Getting Ready for a Bond Bear Market

Post on: 5 Сентябрь, 2015 No Comment

NEW YORK ( TheStreet ) — Since the financial crisis, some financial advisers have warned repeatedly that the long rally in bonds could end soon. So far the pessimists have been wrong. During the past three years, the average intermediate-term bond fund returned 7% annually, according to Morningstar.

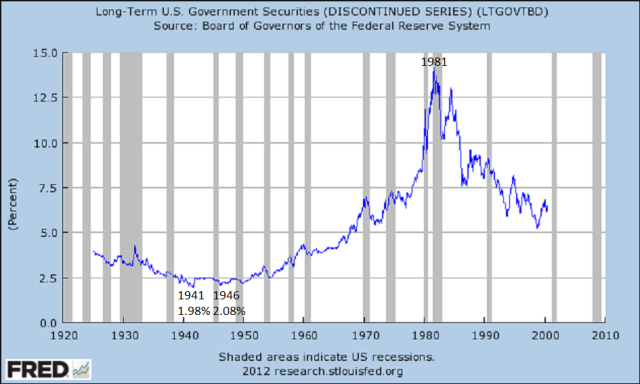

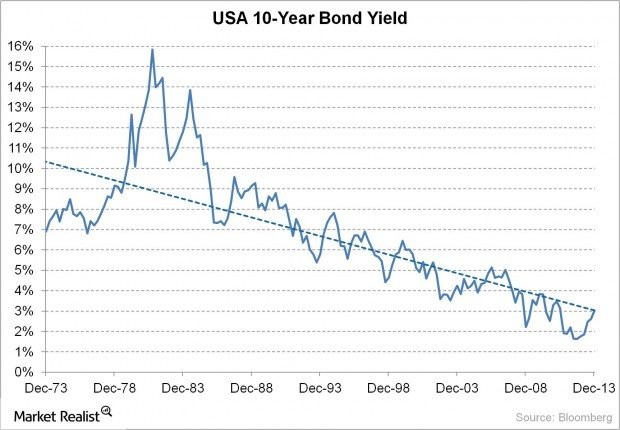

But lately the bears have been joined by some prominent fund managers who argue that the bond markets are about to enter harder times. With the government running huge deficits, inflation will appear and drive up interest rates, the managers worry. When rates rise, bond prices tend to fall.

Among the noteworthy figures sounding a cautionary tone is Jeffrey Gundlach, the star manager of DoubleLine Total Return Bond (DBLTX ). A longtime critic of Washington’s policies, Gundlach has taken defensive steps, increasing his stake in cash, which can hold its value in a downturn. The portfolio now has 19% of assets in cash, up from 7% two years ago.

In addition, Gundlach has lowered his fund’s duration, a measure of the portfolio’s sensitivity to rising interest rates. The fund now has a duration of 1.6 years. So if rates rise by 1 percentage point, the fund could lose 1.6%. Two years ago the duration was 3.9 years.

Another prominent bear is Ben Inker, co-head of asset allocation for GMO, who manages Wells Fargo Advantage Asset Allocation (EAAFX ). GMO forecasts that U.S. bonds will enter a prolonged slump, losing 1.2% annually for the next seven years. The Wells Fargo fund holds a mix of stocks and bonds. But lately Inker has been lowering the bond allocation. The fund currently has 11% of assets in bonds, down from 22% in 2009.

Should you avoid bonds altogether? Probably not. The bond bears could be wrong again. The Federal Reserve has pledged to hold down interest rates into 2014. If that happens, bond prices could remain firm for at least another year. Whether or not rates rise, a solid bond fund can help to diversify a portfolio.

Still, this is a time for caution. One way to limit risk is by holding shorter bonds. Those tend to be relatively resilient in downturns. Many of the biggest bond funds are intermediate-term portfolios that are benchmarked against the Barclays Aggregate U.S. Bond Index. which has a duration of 5.1 years. For a bit less risk, consider a fund that is benchmarked against Barclays Capital Intermediate Government/Credit Index. which has a duration of 3.9 years.