrong! What if prices actually fall � or you have what people commonly call a deflation? Deflation kills those that borrowed to hedge with real estate, because it makes those debts more difficult to pay. Even worse, deflation triggers recession, unemployment, and falling income. Similarly to what happened during the Great Depression and to Japan during the 1990s, deflation results in massive foreclosures and business failures.

Another trap for leveraged real estate is the possibility of another credit crunch might spook the market. We saw this in February; we saw it again in August. Real estate was no place to hide then.

The third trap is how the real estate is financed. An ARM, or adjustable rate mortgage, can be a risky way to finance. Rising prices drive interest rates higher. Mortgage rates may rise from modest 3-4% to 12-15%. This actually happened during the 1970s. Thus, monthly payments could easily triple. Obvious, yet millions of Americans fell for it once again in the early 2000s. Sure, they fell driven by greed. Still, many hedgers are oblivious to this.

The last trap is by far the most insidious, for it is the hardest to see. Inflation overwhelms the borrower; it eats him alive. Before long, food prices double, gas doubles, electricity doubles; prices of all the basic needs double in short order. Yet salaries do not; they lag far behind prices. Oftentimes, as in the 1970s, many years behind. Similarly, prices of basic goods, like food and energy have more than doubled since 2002. Eventually, there comes the time that once you pay for your basic needs, not enough is left to pay the mortgage. Let’s further clarify this point with an example.

Say the borrower makes two grand � one goes to pay the mortgage, the other goes to pay the bills. As the prices of food and gasoline nearly double, the borrower gets squeezed. To pay the bills, he cuts down on consumption, but the bills overwhelm him, they cost him now $1,600. He got a raise, his salary now $2,300, but he must still borrow some more, may be on his credit cards, to pay the bills and keep up with the mortgage. He falls deeper and deeper in debt. The higher interest on the credit drains more and more of his income. Less is left for living expenses and for the mortgage. Eventually, the consumer is tapped out; he buckles. Only now it becomes apparent that he erred � he saw the cheaper dollars when he paid the mortgage, but he didn’t see the cheaper dollars when he was getting paid. Even a mortgage with a fixed interest rate below and fixed monthly payments did not help. Many fell for this in the 1970s, but few saw it coming. Worse, many seem to fall for this today, yet no one warns them. Forewarned is forearmed!

Thus, leveraged real estate is not only a poor hedge against inflation, but also a very risky one.

However, if you must hedge, then hedge with gold, not with real estate.

2008 Krassimir Petrov, Ph.D.

Contact Information

Krassimir Petrov, Ph.D.

Associate Professor in Finance at I-Shou University, Taiwan