Funds Lowvolatility ETFs are riding high

Post on: 27 Апрель, 2015 No Comment

Story Highlights

- In Q1, low-volatility ETFs took in $4 billion of new investor cash Low-volatility ETFs are big with cautious investors Low-volatility ETFs that invest in U.S. stocks are outperforming the S&Ps 500 so far this year

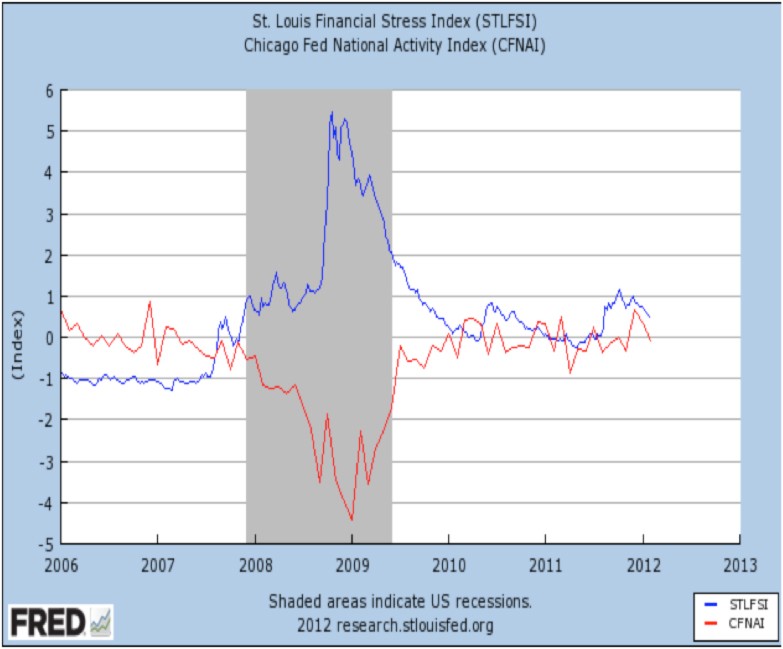

Specialized ETFs tracking low-volatility indices have been a big hit with investors who want to dip a toe back into the stock market but remain suspicious after getting burned by the dot-com crash and 2008 financial crisis.

The funds are billed as safer equity investments because they focus on stocks that offer smoother rides while avoiding riskier companies and sectors that tend to jump around more in price.

It also doesn’t hurt that low-volatility ETFs that invest in U.S. stocks are outperforming the Standard & Poor’s 500 so far this year, thanks to the leadership of defensive, stable sectors such as utilities and consumer staples.

In the first quarter, low-volatility ETFs took in $4 billion of new investor cash, up 76% from the year-ago period. They now hold over $11 billion in assets under management, and their growth suggests investors remain wary of stocks even with the S&P 500 and Dow Jones industrial average climbing to new all-time highs.

The appeal of low-volatility ETFs is related to investor psychology of suffering through two bear markets, says David Mazza, head of ETF investment strategy at State Street Global Advisors.

Risk-adjusted performance makes low-volatility strategies look even better, Mazza explained. Low-volatility strategies sacrifice gains but limit downside, and it’s very difficult to make up losses. One of the key benefits is a smooth return stream. Investors are very concerned with volatility.

Yet investors should keep in mind that low-volatility strategies don’t perform as well when the market explodes to the upside and cyclical growth sectors are leading the way.

State Street earlier this year launched the small-cap SPDR Russell 2000 Low Volatility ETF (SMLV) and the large-cap SPDR Russell 1000 Low Volatility ETF (LGLV), its first low-volatility funds.

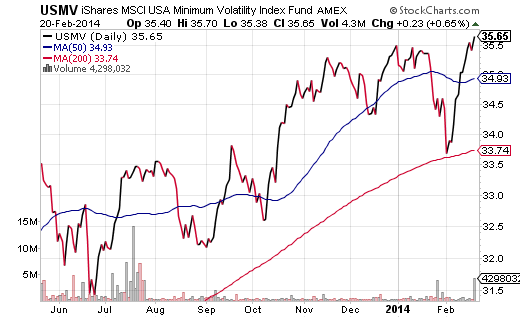

The two largest ETFs for U.S. stocks in the category are the $4.9 billion PowerShares S&P 500 Low Volatility Portfolio (SPLV) and the $3.5 billion iShares MSCI USA Minimum Volatility Index Fund (USMV).

USMV ranks fifth on the list of top-selling ETFs so far this year, hauling in $2.3 billion, according to flow data from IndexUniverse.com.

More firms are looking to add ETFs in this fast-growing space, says Nicholas Colas, ConvergEx Group chief market strategist.

Min-vol is max-hot, Colas said.

SPLV is the oldest low-volatility ETF, introduced in May 2011. The fund is up 16.4% year to date, easily outperforming the 13.3% return delivered by the S&P 500.

The fund has a tilt to more defensive sectors with 31% of the portfolio in utilities and 24% in consumer staples. The index is composed of the 100 stocks from the S&P 500 with the lowest volatility over the past 12 months. The ETF also gives a greater weighting to the least-volatile stocks.

The low-volatility theme has resonated with investors by offering the potential for a smoother ride, says Michael Rawson, an ETF analyst with Morningstar. Over the long term, low-volatility stocks have offered comparable returns but lower risk than the broad stock market.

The popularity of low-volatility ETFs highlights investors’ fragile psyche after enduring a pair of brutal bear markets the past 13 years. For example, the S&P 500 recently setting a new high was met by indifference and even suspicion by many.

Investors unnerved by the 2008 credit crunch, 2010 flash crash, ongoing Federal Reserve stimulus and lingering European debt crisis feel like the carpet could be pulled out from under them at any time. The fact that one fake tweet from the Associated Press’ hacked Twitter account briefly crashed the market this week certainly doesn’t help confidence. Many individual investors are simply afraid the market is rigged against them, which partly explains the allure of defensive strategies such as low-volatility ETFs.

For example, an American Association of Individual Investors survey earlier this month revealed bullish sentiment fell to levels not seen since March 2009, when the S&P 500 hit bottom in the financial crisis. It’s striking that this extremely low sentiment reading coincides with a new record high for the S&P 500.

Clearly, individual investors don’t seem to have much faith in the rally or stocks in general. Therefore, the bull market in low-volatility ETFs looks set to continue.