Gauging stock value using PE ratios or Price Earnings Pettir

Post on: 22 Апрель, 2015 No Comment

Gauging stock value using P-E ratios

Price-to-earnings ratio, also known as P/E or P-E ratio, is one of popular tools for investors to value stocks or stock market indices, whether their prices are cheap, expensive, or fairly valued. Long-term, value investors use the P-E ratio to get indication whether stocks are cheap enough to make them start buying.

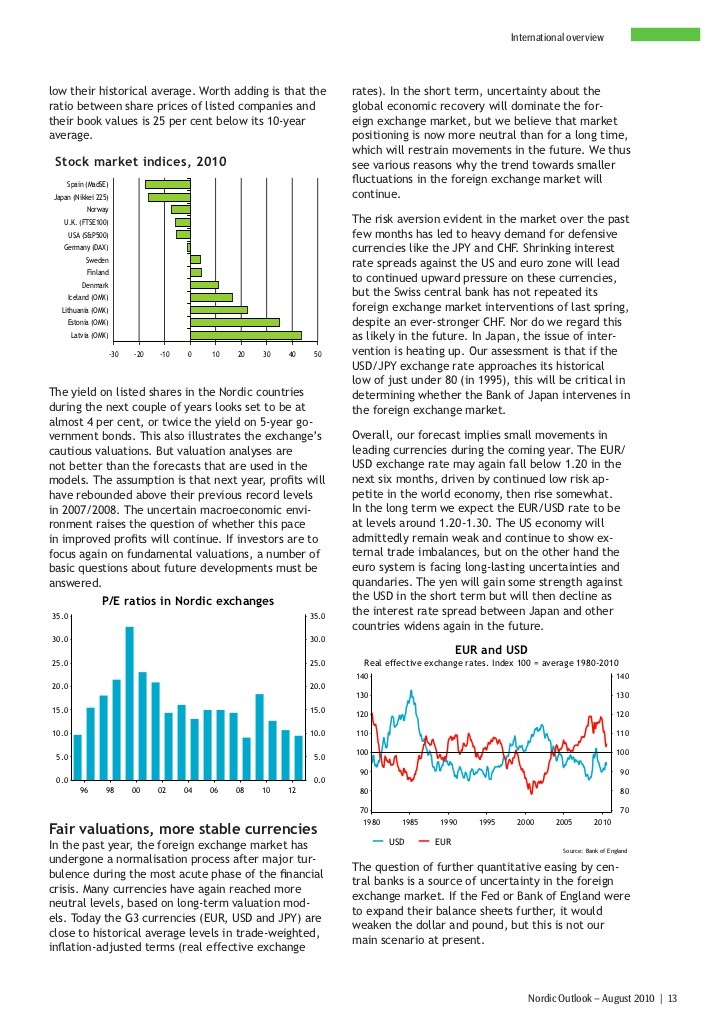

The following graph shows the S&P 500 normalized trailing P/E (10-year price/earnings) ratios based on Yale economist Robert Shiller’s (Irrational Exuberance) stock valuation metric for a period starting from 1926 up to September 2009.

The P-E median over the 82 years is 15.68, while the average is 16.34. The ratio stood at 19.35 at the end of September 2009. The record overvaluation of 44.2 happened in Dec. 1999.

This simple gauge focuses on fundamental measures, which are earnings. In its basic form, the P/E ratio is calculated by dividing a stock’s price (or the value of an index) by its annual earnings.

Before using the price earnings ratios, investors have to understand the ratios and how reliable they are to gauge stock value.

Interpretation

A high P-E can be a sign that a stock is either overvalued or poised for stellar growth.

A low P/E can be a sign that a stock is a good long-term value or a company in trouble.

If earnings hold steady, falling stock prices should make the stocks more attractive to long-term investors. The P/E will fall accordingly. But that’s not necessarily true if earnings fall faster than prices do. In this case, the P-E will increase.

Earnings Issue: Trailing P/E or Forward P/E

A stock price can look cheap or expensive, depending on how the price to earnings ratio is determined. While prices are noticeable in stock market, earnings are harder to measure. Investors need to determine how much they trust the E or earnings per share in the P/E ratios.

Some investors prefer forward P-E, which use forward earnings. They argue that the stock market looks forward, and investors should too. Forward earning is often determined by analyst estimates for earnings of the next 12 months. While analyst predictions are imperfect, consensus earnings estimates give the best sense of where the market believes corporate profits are headed.

A forward P/E of 15 means investors are willing to pay $15 for every dollar that analysts expect companies to earn in the following 12 months.

The problem with forward P/E is that earning expectation are just a best guess and are often incorrect. During economic uncertainty, estimates are all over the place, making them more unreliable than usual. If the projected earnings are overstated, then the P/E would be understated.

For investors looking for more certainty, trailing P-E are preferred. This measure uses trailing earnings, which is often based on the past 12 months. Looking backward is not a perfect way to value the market, but at least the earnings are real. Historical long-term trailing P/E stood at 15.59.

Trailing P/E has the disadvantage of looking backward while the stock market is often looking forward.

An adjusted trailing P/E or normalized trailing P/E uses the price adjusted for inflation and trailing ten-year average earnings adjusted for inflation. This adjusted methodology popularized by Robert Shiller (Irrational Exuberance ) is used as a long term stock market valuation metric.

Are P-E’s useful?

With so many questions about the reliability of the simple P-E ratios, there is naturally a lot of debate about how useful P/E’s are to investors in picking stocks.

Some analysts argue that price earnings ratios are not a good screen tool on the ground that some of the best-performing stocks can have higher P/E ratios, reflecting their better growth prospects.

Another group of analysts finds that P/E ratios can be a good guide for investors with a long time horizon, though the P/E’s are not a good way of predicting the near future. If valuations are inexpensive, they can stay that way for quite a while. In the past, periods where stocks have low P-E’s have been great times to invest.