FX in 2015 The key trends shaping the markets this year

Post on: 27 Май, 2015 No Comment

A new year brings a new set of challenges for the financial industry. This month will see experts from Thomson Reuters outline their key predictions and challenges facing the financial markets in 2015 – and how to solve them.

In this post, Ron Leven, Head of FX Pre-Trade and Economic Strategy at Thomson Reuters, examines what the year has in store for the markets.

1. The CHF is just the beginning of a very volatile year across all asset markets

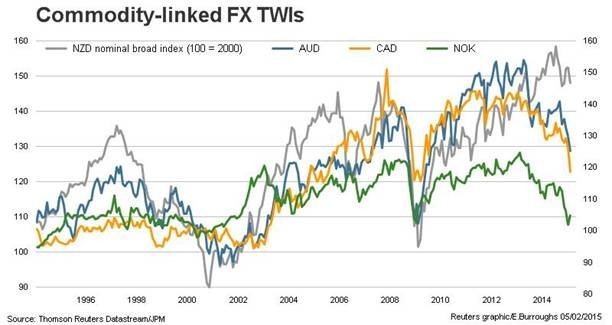

Many of the issues that triggered volatility in 2014 remain unresolved Ukraine, global slowdown, euro-related issues, dislocation in the oil markets are just a few and will continue to affect the markets in the months ahead.

In addition, central bank policy and rate trends are diverging in the G10 space for the first time in several years in particular, rates in the US and UK are firming while rates in Europe and Japan remain low.

As a result of the volatility and uncertainty on global growth, 2015 will be much less friendly to equities than 2014: bank stocks and the energy sector, in particular, will continue to struggle. Higher volatility should, in principal, be good for currency trading volume and proprietary traders, but I think the latter will be hurt in the second half of 2015.

Source: Thomson Reuters Eikon

2. The Fed will hike rate much later and more slowly than the market expects

I remain very bearish on the prospects of inflation gaining any traction in the major markets. It is my contention that core inflation cannot really take hold unless labor markets have pricing power you need to get a feedback loop from higher prices to higher wages back to higher prices to see true inflation.

While the US employment picture is improving, wage growth remains non-existent and the drop in energy prices is also going to make it hard for inflation to emerge. With no apparent inflation pressures, global growth sputtering, the dollar soaring and equity markets struggling, the Fed will be pushed to delay rate hikes. Not only do I not think there will be hikes in 2015, I believe another round of quantitative ease will be under active discussion before year end.

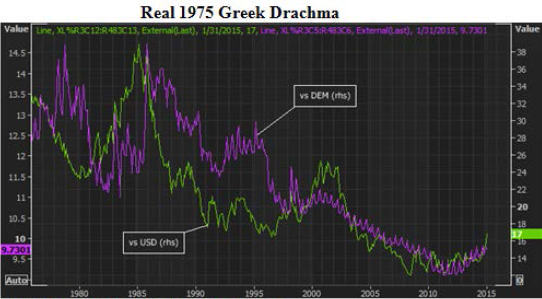

3. Greece will default (or restructure) its sovereign debt but remain in the euro

It is almost a mathematical impossibility for Greece to repay its debt on anything close to a commercial basis. As evidenced, they have adopted truly Spartan-worthy fiscal constraint since the financial crisis. But, despite dramatic cuts in fiscal spending and the deficit, their debt burden has not improved because there has been a comparable reduction in nominal GDP.

There will be a reckoning of this impossibility this year either because the Euro-area governments agree to fund a subsidized restructuring of their debt effectively a write-down or Greece will go into default.

Contrary to recent press, a default would not obligate Greece to leave the euro and they wont. A voluntary restructuring would be welcomed by the market and rally the EUR. A default, at least temporarily, would be the opposite.

Source: Thomson Reuters Eikon

Ron’s top 3 FX predictions for 2015

tmsnrt.rs/1wyR2GN #Predictions2015 Tweet this

tmsnrt.rs/1wyR2GN #Predictions2015 Tweet this

tmsnrt.rs/1wyR2GN #Predictions2015 Tweet this

Related reading:

About Ron Leven

Ron Leven is the Head of FX Pre-Trade and Economic Strategy at Thomson Reuters. Ron joined Thomson Reuters in January 2014 with over 25 years of FX investment strategy experience on both the buy- and sell-sides, most recently as head of FX derivatives strategy at Morgan Stanley. Ron earned a PhD in Economics from Rice University and is a Columbia University Adjunct Professor teaching courses on emerging market investments.