FXI The Largest China ETF But Not the Best

Post on: 26 Апрель, 2015 No Comment

Recent Posts:

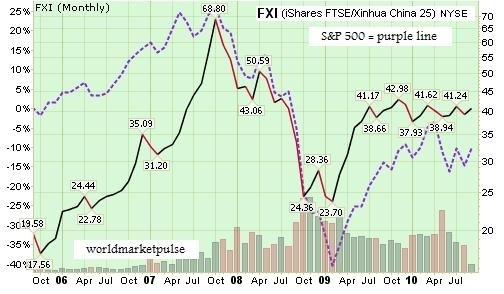

FXI: The Largest China ETF, But Not the Best

When it comes to exchange-traded funds, bigger isn’t always better.

By now, most investors undoubtedly know that ETFs within a single category can produce widely divergent returns due to differences in the construction of the underlying indices.

One result is that the best way to invest in a particular market segment might not always be the largest ETF which may only have achieved that status due to seniority or the size of the provider’s marketing budget but one with fewer assets and a less recognizable name.

This is proving to be the case in the universe of China ETFs, where $4.8 trillion of the $8.2 trillion assets in the category are invested in one fund: the iShares China Large-Cap ETF (FXI ).

FXI: Big, But Inefficient

Over time, FXI has become the go-to fund for investors to gain quick access to China. One reason for this is that the fund is the oldest and most well-known China ETF, having debuted in October 2004.

But even though FXI is the largest China ETF, it isn’t necessarily the most efficient way for individuals to invest in the country. Not only is the fund concentrated in just 26 names, but a full 53.5% of the portfolio is invested in financials.

Right now, this means quite a bit for performance given that financials are ground zero for the concerns about the country’s burgeoning credit crisis. They’re also among the most liquid stocks in the market, meaning that they’re first on the chopping block once investors get cold feet.

Just how poorly are Chinese financial stocks performing? Since the beginning of December, the Global X China Financials ETF (CHIX ) has fallen 21.9%, well below the return of the broad-based ETFs. In the same time period, WisdomTree China Dividend Ex-Financials Fund (CHXF ) has declined just 12.8%.

While FXI’s concentration in financials hasn’t hurt the fund over the longer term, it has certainly mattered in the past four months.

Since the Chinese stock market began to weaken at the beginning of December, FXI has shed 17.2%. In this same interval, the second- and third-largest China ETFs iShares MSCI China ETF (MCHI ) and SPDR S&P China ETF (GXC ) have outpaced FXI with returns of -14.2% and -11.5%, respectively.

The most important factor in their outperformance in this interval has been their lower weighting in financials. MCHI holds 36% in the sector, GXC holds 29%. That’s still high, but it’s far less than FXI and this difference can be seen in the performance results.

Outside of the large-cap space, the performance gap is even more pronounced. The small-cap Guggenheim China Small Cap ETF (HAO ) has been barely touched by the selloff. Even as the country’s large-cap stocks have cratered, the fund has fallen just 3.5% from Nov. 29 through March 20. Not coincidentally, the fund holds less than 20% of its assets in financials.

Taking this one step further, the Global X NASDAQ China Technology ETF (QQQC ) which of course holds no financials whatsoever has avoided the market downturn entirely and gained 13.2% in the same period thanks in part to the strong showing of Chinese Internet stocks.

Bottom Line

This leads to the broader lesson investors can glean from FXI’s recent shortfall.

Those who still believe in the China story may have cost themselves some performance of late by investing in the flagship ETF rather than digging deeper and looking at the alternatives, but this isn’t an issue that’s specific to China ETFs. Across the board, it pays take the time to research the alternatives before jumping into the biggest-name ETF in a particular category. The issue may be concentration, but it also could be expenses, yield, or liquidity.

So the next time you’re considering an ETF purchase, take the time to review the alternatives. Chances are, there’s a better choice than the first fund that jumps to mind.

As of this writing, Daniel Putnam did not hold a position in any of the aforementioned securities.

investorplace.com/2014/03/fxi-largest-china-etf-best/.