Geopolitical Alpha What It Is And Why You Need It

Post on: 20 Июнь, 2015 No Comment

Summary

- Geopolitical Alpha (GpA) is the value-added analysis of non-quantifiable political, social, natural and technological events, facts and forces that affect asset prices.

- GpA is needed because geopolitics is back with a vengeance as a key factor even for domestic investors.

- GpA is also needed because economics and finance are lagging indicators: geopolitical events and trends ultimately drive money flows and assets prices.

- GpA starts with properly structuring and framing non-quantifiable investment factors.

This column is the first in a series called Foundations of Geopolitical Alpha. The series will lay the basis for the value-added analysis of political, social, natural and technological events and forces that affect money flows and asset prices. I call this insight into such events Geopolitical Alpha, or GpA for short.

Why is GpA needed by financial market participants? I believe it’s essential for three reasons.

Geopolitics is Here to StayEven When Your Money Stays at Home

The first reason is obvious from a glance at the headlines: geopolitics is back with a vengeance. Whether it’s Russia’s newfound ambitions on its borders (think Crimea and the Donbass, or the Georgia invasion five years ago), the fracturing of countries in the Middle East (think Syria, Iraq and Libya), or increasingly aggressive Chinese assertion of the Nine Dash Line territorial claims offshore (think tensions with Japan, Vietnam, and the Philippines, among others), Investors can’t ignore geopolitics.

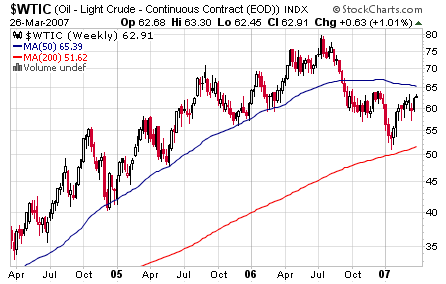

But GpA isn’t just for Emerging Markets aficionados or commodity market players (try thinking about oil markets just in economic terms). Given global supply chains, commodity and currency flows and the myriad interests of the US and other multinationals, even strictly domestic investors need to keep one eye on events around the globe. To paraphrase Trotsky, as an investor, you may not be interested in geopolitics, but geopolitics is interested in you (and your portfolio).

Economics and Financial Markets are Lagging Indicators

The second reason investment professionals need GpA flows from the first: economic and financial markets are lagging indicators. (If you’re keen on the wisdom of crowds and don’t believe me, check sovereign bond 1914 prices the summer of 1914. They didn’t twitch over the mere assassination of an Austro-Hungarian Archduke and his wife; then, they predicted a short war). Ultimately, the companies you invest in are present in real places, making real things or creating services used by people and companies outside the somewhat artificial world of finance and the highly idealized world of economics. Indeed, even the two areas of two topics beloved of macroeconomists — monetary policy and fiscal policy — are ultimately matters not of mere economics, but of politics. For example, if you really think Greece’s potential exit from the Eurozone is purely a technical economic matter and will be decided as such, stop reading now (and viel glck !).

The metaphor that I like to use to explain the relationship between economics and geopolitics is that economics are the day-to-day weather of investing and finance; geopolitics is the climate of investing and finance. Just as changes in climate ultimately drive changes in the weather cycle, so do changes in geopolitics drive changes in the economic cycle. To have any hope of getting ahead of the economics and finance curve, you need GpA.

GpA Starts with Properly Structuring Non-quantifiable (but Important!) Ideas

The final reason GpA is required is that very few investment professionals are trained in methods for structuring non-quantifiable problems, and that is what most geopolitical problems are. Numbers and quantitative models, of course, can shed light on such problems, but ultimately the numbers won’t speak for themselves, and they will only rarely prompt the right questions. Without a conscious and sound structure for posing qualitative questions, investors rely on a couple of flawed methods for geopolitical judgments.

First, they rely on that greatest of liars, gut instinct. If geopolitics was that easy, the CIA wouldn’t have 80% of its employees analyzing, not gathering, intelligence.

Second, investors often blindly use the judgment of area experts. (Embedded in this approach is the Better Rolodex Assumption combined with an Argument from Authority rather than real logic: A well-placed India expert says Modi’s reforms will work, so I’m long India). There are two problems with this outsourced thinking approach: First, it relies on political experts who are sometimes no better than fortune-tellers; more importantly, it presupposes that you are asking these experts the right questions. Without a disciplined structure to query area experts about the impact of events on the specific assets, experts can end up mirroring your unconscious ignorance. GpA is not about becoming an expert in every geography that might affect your investments, but it is about making the most about the expertise you are paying for by framing your inquiries properly.

Third, many investment professionals put geopolitics in the too hard box, and then rely on ever-more-elaborate Risk Models to make their judgments for them. For these poor souls, quantitative models become a safety blanket that hide more reality than they reveal. That is how, for example, the CFO of Goldman Sachs (NYSE:GS ), Harvey Schwartz, could say this January that the Swiss central bank’s decision to unpeg the franc — a political decision — was a 20-plus standard deviation event. (Wow! How many standard deviations from this — presumably Gaussian? — norm was the rise of Hitler? Talk about an Off Model event or non-spreadsheet risk!).

Such economic models of a political decision are clearly so unmoored from reality as to be useless (even compared to the astrology that passes for geopolitical commentary on channels like CNBC). The CFO of arguably the world’s most respected investment bank literally didn’t have words — much less mental models — to frame a quite simple political decision. Indeed, the fact that such statements can be made by a senior Goldman Sachs employee and not provoke laughter demonstrates that when it comes to geopolitics, even the most august (and connected!) Wall Street analysts are impoverished.

Key Information Isn’t Always Dressed in Numbers

Ultimately, a sound methodology for structuring qualitative questions about geopolitical events that can impact asset prices can prevent flights of fancy like that of Mr. Schwartz. Sometimes, especially in the realm of geopolitics, important information isn’t dressed in numbers, and appears off model. That doesn’t mean, however, that it can’t and shouldn’t be analyzed and explored by those running money.

In future pieces, I will offer some rules of thumb drawn from the world of intelligence analysis. political science, history, psychology and other disciplines that I hope will increase financial professionals’ Geopolitical Alpha.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.