Generational Cycles in the Dow

Post on: 16 Март, 2015 No Comment

Generational Cycles in the Dow/Gold Ratio

The endeavor of speculating in financial markets is shrouded in confusion, fierce debate and — often — mysticism. Here at greshams-law.com. were at least a little bit guilty of succumbing to the latter. The long-term trends in financial assets seem to follow generational cycles. This is particularly evident in the gold price of the Dow Jones Industrial Average.

Hey! Stop Pricing the Dow in Gold, you #@!%!

I am sure that many people are fuming because I had the audacity of calculate & chart this ratio. So, just to get things clear, I thought Id address the reasons behind using it before anything else. To demonstrate why this is a legitimate means of analysis, Ill have to go over the history of the dollar briefly.

Prior to 1933-34, the dollar was on the Classical Gold Standard. Meaning, dollars were redeemable into gold at the rate of around $20 per ounce. In this way, the Dow was effectively priced in gold (that is, the Dow traded with dollars — which were defined as $20.67 an ounce). After the unpalatable circumstances of 1929-1934, the dollar was debased to $35 per ounce (i.e. instead of requiring $20 to get one ounce of gold, one required $35). Moreover, public ownership of gold was banned, and redemption claims were made the exclusive privilege of world governments and central banks. So, from 1934 onwards, governments and central banks were half-heartedly engaged in defending their currencies against gold at the decreed rates. In this way, the Dow was essentially priced in gold (that is the Dow traded with dollars which governments attempted to keep at specific rates against gold — $35 an ounce). However, by the late 1960s / early 1970s, it became clear that the quantity of gold backing the outstanding quantity of dollars was insufficient. So, as the resultant circumstances were deemed to be unpalatable (after all, who likes dealing with an angry Frenchman with a battleship ), the dollar was debased again (to around $42 an ounce) and unequivocally unleashed from gold.

Now, I use the term unleashed because gold is still a major component of the Worlds monetary assets. That is, gold still backs dollars, Swiss francs, Yen, Pounds not-so-sterling (etc.) but not at a specific rate. The Worlds governments and central banks have given up the task of defending their currencies against gold, and so those currencies are free to depreciate indefinitely against gold.

The important point is that the dollar of 1971 is entirely different to that of 2011! Even, the dollar of last week is different to the dollar of this week! As the central banks of the world change the sizes and compositions of their respective balance sheets, outstanding dollars, euros and pounds (etc.) become (different) irredeemable claims upon different sets of assets. Hence, it is inappropriate to measure long-term price trends in terms of these unleashed fiat currencies.

It is quite conceivable to me that the above is unconvincing to some. So, to really hammer the point home, let me ask you a question: If I plotted a chart of the US Government bond price of the Dow from 2000 to 2007 and then changed the line to a MBS price of the Dow from 2007 to 2011, would you call me crazy? Well, that is — roughly speaking — what one is doing when plots a chart of the Dow priced in dollars! [See chart below]

Therefore, to understand the progression of valuations through time. it makes sense to measure the Dow Jones (a proxy for the valuations of US prime-productive output) in terms of gold. By doing so, we can reasonably compare the progression of these financial assets over a 100-year period. Indeed, looking at the chart above, this seems to be corroborated the range of the Dow priced in gold these days is not outrageously different to the range 90 years ago.

I should remind you that the dollar price of anything, as well as the egg price of milk, the beef price of Ferraris, the shaving cream price of oranges and so on are all subject to this trait. That is, the trait that all prices are exchange ratios between two things i.e. the rates at which people swap stuff. Financial markets are arenas where people swap stuff for dollars, so symmetry surely does pervade them. The dollar price of a thing is as much about dollars as it is about the thing. Hence why greshams-law.com has such a keen focus on money we operate under the premise that long-term success in financial speculation is contingent on a solid understanding of this fact. The result is that one should spend as much time on monetary trends as one does on trends in things.

So, spelling it out, when we say that gold increases in value, we should note that gold increases against dollars. It is as much about dollars as it is about gold.

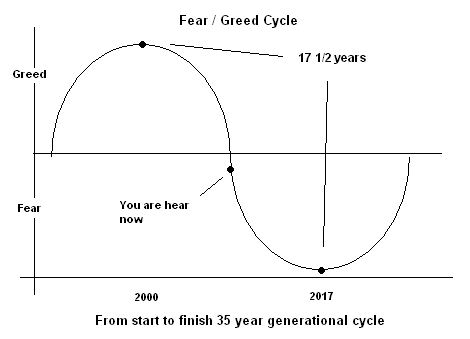

So, lets address the pertinent question: Why should it be the case that financial markets move in generational cycles? Why should each generation be bound to repeat the follies of their fathers?

As Robert Prechter often reiterates, the financial markets are a peculiar field. Unlike consumption goods & services, we do not have personal utility for the things that we purchase. We have no internal gauge when it comes to financial speculation, rather, we are executing with the hope that someone else will want it more (again for speculative reasons). So, in this way, were trying to anticipate the anticipator. This is an incredible task, because we are trying to do something that is contingent on someone elses view, and yet we only have our own lenses with which to view reality. So, naturally, financial markets are surrounded by confusion and tentativeness. With this inescapable context of operation, we in aggregate are suckers for the respectability of something that works. This requires the passage of a long period of time where the trend remains intact. It would seem that a bullish price trend (in the Dow versus gold) becomes extended after a generation have grown up with it (around 20-25 years). Or, if you will, a generation has found that a bullish price trend is a normal operating environment. Likewise, the bearish price trends that is, the undoing and refutation of our aggregate premises takes 15 years to reach the depths of apathy and distaste for speculation.

Current Context & Positioning:

Currently, were around 11 years into a bear market in the Dow Jones vis-a-vis gold. Moreover, it would seem that we have a reasonable way to go: it still takes roughly 8 ounces of gold to purchase the Dow Jones Industrial Average. Typically, the bottom would be characterized by a Dow/Gold ratio of 1-3. So, although the contrarian asymmetry has gone. the trend seems to be intact, and could easily remain intact for another 3-5 years.

If one believes in the above interpretation (as I do), then it would make sense for one to have a portfolio that revolves around being long gold and short stocks (in whichever way may be appropriate to ones sensibilities). Fortunately, this also means that we have a fantastic opportunity in the not-too-distant future. As Russell Napier said in a recent interview with the FT (paraphrasing as the link is broken for now):

Remember, these are great opportunities to buy for a generation. If you buy near these bottoms, you can literally go to the beach for the next 20 years

As can be seen on the Dow/Gold chart at the top of the article. The depths of bear markets typically bring about some kind of meddling with money. In 1933-34, the consensual opinion was that gold speculators and gold hoarders were causing the nations pain and that their actions were decidedly unpatriotic. The result was a series of bank holidays and a resultant debasement and expulsion of gold from public eyes. In the late 1960s / early 1970s, the consensual opinion was that the Bretton Woods system lacked the flexibility of freely-fluctuating rates. And that gold speculators were unpatriotically driving up the dollar price of gold in excess of the decreed rate. The result was a series of frivolous monetary agreements that lead to the full unleashing of the dollar from gold.

So, if we continue to see a fall in the gold price of stocks (that is, an appreciation of gold against stocks), the concomitant finger pointing could lead to another round of meddling with money.

Be a Lover Not A Fighter:

The price trend shown on the above chart is blindingly clear. Moreover, it is — quite frankly — well developed. This means that the asymmetry (i.e. favorable risk reward profile), is diminished, however, the trend remains in force. There seems to be a few years to go, so I would strongly suggest that you embrace it while it remains (and before the risk/reward profile becomes unfavorable ).

After the plethora of bubbles over the past decades, it is unsurprising that people are watching for bubbles like crazy, but it doesnt matter. Gold is still wholly underowned (see chart below), and stocks are still the instruments that people think theyll retire on.