Global Emerging Markets Fund M G Investments

Post on: 22 Май, 2015 No Comment

Global Emerging Markets Fund

Fund objective and approach

Fund objective

The Fund aims to maximise long term total return (the combination of capital growth and income) by investing in emerging market countries.

The M&G Global Emerging Markets Fund is an equity fund invested in publicly listed companies throughout Asia, Latin America and EMEA (Europe, Middle East and Africa) or companies that conduct the majority of their business activities in these regions. The fund manager aims to deliver consistent top-quartile performance in the global emerging markets sector by focusing exclusively on bottom-up stock selection. (In the UK, it is the IMA Global Emerging Markets sector; in Europe, the Morningstar Global Emerging Markets Equity sector.)It is the core belief of the fund manager that value creation for shareholders, not economic growth, drives share prices over the long run. Consequently, investment decisions are determined by the fundamental analysis of individual companies and the fund’s country and sector exposure is not influenced by top-down views.

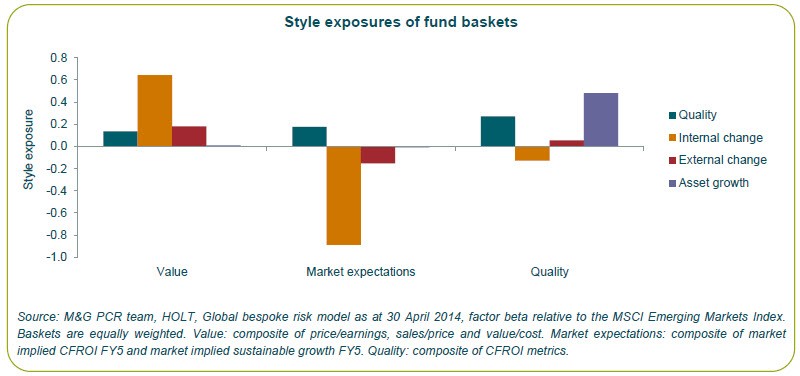

The investment strategy of the fund is to identify companies that are undergoing improvements in their return on capital, either through external change or internal change. The fund also invests in higher returning businesses where the market does not believe these levels of returns are sustainable; we define these as asset growth and quality companies.The fund manager aims to hold between 50 and 70 stocks, with a typical holding period of three to five years. Taking a long term view enables the manager to align his interest with the strategic value-creating decisions of company management. It also enables him to take advantage of valuation anomalies created by the short-term nature of emerging market investors.

The fund invests mainly in company shares and is therefore likely to be more volatile than funds that invest mainly in bonds and/or cash.

Performance

The value of stockmarket investments will fluctuate, which will cause fund prices to fall as well as rise and you may not get back the original amount you invested. The level of any income earned by the fund will fluctuate. Past performance is not a guide to future performance.

Source: Price: State Street. Performance: Morningstar. Performance figures are on a price to price basis with net income reinvested. Performance figures may not reflect all relevant charges.

Neither Morningstar nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web site, including, but not limited to Information originated by Morningstar, licensed by Morningstar from Information Providers, or gathered by Morningstar from publicly available sources. There may be delays, omissions, or inaccuracies in the Information.

News

Matthew Vaight // 18/04/2013